The Montney Shale play in Canada has drawn significant amounts of interest, investment and activity in recent years. Even as commodity prices collapsed and rigs were cut across North America, natural gas production in the Montney has remained steady. In addition to the many pure play operators, large producers such as Encana (NYSE: ECA) have made the Montney one of their "core" areas of focus and are devoting significant attention to the Montney shale. With the recent update to Alberta's royalty program, BTU Analytics' wanted to explore production and economic trends for producers operating north of the border.

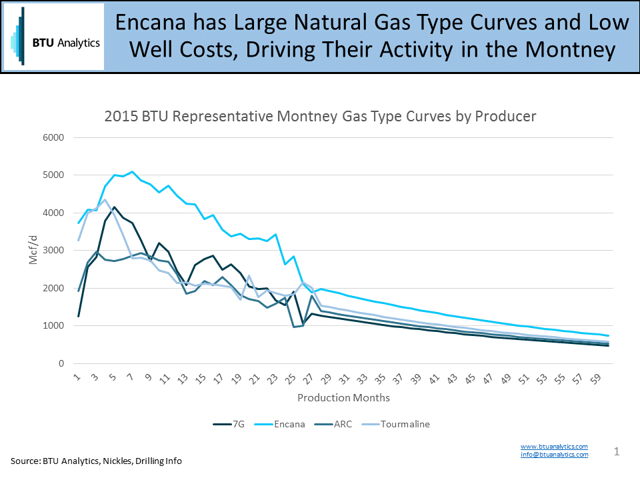

The Montney shale has often been compared to the big shale plays in the US, and production results have been strong the last few years. The Central region of the Montney, in particular, has seen large benefits from the quality condensate window, with many of top producers operating out of this region. Using data from 2014-2016, natural gas type curves were generated for a selection of active producers in the Montney formation, representing the overall producer average for all of their wells drilled within the play. Due to variances in zone depths and condensate windows across the Montney, the type curves for specific drilling areas could be higher or lower when comparing to investor presentations on a particular location.

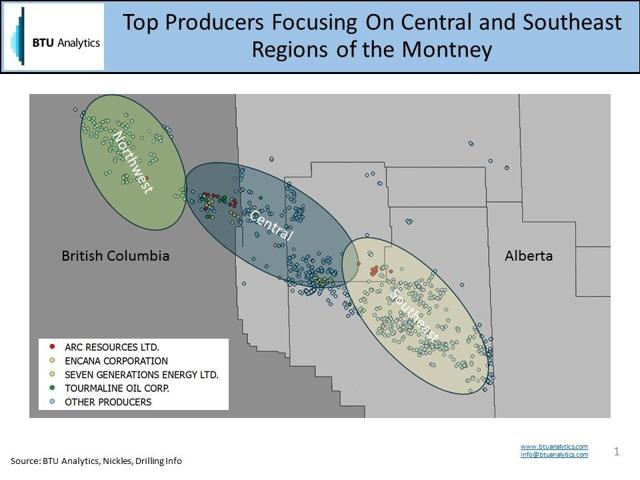

Seven Generation (SVRGF) [TSE:VII], Encana, Arc Resources (OTCPK:AETUF), and Tourmaline (OTCPK:TRMLF) represent a selection of the most active operators in the Montney shale in 2015. The fact that these producers are drilling in various locations throughout the Montney highlights the extensiveness of the play. Encana in particular has reported high production rate wells in investor presentations and the data shows an overall type curve that is much higher than its competitors in the region. The type curves indicate why producers are interested in the play, but how do the economics stack up after the changes in the Canadian royalty structure?

US producers normally pay a flat royalty percentage to landowners, typically around 20%. The royalty structure in Canada utilizes a sliding scale based on project payback periods and commodity prices. This method sets a flat rate royalty of 5% until a pre-determined payback amount has been reached. The payback is calculated using average drilling and completion costs for the play. Once the initial investment (payback) has been recouped by the producer, higher royalty rates (from 5% to 40%) are implemented based on current oil and gas prices (Source: Alberta's Modernized Royalty Framework). The idea behind this royalty structure is to encourage investment in Alberta, support production in low price environments, and maximize payouts to Albertans. So how does this look from a producer economic standpoint?

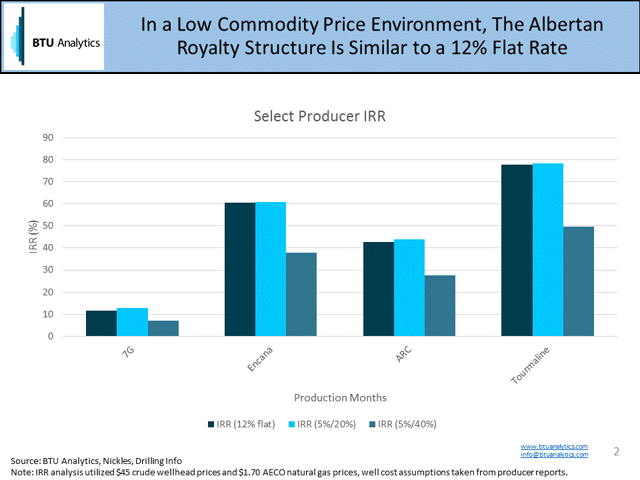

The chart above shows internal rates of return (IRR) for specific Montney Producers and assumes Alberta royalty rate structures. Montney producers on the British Columbia side would be subject to a different set of royalty calculations, though they follow a similar theme. The IRR calculations assumed a standard $0.85 gathering and processing fee, a GPM value of 4, a BTU content of 1250 BTU/Mcf and utilized the type curves generated above. Average well costs were collected based on producer reported 2015 results within the play. In the flat rate case royalty scenario, a 12% royalty was used over the life of the project. This rate was chosen as a standard based on the reported realized royalty rates of 10-15% for multiple producers. For the variable rate case, royalties are 5% until the producer breaks even on the drilling and completion costs, then the variable royalty rate is used based on low and high price environments.

Of note is the similarity between the 12% flat rate case and the 5%/20% scenario. The IRR stays nearly the same, but there is an added benefit of a lowered risk potential for producers due to swings in commodity prices. With smaller upfront royalties, there is more incentive to risk a new well and maintain activity in a low price environment. In addition, the 12% realized rate is far less than the standard 20% royalty rate in the US, possibly helping to even the playing field between the Montney, the Marcellus and Haynesville. At higher prices and higher royalties, the IRRs are significantly lowered, but in today's commodity environment, the Montney Shale seems quite attractive. For more information on BTU's economic analysis, request a sample of the Upstream Outlook.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.