It has been tough going for Infosys (NYSE: NYSE:INFY) in recent times. Back in April this year, the company raised its guidance for revenue growth, but had to lower it three months later. This was mainly due to weak discretionary spending by clients on consulting services, which is a result of the current macroeconomic environment.

Even before the market could come to terms with the cut in guidance, it received another jolt from the company. A month after lowering its guidance in mid-July, Infosys announced the loss of one of its marquee clients, the Royal Bank of Scotland. While the company did not disclose the impact on revenues from this event, some analysts believed the figure could be USD40 million. The company only said it would impact 3,000 jobs.

The stock currently trades at $15.75, which is roughly 2.5x the post-Lehmann lows made during March 2009. However, it is at the same level as in March 2014 and 25% below the recent highs made three months back. In other words, over the last two years, depending on when you bought the stock, you either made no money or lost a good bit.

INFY data by YCharts

While that seems too bad, what about those don't own the stock? Is a 25% dip from recent highs a good time to enter? That's what we are going to explore in the rest of this article.

Near term headwinds will only intensify going forward…

In last Friday's analyst meet, Infosys' management mentioned that Brexit is going to hit clients' IT spending going forward. The impact on revenues from Brexit is hard to estimate but we can expect more headwinds following the RBS deal cancellation.

Even without Brexit, the operating environment remains challenging for Infosys. Majority of its large clients are from the financial services sector, typically global banks, insurance and asset management companies. These large clients are under serious pressure today from regulators (Dodd-Frank, Basel III), disruptive technologies (fintech, P2P) and ultra-low interest rates. More importantly, none of these pressure points will go away anytime soon. As a result, Infosys' large deals are seeing significant cost pressures, something that management is becoming increasingly candid about with each passing quarter.

…while the traditional business model stands broken

Operating out of India, Infosys and other Indian IT companies enjoyed significant cost advantages over their more illustrious global competitors, the likes of IBM (NYSE: IBM), Oracle (NYSE: ORCL), Accenture (NYSE: ACN), SAP (NYSE: SAP), Intel (NASDAQ: INTC) among others. Combined with sharp focus on service delivery, this cost arbitrage formed the basis of their value proposition. Those days are now over. Firstly, the large global peers have set up large operations bases in India and other low-cost destinations. Secondly, manpower costs in India have gone up significantly over the last two decades. The combined effect of these two factors has narrowed the cost differential to such an extent that it can no longer be the main value proposition for Infosys and its Indian peers.

The changed scenario…

The above two points should make it amply clear that Infosys' traditional business model is surely becoming a thing of the past. It is no longer a case of increasing billing rates, adding manpower count and increasing their utilization to fuel growth. Instead of low cost services, clients are looking for solutions tailored for this new world, solutions that address their challenges and fit within their budget constraints. This means a shift to automation and artificial intelligence (AI). A shift towards greater value addition with lower hours billed, i.e. bigger bang for the buck.

…creates an uncertain new world for Infosys

In this new environment, Infosys finds itself increasingly pitted against the global IT giants. While its automation and AI capabilities are not to be underestimated, investors need to understand the company is now playing a different ball game. It neither has a great deal of expertise nor a rich legacy in the new world in which it finds itself today. Moreover, disruptive new technologies will only add to its problems. The company is making bolt-on acquisitions to increase its capabilities and stay competitive, but so are its competitors. These competitors have a history of innovation and disruption which Infosys or its India IT peers do not. Whether the company succeeds in this new environment remains to be seen.

Infosys is responding to this changed environment. Its automation initiatives have eliminated the need for 3,900 full time employees in FY16, and the number is only going to increase in the coming years. Yet, rather counter intuitively, automation replacing jobs would result in a net loss of revenues in order to create cost savings for clients. While it will be a positive for margins, at a firm-wide level, margin gains through automation and AI are not a given. Such gains will ultimately depend on how successful these initiatives prove to be and how fast the company can ramp down its traditional business. In addition, operating costs continue to increase for Infosys due to ever rising H1B visa costs in the US, the largest market.

Valuation does not reflect the new age realities

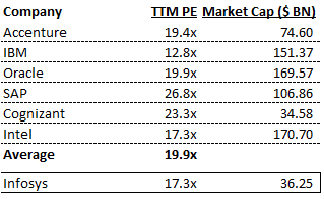

The trailing 12-month PE of Infosys is 17.30x, which is inside its peer group's mean, but not by much. The TTM PE has inched over 20x on a few occasions in the past five years, although the average PE during this period stands at 17.9x, which is very close to where the stock currently trades. Considering the current scenario, we expect the multiple to drift downward over the medium term. There is no investment case for going long on the stock.

Infosys vs. Global Peers

INFY PE Ratio (TTM) data by YCharts