On Tuesday August 9th Scripps Networks Interactive (SNI) fell 7% after reporting quarterly earnings that beat on EPS but missed expectations on revenue. The negative stock market reaction was nothing new for SNI over the past year. As investors have become concerned about the loss of cable subscribers, the breakdown of the traditional cable bundle, and the rise of streaming and over the top (OTT) services there have been many questions about the future of the media landscape. The market has taken the view that scale is going to be of paramount importance in the shifting media landscape and the larger media players can use their clout to maintain their lucrative revenue streams.

If we look at a table of the major media companies we can see that investors are basically paying more for the bigger companies (as measured by forward P/E) then the smaller companies.

Company (Ticker) | Market Cap | Fwd P/E |

Comcast (CMCSA) | $161.2B | 17.0 |

Disney (DIS) | $158.5B | 15.6 |

Time Warner (TWX) | $62.3B | 13.3 |

Twenty-First Century Fox (FOXA) | $48.4B | 11.6 |

CBS Corp (CBS) | $23.2B | 11.9 |

Viacom (VIAB) | $16.8B | 9.3 |

Discovery Communications (DISCA) | $11.2B | 10.5 |

Scripps Network Interactive | $8.1B | 11.6 |

AMC Networks (AMCX) | $3.8B | 9.1 |

There are some anomalies here or there (Fox trades at a discount given the uncertainty at Fox News and Viacom is a hot mess as we all know) but by and large the bigger the company the higher the multiple.

In the case of SNI we don't think that the small company discount is deserved. We believe that the company is just fine on its own and has a bright future without any strategic combination with another media company. Scripps owns a collection of domestic and international cable channels that focus on life style brands and generally cater towards women. The company's three major media properties are HGTV, Food Network, and the Travel Channel.

Scripps Channels are Cheap and Popular

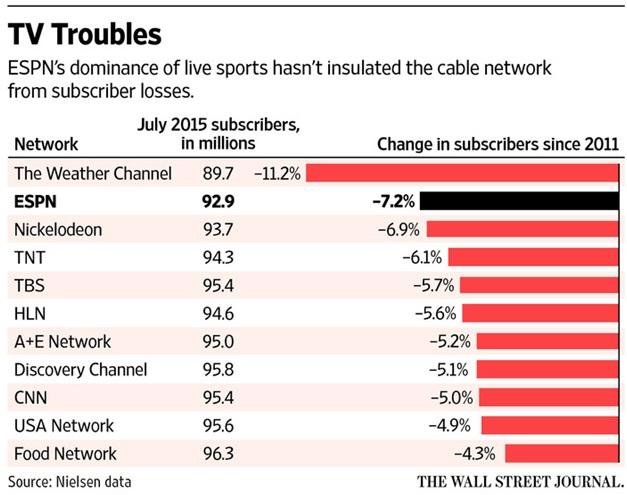

The biggest advantage Scripps has is that it's three biggest channels are wildly popular. Taking a look at some of the channels that have lost the most subscribers over the past five years we can see that Scripps' channels are near the bottom of the list.

This from the WSJ shows the Food network dead last in sub losses out of the channels they looked at.

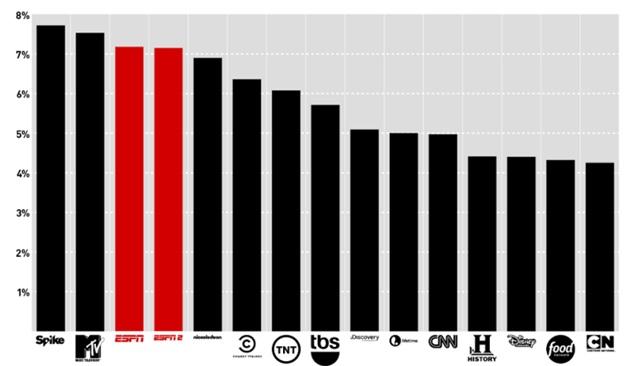

Another article from Deadspin again shows Scripps channels second to last in sub losses.

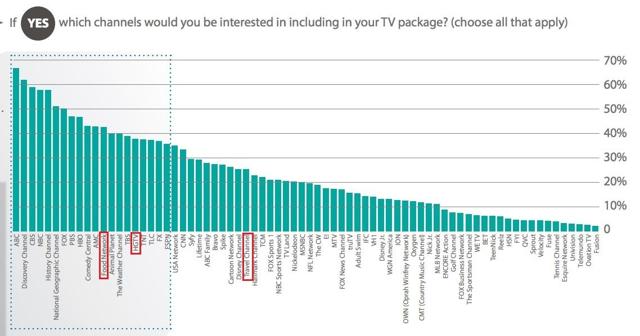

Not only have subscriber losses been minimal at SNI channels but a recent Variety survey found that in a world of a la carte pricing Food, HGTV, and Travel would be some of consumers' top choices to include in their bundle.

The popularity and niche nature of SNI's channels is a huge advantage. Scripps isn't carrying around a bunch of dead weight in unpopular channels that it is trying to force onto cable providers during negotiations. Take Viacom for instance. It has a hugely popular channel in Comedy Central (10th most popular in the survey) but it's also trying to get deadweight like BET carried when it's in negotiations. If the world goes unbundled (we don't think it will though) what happens to BET and the affiliate fees Viacom earns?

Scripps also doesn't seem to depend on huge affiliate fee revenues for profit. We estimate that HGTV costs around 21 cents per sub per month, Food Network costs around 18 cents per sub per month, and Travel costs around 7 cents per sub per month. We estimated affiliate fees using data in Scripps FY2015 10-K. Scripps earned 22.8% of its overall revenue from net affiliate fees. We estimated affiliate fees for each channel but taking 22.8% of each channels reported revenues and then divided that number by the year end subscriber number. Finally we divided by 12 to get the monthly affiliate fee number.

Given that the median affiliate fee for a cable channel is around 14 cents per subscriber per month we think that all of Scripps channels are if not underpriced at least appropriately priced. There seems to be very little risk for Scripps in a changing media landscape because of its low pricing and high popularity.

Just compare Scripps situation to ESPN. ESPN is the most expensive channel in the cable bundle at over $6 per sub per month. Yet there is a large portion of the population that does not want ESPN as evidenced by the subscriber losses and as shown in the Variety poll above. So, we have a situation where large cable bundles are forcing individuals to pay $6 per month to Disney (ESPN's owner) that they might not otherwise pay. I'm not sure how you could argue this would be the case with Scripps. The channels are both cheap and popular. The traditional cable bundle is likely not artificially increasing affiliate fees for Scripps.

Summary

In summary we find it hard to make a data driven case for Scripps needing scale to compete in the (possible) new media landscape. Scripps really does not have a "bundle centric" business model with an outsize reliance on fees. The popularity of its niche networks and its affordable affiliate fees should mean that the company can thrive just as well in an environment driven by streaming and skinny bundles versus the traditional cable bundle.