Welcome to the Laborious issue of M&A Daily

General Electric

General Electric (NYSE:GE) is battling Siemens (OTCPK:SIEGY) and a Chinese bidder for GKN. The global engineering group would be a good fit for either GE or Siemens, but any buyer would have to contend with its underfunded pension plan.

Media General

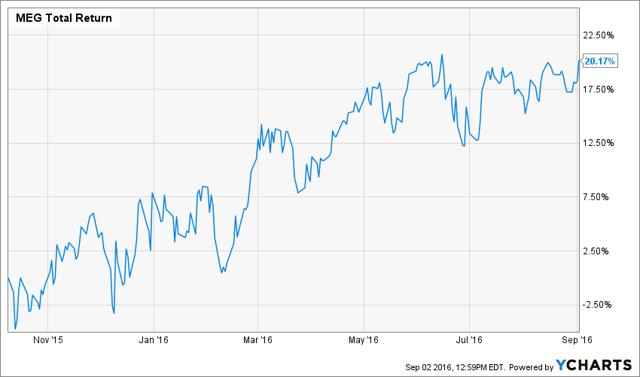

Media General (MEG) has done well since Andrew Walker published Catalysts Drive Media General's 20% Upside.

The Nexstar (NXST) acquisition of Media General secured DoJ approval. It will probably close in November.

Labor Day (M&A) Deals

Who will get bought this weekend? I have a few clues. Any Sifting the World members interested can join the conversation here.

McDonald's

Carlyle (CG) and Citic (OTCPK:CTPCY) are working together on a bid for McDonald's (MCD) Chinese operations.

TiVo

The exchange ratio based on the Rovi (ROVI) and TiVo (TIVO) merger agreement is 0.3853.

Fairchild

ON (ON) extended its tender offer for Fairchild (FCS) to September 16.

Linear

The preliminary proxy has been filed for the acquisition of Linear (LLTC).

Polycom

Polycom (PLCM) shareholders approved its acquisition.

Cypress

One takeover candidate that came up in the StW Live Chat is Cypress (CY). It is working with Morgan Stanley (MS) on a sales process in reaction to interest from possible suitors. More to come in future editions of M&A Daily…

Done deal.

- First Cash (FCFS) completed its Cash America (CSH) deal.

Elsewhere on Seeking Alpha

- 'Oops' - Tesla Bankers (TSLA, SCTY, LAZ)

- Welcome To September (LMBH, HONE)

- Publicity Stunt Or Buyer's Remorse? (ABT, ALR)

Beyond Seeking Alpha

Sifting the World

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.