Radius Health (NASDAQ:RDUS) was fairly active on the rumor mill this past week with both the Financial Times (and here, subscription required) and Telegraph passing around chatter that the company had drawn interest from the likes of Shire (SHPG) and potentially Pfizer (PFE) and Amgen (AMGN). Specifically, the Telegraph reported that the company was rumored to have rejected a $70/share bid from Shire recently, which places a price tag of ~$3 billion.

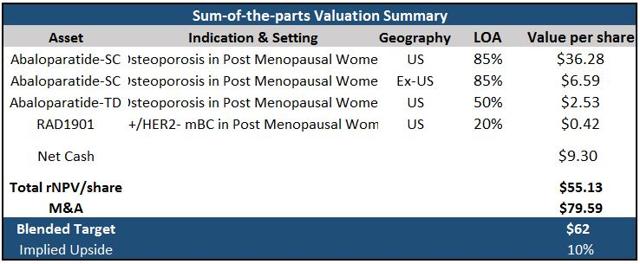

Regardless of whether Radius is taken over or remains independent, the company is set to enter an osteoporosis treatment market that should be kind to the company lead drug Abaloparatide-SC, a parathyroid hormone receptor (PTH1 receptor) that has a PDUFA date of March 30, 2017. Chemically, the buildup of Abaloparatide is ~41% homologous in terms of the proteins that make up Eli Lilly's (LLY) Forteo (teriparatide), which did ~$1.35 billion in WW sales in 2015. In terms of other injectable competition, Amgen's (NASDAQ:) Prolia did ~$1.31 billion in WW sales in 2015, up 27% from FY 2014. Amgen also holds the rights to Romosozumab, an investigational compound currently in Phase 3 testing and could potentially be on the market sometime in 2017.

Figure 1: Forteo and Prolia Yearly Sales

(Source: LLY and AMGN company filings)

Radius Should Face Little Resistance With Only Two Major Players in the Osteoporosis Market

The two major players in the market (Lilly and Amgen) both deliver their compounds via subcutaneous injection (SC), and the market for oral delivery drugs has actually declined nearly 18% and 9% (OTC:CAGR) in the US and ROW (rest of world), respectively (slide 8). For a drug that was approved over ten years ago (approved in 2002), Forteo impressively continues to grow low-mid single digits on a full-year y/y basis. Despite facing competition from generics and drugs of other mechanisms like Prolia, which is an anti-resorptive agent versus Forteo and Abaloparatide which are anabolic agents (stimulation of new bone production), Forteo has managed to grow its footprint on a domestic and international scale. Radius included Forteo as an active comparator in its Phase 3 "Active" trial along with placebo but didn't test the drug head-to-head against Abaloparatide, which isn't necessarily required per FDA guidance but would've been an additional selling point. Regardless, competition in the market simply isn't a factor to worry about especially in one that won't become saturated for a substantial amount of time heading into the future. CEO Robert Ward of Radius has claimed numerous times that the disease is "under-diagnosed and under treated" as the patients come to the realization that they have the disease only after a fracture occurs. According to the NOF and IOF, osteoporosis affects around eight million in the US and around 200 million worldwide (Radius 10-K, page 6). Moreover, the market for treatment was worth around $6.4 billion WW in 2015, indicating that there's plenty of room for Abaloparatide-SC to fit in amongst the little (if any) crowd (slide 8).

The 24-month dataset that the company submitted along with its NDA should satisfy FDA requirements as the agency in 2012 asked for an additional 6-months of data along with the 18-month data that was going to be provided via the Phase 3 "Active" trial. In the 18-month trial, patients in the Abaloparatide group achieved a 6% greater reduction in new vertebral fractures versus the Forteo group, and a 43% reduction in the risk of non-vertebral fractures. Notably, the risk-reduction in patients taking Forteo was not statistically significant. While the results aren't earth-shattering, the drug certainly doesn't appear to be a "me-too" compound and certainly does have a future on the market. In terms of a direct comparison with an active comparator, the 6-month extension "ActiveExtend" trial did show that Abaloparatide achieved a 1.6% difference (statistically significant) in terms of the amount of patients that had a major osteoporotic fracture.

Additionally, the favorable safety profile of abaloparatide should serve as a differentiator for the drug given Forteo's incompatibility in patients suffering from hypercalcemia. Specifically, over 6% of patients in the Forteo arm experienced signs of hypercalcemia, while less than 3.5% of patients in the abaloparatide group showed signs. Further, aside from simply causing hypercalcemia, Forteo's label discourages prescribing the drug to patients with hypercalcemia, excluding a fairly substantial portion of potential patients. Since Forteo and Prolia are often prescribed after older standard-of-care's like bisphosphonates (anti-resorptive agents), the treatment is technically given as a 2nd-line therapy. Biphosphonates (ex: Boniva) have also been associated with questionable safety profiles which should pave a cleaner path and entry for Abaloparatide following approval.

Pictured below is Abaloparatide's revenue forecast. Assuming the drug receives approval on March 30, 2017, the drug should hit pharmacies during the first week of Q2 2017. Of the eight million post menopausal women projected to have osteoporosis in the US, I'd estimate 60% to either be diagnosed or eligible for treatment. I've projected the WAC to be $2,500/year, which translates to ~$208/month, and ~$6.85/injection/day. Prolia is priced at a WAC of $1,650/year and Forteo carries a cost of $6,700/year on a wholesale basis. Note, Forteo is administered as a once daily injection. Abaloparatide will also be approved as a daily injection.

Figure 2: Abaloparatide-SC Model Assumptions

Assuming a 5% increase in the amount of patients eligible for treatment/overall market, a gross-to-net adjustment of 40%, an 85% likelihood of approval (LOA), and peak market share of 6%, I arrive at a risk-adjusted NPV per share for Abaloparatide-SC in the US of $36.28. The company has 43,082,740 shares outstanding.

Figure 3: Abaloparatide-SC US Revenue Forecast

Moving on to international sales, the company has re-iterated that they intend on partnering Abaloparatide-SC outside the US, and the company is "actively engaged in partnering negotiations" per CEO Robert Ward. Below, I've modeled for Radius to net 12.5% of all sales conducted ex-US, achieve peak ex-US market share of 2%, and be met with a gross-to-net adjustment of 60%. Further, of the 200 million women estimated by the IOF to have osteoporosis, I project 185 million to be post menopausal and 15% of them to be eligible/diagnosed for treatment. That said, rNPV/share for Abaloparatide-SC ex-US comes out to $6.59. As a whole, Abaloparatide-SC carries a rNPV/share of $42.87.

I am projecting peak sales for Abaloparatide-SC to come in at ~$749 million WW, with the US accounting for ~$645 million and ex-US accounting for ~$104 million (total attributable to Radius).

Abaloparatide-SC Remains Main Focus But Abaloparatide-TD and RAD1901 Provide Additional Pipeline Value

Of the several million providers treating osteoporosis, many shy away from prescribing injectables, despite being the most commonly used form and most effective (to date). That said, the company estimates that its investigational transdermal patch could potentially come in handy for the ~50,000 physicians who " rarely prescribe injectables" (slide 17).

The company plans on filing for approval of Abaloparatide-TD by submitting results of a bioequivalence study ( 10-K, page 8), and the company expects evaluation to be complete by the end of 2016. Note however that because of the method of filing for approval for the patch, any delay in SC's approval subsequently hinders the timeline for the patch as well. The company is set to present potentially pivotal data at ASBMR 2016 in September, making it the only notable catalyst left for the year.

In my working revenue model pictured below, I started with the assumption that 50,000 patients could potentially be awaiting treatment in the form of a wearable patch. From there, I'd assume that 60% have been diagnosed/eligible for treatment. Assuming a WAC of $2,000, a gross-to-net adjustment of 30%, 10% growth in patients eligible on an annual basis, and 70% peak market share, I arrive at a rNPV of $2.53/share for Abaloparatide-TD in the US. Peak sales projection comes out to ~$68.6 million. Further, I've set a 45% LOA to adjust for developmental/regulatory risk. Additionally, if approved, the launch could commence sometime in Q4 2017.

Figure 4: Abaloparatide-TD Model Assumptions

Figure 5: Abaloparatide-TD US Revenue Forecast

Moving on to the company's SERD (selective estrogen receptor degrader), RAD1901, which is currently in Phase 1 testing in advanced/metastatic ER-positive/HER-2 negative breast cancer patients. Limited data is available for the compound given that it is still in Phase 1 testing, but data presented last fall gave a solid indication in terms of an acceptable dose moving forward. In terms of revenue forecasts, I've modeled (not pictured) for ~14,000 patients to be eligible for treatment via a SERD such as RAD1901 and for the drug to grab 20% peak market share. Assuming a launch in 2019, I'd expect peak sales to come in around $40 million in 2023 given the competitive nature of the breast cancer treatment market. Peak sales of $40 million are derived using a WAC of $12,000/year as fulvestrant (current standard) is priced at over $8,000/year, gross-to-net adjustment of 20%, and an LOA of 20%, I arrive at a rNPV/share of $0.42 for RAD1901, essentially providing salvage value to the bigger picture. Investors should expect more color on RAD1901 as the company presents data at conferences.

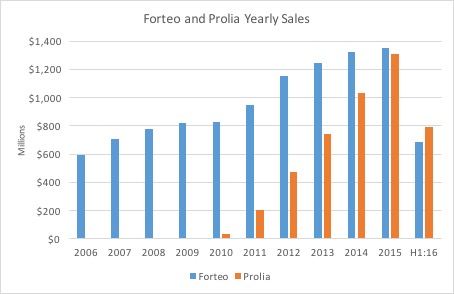

Valuation Summary

Figure 6: Radius Health Sum-of-the-parts Valuation Summary

For Abaloparatide-SC, I have modeled a 3% increase in WAC in 2018 and 2019, followed by subsequent, yearly increases of 5%. Price increases for the TD formulary follow an identical pattern as the injection. For RAD1901, I am modeling for 5% increases on a yearly basis, immediately following the first full year that the drug is on the market. The company has exclusivity for Abaloparatide-SC until 2027 and expects exclusivity for RAD1901 to be extended until 2026 from 2023.

The company had ~$401 million in cash at the end of Q2 2016 and is debt free, bringing net cash/(debt) to $9.30/share.

I've applied a peak sales multiple of 4 for M&A value, calling for a potential takeout to be around $3.4 billion, using total peak sales of ~$857.2 million. For my 12-month target, I utilized a blend of 70% rNPV and 30% M&A as Abaloparatide-SC remains an attractive, late-stage, and un-partnered asset (expect Japan), which comes out to ~$62/share, suggesting additional upside of 10% from current prices. Recommending buy.

Note: Data as of market close, August 12th, 2016