This article is part of a series that provides an ongoing analysis of the changes made to Alex Roepers' US stock portfolio on a quarterly basis. It is based on Roepers' regulatory 13F Form filed on 08/15/2016. Please visit our Tracking Alex Roepers' Atlantic Investment Management Portfolio article for an idea on his investment philosophy and our last update for the fund's moves during Q1 2016.

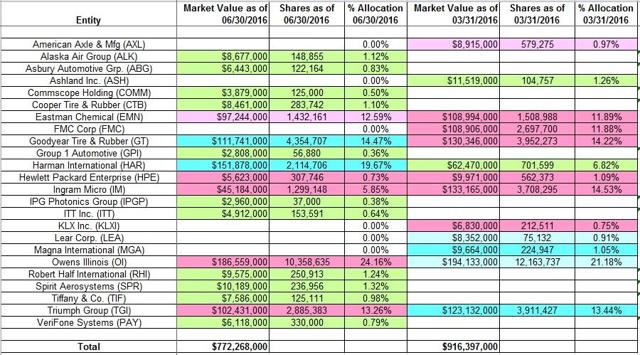

This quarter, Roepers' US long portfolio decreased 15.73% from $916M to $772M. The number of holdings increased from 13 to 18. The top three holdings are at 58.29% while the top five are at 84.15% of the US long assets: Owens Illinois, Harman International, Goodyear Tire & Rubber, Triumph Group, and Eastman Chemical.

Atlantic Investment Management's annualized returns since 1993 are impressive at ~20%. To know more about activist investing, check out Deep Value: Why Activist Investors and Other Contrarians Battle for Control of Losing Corporations.

Stake Disposals:American Axle & Manufacturing (AXL): AXL was a small ~1% of the US long portfolio position. It was first purchased in Q1 2014 and doubled the following quarter at prices between $17 and $21. There was a ~43% decrease in Q1 2015 at prices between $22.20 and $25.86. The disposal this quarter was at prices between $13.76 and $16.97. The stock currently trades at $17.75.

FMC Corp (FMC): FMC was a large 11.88% of the portfolio stake. It was established in Q4 2014 at prices between $51.60 and $58.96 and increased by ~170% the following quarter at prices between $55.72 and $64.59. Q2 2015 saw a further ~38% increase at prices between $51.77 and $60.95. Q4 2015 saw an about-turn: ~35% reduction at prices between $34 and $43 and that was followed with a ~23% decrease last quarter at prices between $33.53 and $41.73. The elimination this quarter happened at prices between $36.90 and $50.45. The stock currently trades at $48.19. Roepers realized losses.

Note: FMC was previously purchased in 2009 in the low-20s. It was a huge ~13% stake. That position was eliminated in 2011 in the low-40s.

Lear Corporation (LEA): LEA is a ~1% of the portfolio position established in Q4 2014 at prices between $78.22 and $98.42. Q4 2015 saw a ~43% reduction at prices between $109 and $126. The position was sold out this quarter at prices between $98 and $119. The stock currently trades at $116.

Ashland Inc. (ASH), KLX Inc. (KLX), and Magna International (MGA): These three very small positions (less than ~1% of the portfolio each) were eliminated this quarter. The position sizes were too small to indicate a clear bias.

Note: KLXI was spun off from B/E Aerospace (BEAV) in December 2014.

New Stakes:Alaska Air Group (ALK), Asbury Automotive Group (ABG), Commscope Holding (COMM), Cooper Tire & Rubber (CTB), Group 1 Automotive (GPI), IPG Photonics Group (IPGP), ITT Inc. (ITT), Robert Half International (RHI), Spirit Aerosystems (SPR), Tiffany & Company (TIF), and VeriFone Systems (PAY): These eleven very small (less than ~1% of the portfolio each) stakes were established this quarter. Although the current position sizes are very small, it is likely that some of these will be built up in the coming quarters.

Stake Decreases:Eastman Chemical (EMN): EMN is a large (top five) 12.59% of the 13F portfolio stake established in Q4 2015 at prices between $65 and $74. Last quarter saw a ~12% trimming at prices between $58.43 and $73.72. The stock currently trades at $67.06. This quarter saw a minor ~5% reduction.

Ingram Micro (IM): IM is a fairly large 5.85% position. It was established in Q1 2015 at prices between $23.04 and $27.64. The stake saw a huge ~134% increase the following quarter at prices between $24.67 and $27.26. There was an about-turn in Q3 2015: a ~26% combined reduction over three quarters at prices between $24 and $37. This quarter saw another two-thirds reduction at prices between $33 and $36. The stock currently trades at $34.92. Roepers is harvesting gains.

Owens Illinois (OI): OI is Roepers' largest position at 24.16% of the US long portfolio. It is a very long-term stake. In 2008, the position was minutely small and was built up to 11.2M shares by 2012 through consistent buying. 2013 saw an about turn as ~40% of the stake was sold. In 2014, the position was built back up to 12.2M shares at prices between $24 and $35. Q3 2015 saw a ~16% reduction at prices between $19.42 and $22.94. Last two quarters had seen a ~15% increase while this quarter saw the stake reduced by around the same amount. The stock currently trades at $18.42. Roepers controls ~6.4% of the business.

Triumph Group Inc. (TGI): TGI is fairly large (top five) 13.26% of the US long portfolio position. It was established in Q4 2013 with the bulk purchased over the next two quarters at prices between $61.52 and $78.97. Q1 2015 also saw a ~25% increase at prices between $53.96 and $66.75. Last three quarters had seen a combined ~37% reduction at prices between $33 and $70. The pattern reversed last quarter: one-third increase at prices between $23.53 and $40.03. This quarter saw a ~26% selling at prices between $30 and $40. The stock currently trades at $32.12. Roepers controls ~5.8% of the business.

Hewlett Packard Enterprise (HPE): HPE is a very small 0.73% position that has seen significant reductions over the last two quarters.

Note: HPE is a November 2015 spinoff of Hewlett Packard's (HPQ) Enterprise business.

Stake Increases:Goodyear Tire & Rubber (GT): GT is a large (top three) 14.47% of the US long portfolio stake. The original position was from Q1 2013 when ~1.2M shares were purchased at prices between $12.50 and $14.50. Q1 2015 saw a huge ~242% increase at prices between $23.97 and $28.58 and that was followed with a ~95% increase the following quarter at prices between $28 and $32.40. There was an about turn in Q3 2015: ~70% combined reduction over the last three quarters at prices between $26 and $35. The pattern reversed again this quarter: ~10% increase at prices between $24.53 and $32.98. The stock currently trades at $29.42.

Harman International (HAR): HAR is now the second-largest position at ~20% of the US long portfolio. It was established last quarter at prices between $67 and $96 and tripled this quarter at prices between $66 and $89. The stock is currently at $85.90.

Note: HAR has seen a previous roundtrip in the portfolio. It was Roepers' third-largest position at ~18% of the US long portfolio as of Q4 2014. The entire position was eliminated the following quarter at prices between $96 and $143. The original stake was from 2012 with the bulk purchased in Q2 2013 in the mid-40s price range. Roepers harvested huge long-term gains.

Kept Steady:None.

The spreadsheet below highlights changes to Roepers' US stock holdings in Q2 2016: