In the first article of this series, I have shared my thoughts on the Brexit and its implications for the European stock markets in general.

Yesterday, I wrote about Allianz SE (OTCPK:ALIZF, AZSEY), Germany's leading insurance company, an attractive income stock with a 5.8% yield.

My next pick, BASF (OTCQX:BASFY, OTCQX:BFFAF) comes from the chemical sector and is a stock which I recommended already at the beginning of the year.

Courtesy of BASF SE

The stock fell near its five-year low in February 2016, gained 20% in the following few months, but is now again down by 10% after the Brexit vote. The drop in February coincided with the oil price low, not very surprising since BASF's Oil & Gas segment is an important earnings contributor. BASF has a shareholder friendly dividend policy, it raised the dividend for five consecutive years and currently yields 4.3%.

Catalyst No. 1 - Oil

BASF shares and crude oil trade in parallel since about one year. Consequently, the oil price recovery has helped BASF shares, and I don't expect the stock to test the February low in a more or less stable oil price environment. The recent setback following the Brexit marks another attractive entry point, admittedly the stock is not as cheap as it was earlier in the year, but it still looks attractive to me.

Fundamentally, BASF is doing okay. The first quarter was characterized by a weaker performance in the Chemicals and Oil & Gas segments, but all other businesses reported higher EBIT than in the previous year. BASF Group sales decreased by 29% to €14.2B, however the severe drop was largely on account of the divestiture of the gas trading and storage business, which had contributed €4.2B to sales one year earlier. EBITDA of €2.8B ($3.08B) was 3% lower while EBIT before special items fell 8% to €1.9B ($2.09B). Due to one-time effects, net income actually rose 18% to €1.4B ($1.54B) which corresponds to adjusted EPS of €1.64 ($1.80). Analysts expect full-year EPS of €4.72 ($5.19), the second decline in a row, down from €5.00 ($5.50) in FY15 and €5.44 ($5.98) in FY14.

A higher oil price will help BASF in the second quarter, and at the moment it looks as if oil is more likely to go higher than lower in the near future. Hence, it could remain a tailwind for BASF throughout FY16 and result in an earnings beat. BASF's 2016 current guidance which forecasts slightly lower EBIT before special items, driven by drastically lower earnings in the Oil & Gas segment, is based on an average oil price of $40/barrel (Brent). In Q2, Brent averaged slightly above $45/barrel, ending the quarter at $50/barrel. Should the oil price climb back to $60, it would add substantial upside for BASF's Oil & Gas segment.

I believe that earnings will indeed decline in FY16, but probably less than analysts expect. Agricultural Solutions and the chemical businesses will likely continue to improve their profitability in a challenging environment, and without any new trouble from the oil market, BASF should be able to grow earnings again in 2017.

An attractive Dividend Payer

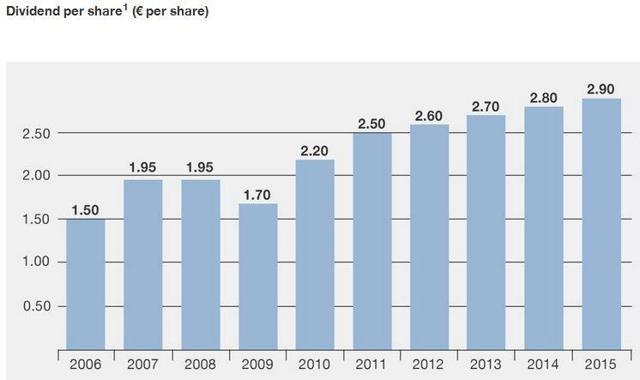

Like many European stocks, BASF pays an annual dividend which was raised with the recent 2016 payment to €2.90 ($3.19), resulting in a payout ratio of 58% (based on the FY15 earnings). The company's dividend policy aims to increase the dividend each year or at least maintain it at the previous year's level. The €0.10 ($0.11) raise corresponds to a 3.6% growth rate, and I believe that similar increases can be expected in the next years. Today, BASF yields 4.3% which is well above the five-year average and very attractive compared to most other stocks.

BASF Dividend History

Source: company website.

More M&A Options?

BASF has been criticized for not playing a more active role in the consolidation of the chemical and agricultural industry. After the Dow Chemical/DuPont merger is completed, BASF will only be the no. 2 chemical company in the world.

Syngenta and BASF's long-term partner Monsanto are in the process of being acquired, but BASF watched speculations and merger talks from the sideline. Only recently, the company made its first cautious move and announced the acquisition of Chemetall from Albemarle for a total consideration of $3.2B.

BASF is a conservative company, it just celebrated its 150th anniversary in 2015, and management surely does not like to rush things. So far, BASF has refrained from major acquisitions, but I believe that it will pull the trigger once opportunity knocks and when the price is right. In order for the Syngenta and Monsanto takeovers to be approved, regulators will ask for some businesses to be divested. This could lead to interesting opportunities to strengthen BASF's Agricultural Solutions segment at a reasonable price.

Conclusion

BASF came under pressure for the first time at the beginning of the year when oil prices tanked. The second drop, triggered by the Brexit vote is another opportunity to invest in one of the most solid German stocks which also offers an above average 4.3% yield.

Disclaimer: Opinions expressed herein by the author are not an investment recommendation, any material in this article should be considered general information, and not relied on as a formal investment recommendation. Before making any investment decisions, investors should also use other sources of information, draw their own conclusions, and consider seeking advice from a broker or financial advisor.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.