Avon Products Inc. (AVP) is a manufacturer and direct selling company of beauty, household and personal care products. A few years ago AVP was the fifth-largest beauty company in the world and the second largest direct selling group with more than 6.5 million representatives ("Avon ladies") worldwide.

Trend reversal almost broke Avon's neck

Direct-Selling was a popular and successful distribution channel for a long time. However, societies shopping behavior changed and so the AVP community changed as well. Today AVP is a strong distressed company with a revenue decrease of 16.85% (OTC:CAGR) within the last three years. Within the last five years the revenues dropped 10.72% annually. In 2015, AVP generated revenues of $6.16bn with a net loss of $1.15bn. The strong decrease in profits over the last years is the main reason, why the equity ratio is negative by 23.23% (MRQ).

Distressed Hedge Fund wants to boost the turnaround

Cerberus Capital Management L.P. is a hedge fund with more than $30bn assets under management that specializes in distressed investments. In this context, Avon is a common investment case for Cerberus. In December last year AVP and Cerberus announced the close of their strategic partnership transaction with a volume of $605m. The deal included the separation of Avon's North America business into a privately-held company. The new company is majority-owned and managed by Cerberus.

Avon Products Inc. will remain the business of its international markets.

The new structure is as follows:

(Source: Avon Investor's presentation)

Extension of financing structure provides better safety

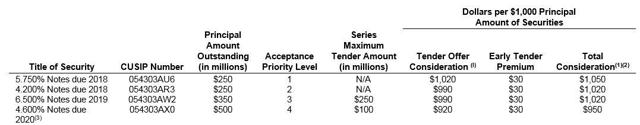

A few months later AVP announced a cash tender offer for its outstanding bonds with a premium for early bird investors.

Only $285m of the principal amount outstanding of $1,35bn were tendered. In the course of this tender offer, they also announced the offering of new senior secured notes with an initial volume of $400m. Just a few days later they increased the amount to $500m. The group completed the offering only two weeks later. From my point of view, these facts are really interesting and might show the strong interest and trust of capital markets concerning the survival of AVP.

New structure is focused on growth-markets

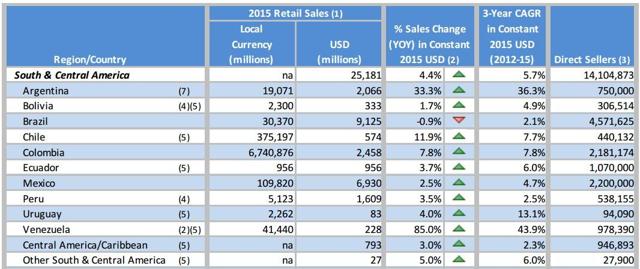

Like already mentioned in the beginning, direct-selling is strongly influenced by consumers' behavior. It doesn't work anymore in the US. The concentration on emerging markets in South-America and Asia seems much more intelligent to me.

Beauty is still the #1 direct selling category of all segments that are distributed through the direct selling channel. Right now, it's most important to focus on attractive growing markets. Currently AVP is #1 in the market for color cosmetics in Brazil, Argentina, Mexico and the Philippines. Excepting Brazil, AVP is also #1 for direct selling in general in the mentioned countries as well as in Colombia, South-Africa and Russia. All these countries seems to be attractive markets, where direct selling still may works.

The latest statistics of the World Federation of Direct Selling Associates encourage this thesis.

The proportion for beauty products of all direct selling products in Brazil is 84% and in Argentina at least 64%. In total South- and Central-America has a proportion of beauty products within the direct selling industry of 62%. On the contrary the USA has a proportion for beauty products of only 17%.

(Source: World Federation of Direct Selling Associates)

Brazil did quite bad compared to other countries in Central- and South-America. I'd guess this is just the result of its economy weakness and not a question of consumers' behavior. The based trend seems to be in upswing. The Philippines, another strong market of Avon Products, grew 6.8% year-over-year.

Strong increase in management effectiveness

The management effectiveness can be analyzed by considering the cash conversion cycle. Within the last few quarters, AVP was able to increase the effectiveness of its processes. For reaching this, the management strongly extended its payable periods by smart negotiations with suppliers.

What is coming next?

On 27th of October AVP will publish its Q3 results. The company needs to provide some positive effects of the first steps. Within the last years, the group didn't match the expectations of analysts with alarming regularity. On the 6th of September, we've had the Barclays Global Consumer Staples Conference. In the following days the share strongly declined without any other news around. This might be a result of the latest rally since the beginning of August OR a negative impression of institutional investors and analysts regarding the conference.

Nevertheless, the company looks from my point of view still attractive. The turnaround is in full swing, the business model is refocused on still attractive markets and the financing structure is more stable based on a longer-term maturity. Cerberus is a long-term "insurance" for a further success of AVP.