The countercyclical wine and spirits sector was buoyed for the last 12 months compared to the Dow Jones Food & Beverage Index, Dow Jones Luxury Index as well as the S&P500. In fact, if you look at the large global premium companies of the industry — Constellation Brands (NYSE:STZ), Diageo (DEO, OTCPK:DGEAF), and Pernod Ricard (OTCPK:PDRDF, PDRDY) — you will notice a surge in their share price, which is justified to our opinion. We will explain why Constellation Brands' performance is on top of its peers.

Constellation Brands was founded in 1945 by Marvin Sands, father of current CEO Robert Sands. From the unique wine brand, initially distributed under the name of Canandaigua Industries, Marvin built a diversified group which is now the third largest brewer in the USA. The company is listed in the S&P500 since 1986 and has been a regular member of the Fortune 500 since its integration in 2006. In 2013 the acquisition of Nava Brewery, a Mexican brewery with 2'000 employees and 25 million hectoliter capacity based 80 miles from the US border, was a turning point for Constellation Brands in becoming one of the biggest brewery in the world. Throughout the years, the firm has built its success elevating the price positioning of its brands coupled with a well-targeted external growth strategy (the latest acquisition being high-end producer Prisonier Wine). The company brands (Robert Mondavi, Meiomi, Svedka, Casa Noble, Corona, to name a few) are positioned to capture the fast-growing demand of premium experience and high quality consumption in North America.

According to the International Wine & Spirit Research (ISWR) institute, wine and spirits companies should benefit from Millennial generation (born between 1980 and 2000) with a robust growth in the upcoming years. This trend is based on the fact that Millennial have now reached the legal age for alcohol consumption. In 2015, Wine Spectator reported that 42% of wine consumption is coming from this generation age. Worldwide wine consumption is expected to grow by 3.7% between 2014 and 2018, exceeding 2.7 billion 9L cases at the end of 2018. Spirits (mostly vodka, tequila, cognac) should be up by 3% to 3.2 billion in the same period. Firms embrace change by premiumising their brand portfolio. They acquire or develop high-end brands in order to offset a potential decrease in volume with a rise in price and margins. Americans are now the first wine consumers in the world with 323 millions of 9L cases in 2015 (a 1% increase from 2014), mostly favoring local wines (representing 80% of US consumption) over imported wines (mainly French, Italian or South American).

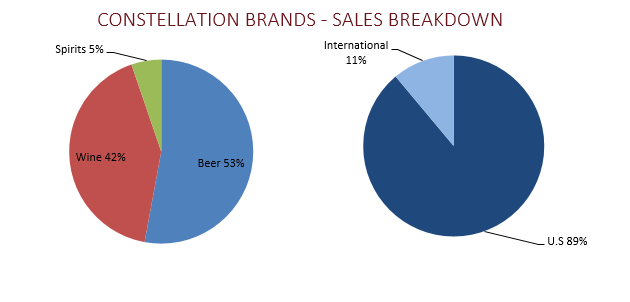

According to the Wine Market Council, the number of regular wine drinkers continues to increase with 35% of the US population drinking several times a week (+2% since 2010). Also, the imported beers in the US grew by +7% in 2015 thanks to the large Hispanic population in the US who are the main growth drivers. Overall, these positive trends for Wine, Spirits and Beers will benefit the whole US market but some brands have competitive advantages thanks to their historical heritage and their strong marketing skills. Constellation Brands, which sells about 90% of its products in the USA, is one of the market leaders in the industry. Corona Extra (+8.5% in sales) and Modelo Especial (+19.2%), which both belong to Constellation Brands, are among the Top 5 US leading brands in the beer category and continued growing their revenues by an astonishing +9% and +19% respectively in 2015.

Within its 91 years in the business, Constellation Brands has concluded acquisitions and divestments that have enabled the firm extend its operations by type of products and clients. Ballast Point has still a strong potential to add capacity to the beer segment and increase volumes. Meiomi and Prisoner Wine offer new high-end wine brands for the American market. Corona and Casa Noble are highly demanded by Mexican-born US citizens, demographics are favorable for the company to boost sales growth. More generally, those deals fit the firm's goal of trading-up and choose higher price positioning.

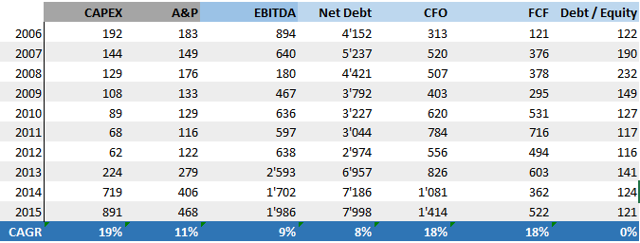

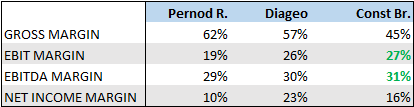

It's no surprise to us that operating margins jumped from 14% to 27% in the last decade and net income margin surged at a CAGR of +14% in the same period while sales grew at a healthy +3% CAGR and inventories are down -1% p.a.. The latest acquisitions did not come for free, the company net debt doubled in 10 years (CAGR +8%) but synergies are visible (mainly economies of scale) as gross margin edged up at a CAGR of +5% between 2006 and 2015 to reach 45% and the company lately started to pay some dividend which is rather a good sign. Even if the Net-Debt-to-Ebitda ratio is above its sector peers (except Pernod Ricard which is above 4.5x), we feel confident about the company when we look as the ratios of return-on-capital-employed (12%) and return-on-invested-capital (6%) are above peers.

Cash flow from operations and free-cash-flow are robust enough to support the debt level of the company.

The evolution of CAPEX (CAGR 19%) in parallel with Advertising & Promotion expenses (CAGR 11%) throughout the years show the ability of the company's executives to prioritize development and brand marketing. As a result, Constellation Brands succeeded in delivering highly recognizable products and give the customers efficient insights about the Group's core premium brands. The following ad for Woodbridge has been selected among the top alcohol TV-Ads in 2015 by Nielsen beverage and alcohol: https://www.youtube.com/watch?v=MxmhwnwInxg.

Constellation Brands has the highest EBIT and EBITDA margins among its two major competitors according to latest fiscal year's results.

(Source: Bloomberg)

These strong commercial and financial performance made the stock surge +500% in the last 10 years. In just 3 years, it's P/E jumped from 8.0x in 2013 to 26.0x currently. However, the valuation is not ridiculous compared to its peers such as Pernod Ricard (31x) and Diageo (21x). When you look at the growth expectations (earnings should grow at a CAGR of +11% in the next 3 years) and untapped potential of Constellation Brands in its local market, the stock is worth the current price. Indeed, it's a defensive stock with a wide portfolio of quality brands that should generate resilient cash-flows during downturns but also bull markets.

Management remains confident about the progress of the synergy programme so we should expect further cost cutting while the premiumisation of the brands (margin expansion) is gaining momentum. We should also mention that the Team USA concluded a record-breaking Rio 2016 Olympic games which could influence alcohol consumption for the audience. Last but not least, election debates and campaigns tend to gather Americans in front of their TV and one could assume that alcohol consumption could be positively impacted.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.