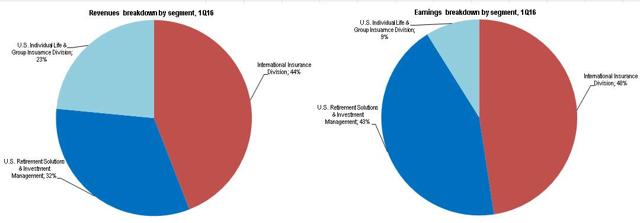

Prudential Financial (NYSE:NYSE:PRU), founded in 1875 and based in Newark, NJ, is a leading life insurer and asset manager with a strong global franchise particularly in the US and Japan. Products and services provided include life insurance, variable annuities, mutual funds, retirement-related investments, asset management, securities brokerage services, as well as commercial and residential real estate in many states of the US. Prudential's largest contributor to earnings is its international unit that generates about 50% of PRU's earnings that are nearly all from Japan.

Source: Company data, Renaissance Research

PRU views the US environment as favorable

According to PRU management, the company views the US environment as favorable despite low interest rates. Prudential has successfully diversified its variable annuity (VA) product line, which now offers attractive risk-adjusted returns. VA product sales with living benefit guarantees are now more focused on fixed income as the underlying investments rather than equities. The company uses reinsurance protection for new sales, but it appears open to exploring reinsurance options for its inforce VA business.

The company's individual life insurance business has performed well. The sales mix is favorable with targeted contributions from guaranteed and variable universal life insurance as well as term life coverage. PRU's group insurance unit has completed its turnaround and is now increasingly focused on growth.

Long term, PRU asset management business as poised to generate strong growth and returns. The business currently has $1 trillion of assets under management. Growth opportunities in Asset Management include global expansion (~20% of AUM from non-US clients), new asset management capabilities, and enhanced product offerings. The company has also hired a significant number of experienced investment professionals.

PRU's international business is its largest and highest ROE unit; The rising yen is a tailwind

PRU management expects its International Insurance unit to generate consistent ROEs in the high-teens to low-20s range. PRU derives almost all of its international business earnings from Japan, which is still an attractive market insurance market. It is bigger than the rest of Asia's combined. According to Barclays Research, Japan has approximately $16 trillion of household assets in currency or short-term deposits that life insurers can target by offering competitive rates of return. Given that Japan is the largest contributor to PRU's bottom line, the company's earnings are very sensitive to moves in USD/JPY rate. The rising yen means higher profits in USD for Prudential and vice versa. Over the decades, the Japanese yen has earned investor confidence as the go-to safe-haven currency in case of crisis, hence we think PRU's significant exposure to Japan adds defensive characteristics to the stock.

Source: Bloomberg

It is also worth mentioning that the company deploys a rolling 3-year hedging strategy, so the impact of exchange rates is reflected in its results over time, not immediately.

SIFI regulatory developments are key for the stock

On 30 March, the US District Court for the District of Columbia rescinded the Financial Stability Oversight Council's (FSOC) designation of MetLife (NYSE:MET) as systemically important. To recap, in January 2015, MET announced that it would fight the SIFI designation in the court. The company argued that it already operated under a strict state regulatory system, that non-bank SIFI regulation creates an unlevel competitive situation, and the Fed should instead address specific systemic activities(similar to the asset management industry) regardless of the size of companies. FSOC has recently announced plans to appeal the 30 March ruling.

If MetLife and Prudential are able to avoid being designated a non-bank SIFI, we think it would mean the companies take a more aggressive stance on share buybacks, which we would expect to drive its RoE and valuation higher.

Fed Governor Daniel Tarullo has recently provided initial outlines of the anticipated regulatory framework for insurers including Prudential Financial and AIG (NYSE:AIG) at the Federal level. We view key points made by Governor Tarullo as all being generally positive for Prudential. Gov. Tarullo acknowledged the difference in funding structures for life insurers and for commercial banks:

Here, though, the major relevant difference is that the funding structures of traditional insurers are generally much more stable than the funding structures of commercial banks, much less broker-dealers. A traditional insurance company's liabilities are largely composed of contingent claims based on the occurrence of specified events, such as the death of an insured person or the destruction of property. Because these claims generally cannot be accelerated, companies engaged in traditional insurance activities are less vulnerable to runs and, accordingly, to short-term pressures to sell assets into declining markets.

He also mentioned that capital and liquidity requirements for insurers should be calibrated differently than for banks:

This insulation from creditor runs in turn suggests that capital and liquidity requirements for insurance companies should be calibrated differently than capital and liquidity requirements for dealer banks. Because Congress modified the Collins Amendment in late 2014, we can now tailor capital requirements for insurance companies.

All in all, we think that even if the Fed successfully appeals the recent ruling in MET's favor to avoid a SIFI designation, the Fed capital rules that would apply to the SIFI insurers would be less onerous than for banks, in our view. This would most likely mean that PRU can more rapidly deploy their growing excess capital positions through stock buybacks and dividends.

Capital deployment strategy

PRU's roughly $4bn of excess capital could potentially be used for share buybacks or for acquisitions. In 2016, the company has reduced financial leverage by $1.3bn, paid approximately $500mn for an acquisition in Chile, and it plans to deploy around $2.8bn in share buybacks and dividends - a 9% yield, based on the current stock prices.

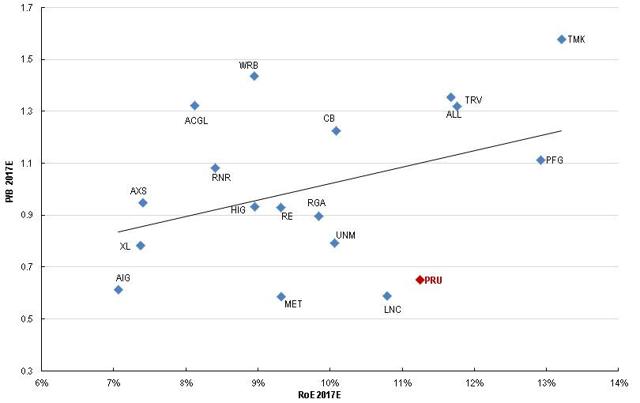

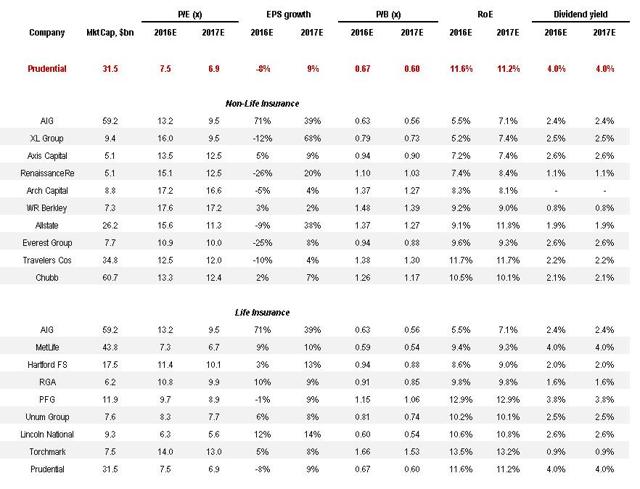

Current valuation offers very compelling risk-reward

PRU trades at a significant discount to the sector despite a significantly higher RoE and a 4% dividend yield. We attribute this partly to a SIFI discount, and see greater clarity on SIFI standards or a path to overturning the SIFI designation as potential positive catalysts.

Source: Bloomberg, Renaissance Research

Source: Bloomberg, Renaissance Research

Bottom line

We view Prudential as an attractive large-cap life insurer with one of the most attractive business mixes in the industry, significant exposure to high-margin international insurance, a mid-teens RoE, strong capital returns to shareholders and a very compelling valuation. If Prudential is able to avoid being designated a non-bank SIFI, we think it would mean the company takes a more aggressive stance on share buybacks, which we would expect to drive its RoE and valuation higher.

I provide equity research coverage on U.S., European, LatAm and CEEMEA banks/financials, including fundamental analysis complete with a valuation, commentary on price-sensitive events and actionable trading ideas. If you are interested in the topic, click the "Follow" button beside my name on the top of the page.