While the equity markets have become more expensive, the business development company (BDC) sector remains one of a few sectors still offering value to investors. I like this sector in particular during periods of interest rate hikes due to the fact that most BDCs have their assets invested in shorter maturities. Furthermore, the majority of BDC investments consist of floating rate loans, which are primarily funded with fixed-rate term debt. This makes BDC loan portfolios better positioned for rising interest rates when compared to the majority of fixed income products.

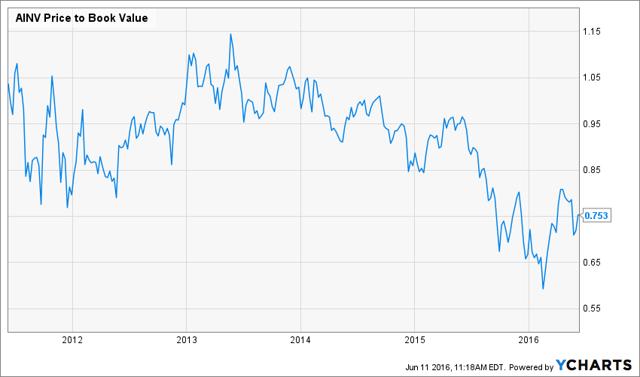

Apollo Investment Corp. (AINV): AINV is one of the largest BDC companies and is currently trading at a large discount. Over the past 12 months, AINV lost about 30% of its market value due to investors' worry about its exposure to the oil sector. As the shares sold off, an opportunity has been created. Currently, AINV is trading at a 25% discount to its Net Asset Value or NAV. The following are 10 reasons why AINV is a great buy at the current price levels.

1- Profitability: AINV is a very profitable company. Based on the last quarter report, AINV earned $0.1953/share. On an annualized basis, the company earned 14.3% based on its current market capitalization.

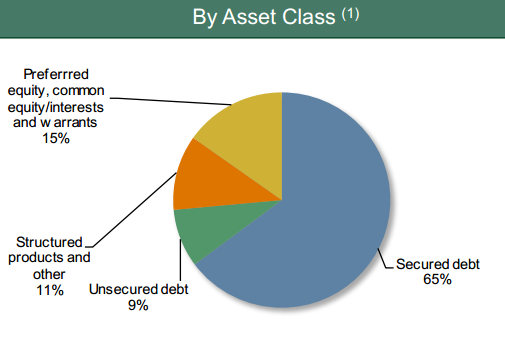

2- Lower risk portfolio structure: Debt holdings account for 74% of the portfolio, of which 86% are secured by 1st lien and 2nd lien. The remainder of the portfolio consists of equities (15%) and structured products (11%).

3- AINV provides a "double hedge" against inflation and rate hikes

The portfolio structure of AINV has two special features which protect against inflation and interest rate hikes:

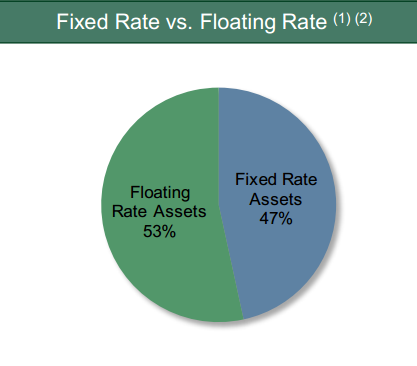

- Variable Rate Portfolio: Apollo Investment Corporation has taken several steps to prepare for higher interest rates which include increasing the floating rate portion of the portfolio and issuing fixed-rate debt. Currently, AINV has 53% of its portfolio consisting of loans with floating interest rates. These loans are usually based on floating LIBOR and typically have durations of one to six months after which they reset to current market interest rates. Additionally, AINV uses standard hedging instruments such as futures, options and forward contracts to insulate against interest rate fluctuations. This gives AINV shares protection against inflation and future interest rate hikes by the U.S. Fed.

- A short portfolio maturity: AINV typically invests in loans which have maturities of three to ten years. In fact, most of its current debt portfolio matures by the year 2022. This is a very favorable balance sheet especially during periods of rising interest rates. It gives the company the means to reinvest in loans carrying a higher rate as its loans portfolio matures. AINV's short portfolio duration provides a 2nd hedge against rising interest rates by the Fed.

4- Reduction in management fees: In March 2016, the company announced that management fees will be reduced which will help AINV's dividend coverage. The fee reduction may continue until the end of 2017.

5- Active share buyback program: AINV has a very active share repurchase program. During the quarter ended March 31, 2016, 2 million shares were repurchased. This brings total share repurchases to 10.5 million shares of common stock since inception of the repurchase program - from August 2015 through May 18, 2016. This is very impressive as the company retired about 4.2% of its shares outstanding in less than one year. This should help lift the company's share price and narrow the price discount to Net Asset Value.

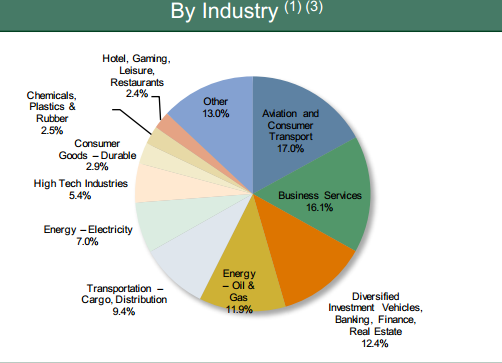

6- Net Asset Value likely to improve: AINV's portfolio has 11.9% exposure to the oil & gas sector which has been provisioned and accounted for based on "market value" as of March 2016; therefore, I would expect that most of the write-downs related to this exposure have already been accounted for. Furthermore, 35% of its loan exposure to commodities is already on non-accrual basis. It is also worth to note that most of the non-accrual energy loans are secured against hard assets.

As oil prices have recovered significantly since March 2016, AINV's Net Asset Value is likely to also recover. Both AINV's investments in debt and equities are likely to be revalued higher as recently stated by AINV's CEO: "So, I think from that perspective, kind of the worse is behind us. And now, we have equity upside in a number of different companies. So, to the extent that oil prices recover which you have seen in the June quarter to the extent it continues obviously there maybe some benefit for our shareholders of this portfolio".

Therefore, I would expect that AINV's Net Asset Value to go up in the next few quarters. Even if this does not happen, an exposure of 11.9% to Energy which has been already written down does not warrant the 25% discount to NAV.

7- A Generous Dividend: AINV currently pays $0.20 per share in distributions giving it a yield of 14.7%. The distributions are paid on a quarterly basis.

8- Dividend coverage: Based on a dividend amount of $0.20/share, the dividend is slightly above its earnings of $0.1953, which gives it a distribution coverage of 97.7%. While AINV's profits are set to improve, a small dividend cut is possible and is most likely already priced in. In a worst case scenario, AINV may cut its dividends by 2.5%, and still the stock would generate a very attractive yield of 14.3%.

9- Large discount to NAV: Historically (over the past 5 years), AINV has traded around 10% discount to NAV as depicted in the chart below. Today, AINV is trading at 25% discount. Therefore, based on historic valuations, AINV has a possible 15% upside on its current market price, in addition to the dividend distributions.

10- Favorable Analysts Price Target: At the time I was writing this article, UBS Bank reiterated their Buy Rating on AINV with a price target of $6.5/share. At $6.5, the stock has an 18% upside potential from the current price level.

Conclusion

AINV is a good investment to hold during periods of rising interest rates due to the floating rate nature of its loan portfolio and to its limited duration. At today's discounted valuations, AINV is set to deliver double-digit dividend returns in addition to a possible 15% upside potential. My next article which is planned to be published over the weekend will highlight another undervalued Business Development company: Medley Capital Corp. (MCC) which currently yields 18%. MCC also provides a great hedge against interest rate hikes by the Fed. For those interested to receive my next updates on stocks, ETFs, and CEFs suitable to hold during periods of rising interest rates, click "Follow" at the top of this article.

Finally, I would like to invite readers for a 2-week free trial to my monthly newsletter at Seeking Alpha, High Dividend Opportunities. The service includes a managed high-dividend portfolio with an overall target yield of 6-9%. We are dedicated to bring investors the most profitable and newest high-dividend ideas. For more info, please click here.

Disclaimer: "High Dividend Opportunities" service is impersonal and does not provide individualized advice or recommendations for any specific subscriber or portfolio, as I have no knowledge of the investor's individual circumstances. Readers should not make any investment decision without conducting their own research and due diligence, and consulting their financial advisor about their specific situation.