The fifty-eighth edition of:

Resource Sector Digest

(vol.58 - October 17 , 2016)

an offering that is brought to you by Itinerant and The Investment Doctor.

As always, this edition of our newsletter will:

- set the scene;

- highlight actionable ideas;

- comment on news releases;

- and link to relevant articles.

As always, here is a cordial invitation to join Itinerant Musings for exclusive access to actionable research on mining and energy stocks. Some examples are sprinkled throughout this newsletter for good measure.

And before we forget, you can read the three most recent editions here, here, and here in case you missed them!

Setting The Scene - A Rant

News release of the week

During TID's temporary disappearance, Itinerant started to highlight one 'interesting' press release, and we have a very clear winner this week. Prepare to laugh. Or to cry.

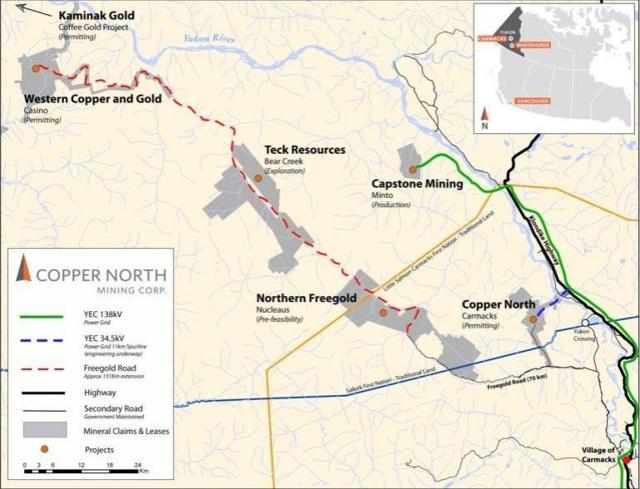

A few years ago, Copper North Mining (CPNVF) appointed a new CEO, who subsequently went on a roadshow to tout the merits of the Carmacks copper project in Canada's Yukon Territory. The company has now released a preliminary Economic Assessment of the Carmacks project, and even though Copper North claims to be 'pleased' to release the study and seems to be keen to point out the production cost per pound of copper will be just $1.08, the project is 100% unviable at the current copper and gold prices.

Source: Copper North Mining presentation

The real killer is the initial capex which has been estimated at $167M. Sure, that sounds 'doable', but if your copper production rate is just 30 million pounds per year at a cash cost of $1.08/lbs, your payback period will be approximately 6 years at the current copper spot price. That could still be acceptable but unfortunately the mine life is just 7 years.

That's why the post-tax NPV8% is negative (at $2.50 copper), and if you'd use the current copper and gold spot prices ($2.25 and $1300/oz to be generous), even the pre-tax NPV8% would be a negative C$32M (and the post-tax NPV would very likely somewhere in the -C$45M range).

The Investment Doctor is unsure why the company (or any company for that matter) would be 'pleased' with the results of the PEA. Even if you'd apply a $3.25 copper price and $1300 gold, the post-tax NPV8% will still be just 50% of the initial capex (whilst we would like to see an after-tax NPV to be higher than the initial capex).

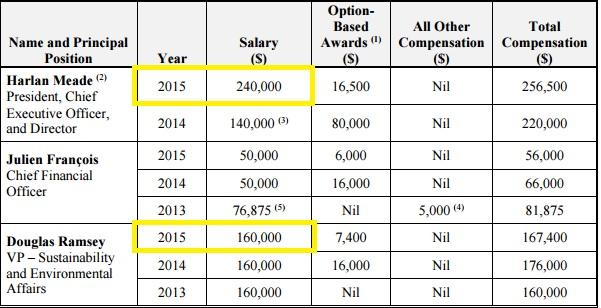

The project is indeed highly levered to the copper price, but the risk/reward ratio isn't good enough just yet, as Copper North continues to burn cash (the CEO and VP Sustainability took home C$400,000 in cash last year).

Source: Management information circular

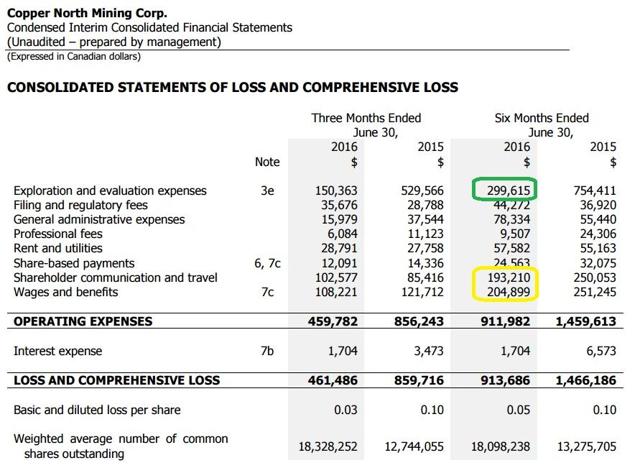

On top of that, the company burned C$912,000 in the first six months of the current financial year, and less than 1/3 of the cash burn was spent on the project. C$205,000 was spent on wages, whilst the company spent a stunning C$193,210 on 'shareholder communication and travel'. We think it's pretty difficult to justify spending in excess of C$1,000/day on this when you constantly need to raise cash to top up the bank account… And this wasn't just a one-time investment in promoting the company, as the total travel and communication budget in the financial year 2015 was a stunning C$421,000.

Source: most recent financial statements (H1 2016)

Long story short, a lot of leverage, but leverage works both ways and at the current copper and gold price, the after-tax NPV8% will be negative. We sincerely hope the Carmacks project will be built one day, but the company should try to cut its cash outflow…

Could it be different?

Yes, absolutely. At the same time Copper North was spun out off Western Copper, the company also floated Northisle Copper (OTCPK:NTCPF) which also owns a low-grade copper project that will need a higher copper price to be profitable.

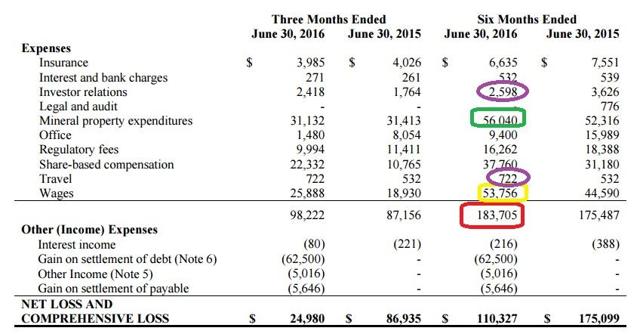

If you'd exclude the exploration-related expenses, Copper North spent C$600,000 on 'other stuff'. If we would now compare this with the spending pattern of Northisle Copper, the difference couldn't be more obvious:

Source: Northisle financial statements

Indeed, the company also spent just 1/3rd of its total cash outflow on the property, but what's more important here is that the overhead expenses in the first 6 months of the year are just C$127,000, or 80% lower than Copper North. The total travel and investor relations budget for the first semester? C$3,320. That's less than 20 bucks per day, or 1/50th of Copper North's budget.

And did Northisle underperform compared to Copper North's performance? Not really. Let's pull up the YTD performance of both companies (courtesy of Ycharts). The blue chart shows Northisle's performance, whilst the orange semi-flatline is Copper North's share price.

NCX Year to Date Price Returns (Daily) data by YCharts

Source: Ycharts

There's a small error in the chart, as Ycharts doesn't seem to take the 10:1 reverse split into consideration. But the end result is clear. Even after taking the reverse split into account, Copper North's share price lost 50% YTD, whilst Northisle Copper's share price increased by 500%. That's a serious outperformance!

As a shareholder of a company, you literally own a piece of that company. And would you prefer your money to be spent on travel and shareholder relations? Or would you prefer a company to tighten its belt during a downturn and only spend the bare minimum?

Note, The Investment Doctor has no position in Copper North Mining, but has a small long position in Northisle Copper. Both projects aren't viable at the current copper and gold price, but TID prefers his money to be spent wisely rather than jetting around the world on the shareholders' dime (at least that's what we would think has happened when looking at the expense report).

Bottom line: when you're thinking about investing in a company, you should always pull up the financial statements to check out how the company is spending its cash resources.

Actionable Ideas

Some interesting commodity-related articles were published last week.

· Freeport McMoRan (FCX) grabbed a lot of attention as it sold some more oil assets, and FCharlie thinks the dividend will return soon.

· Of course, the gold market remains quite hot, and a lot of contributors chimed in on the recent weakness in the gold price. A lot of new articles (38 to be exact) have been released on the Gold ETF (GLD) sub-page, and as always, there are a lot of different opinions and some of Seeking Alpha's top contributors have taken the bullish or bearish stance!

News Releases

Randgold Resources (GOLD) was under pressure as Mali closed the company's offices in Bamako, the country's capital. Randgold claims 'a large proportion' of the tax claims it received from Mali were without merit (which technically indicates that some of the claims were indeed valid). To be continued!

UK-listed SolGold (OTCPK:SLGGF) received a proposal from BHP Billiton (BHP) which wanted to take a 10% stake in the Ecuador-focused copper-gold explorer. Is BHP really interested in working in Ecuador? Let's see how serious they are. Meanwhile, other base metals heavyweight Rio Tinto (RIO) announced a plan to reduce its gross debt by $1.5B.

Banro (BAA) and Endeavour Silver (EXK) both reported production results. Banro's Q3 production set a new record as the company produced a total of 53,377 ounces of gold in the DRC and as the gold price remained consistently high during the quarter, Banro's financial results shouldn't be too bad! Endeavour produced 1.28 million ounces silver (-29%) and 14,364 ounces gold (-6%), which was above the company's own expectations.

Great Panther Silver (GPL) also reported a lower production rate, producing just 953,000 silver-equivalent ounces despite a 2% increase in the milled tonnage.

Alamos Gold (AGI) seems to like Corex Gold's (CGEKF) plans, as the company will pump C$2.53M in the company at a share price of C$0.10 per share. Alamos will also be allowed to nominate two directors to Corex's board.

Seabridge Gold (SA) which owns the huge KSM copper-gold mine in Canada's British Columbia has received the necessary permits to develop an exploration audit into the Deep Kerr deposit, which is copper rich. An underground exploration program should be much cheaper than drilling from surface and as icing on the cake the company should be able to use flow-through funds for this adit (which might very well be production-sized, saving the company cash later on). Together with Western Copper and Gold (WRN), Seabridge remains one of the interesting copper-gold plays (but the capex for both companies is very high).

Coeur Mining (CDE) has provided an extensive exploration update on three of its five mines. The company is planning to spend $30-34M on exploration, so we'll very likely see some more updates from Coeur in the not so distant future.

Polymet Mining (PLM) increased the size of its offering to $30M as there seems to be a lot of interest in the $0.75 deal with ½ warrant valid for five years with an exercise price of $1.00. One large shareholder will invest an additional $10.5M to keep its pro rata share in the company, and this can only be Glencore (OTCPK:GLCNF) (OTCPK:GLNCY). Side note: The Investment Doctor and Itinerant will both participating in the Polymet financing.

Gold Resource Corp (GORO) has received the final permit to mine its Alta Gracia zone which is part of the Oaxaca Mining Unit and located just 15 kilometers from the Aguila mill complex. GORO expects to start mining the ore by the end of this year, or in Q1 2017 the latest.

Ivanhoe Mines (OTCQX:IVPAF) has released an updated resource estimate on its Kamoa copper project in the DRC, and the company's claim it owns the largest copper discovery ever made in Africa might very well be true as the total Kamoa project now contains almost 75 billion pounds (!) of copper.

Almaden Minerals (AAU) was back with more news from its Tuligtic project in Mexico, as it discovered more high-grade mineralization both inside and outside the PEA pit. One of the holes intersected what seems to be a new zone of high-grade veining inside the pit, and this could definitely boost the economics of the project. Further north, in Nevada, Gold Standard Ventures (GSV) drilled 97.3 meters of 3.16 g/t gold, and now becomes one of the most likely buyout targets in North America. Who will be willing to cough up $700M+ for this company and its project? OceanaGold (OTCQX:OCANF)? Barrick Gold (ABX)? Or Newmont Mining (NEM) for the synergy advantages?

On Wednesday evening and Thursday, several mining companies released their production results again. Silver Standard Resources (SSRI) produced a record of 112,559 gold-equivalent ounces, whilst Asanko Gold (AKG) also put in a good performance with a gold production of almost 54,000 ounces. The mill is running at 20% above the nameplate capacity, and Asanko now expects to beat the H2 production guidance. How would K2 & Associates react to this?

Timmins Gold (TGD) produced 24,052 ounces of gold which is more than in Q3 last year thanks to a 20% increase in the average grade, whilst Richmont Mines (RIC) reported a total consolidated gold production of 18,856 ounces of which 14,000 ounces were produced at the Island Gold mine. The company still has $60M in cash. McEwen Mining (MUX) seems to be on track to beat its own guidance as it has already produced 114,000 gold-equivalent ounces (versus a full-year guidance of 144,000 ounces), whilst elsewhere in Mexico First Majestic (AG) produced 3.1 million ounces of silver and almost 15,000 ounces of gold. Fortuna Silver's (FSM) San Jose mine in Mexico produced 1.8 million ounces of silver which is substantially higher than the 1.34 million ounces in the third quarter of last year, thanks to the increased throughput of the mill. FSM also remains on track to meet its production guidance of 7 million ounces of silver.

Kirkland Lake Gold (KGILF), which is about to merge with Newmarket Gold (NMKTF) produced in excess of 77,000 ounces of gold in the third quarter at an AISC of less than $1000/oz, indicating Kirkland will have generated approximately $20M in free cash flow during the quarter (the financials will be released later in November).

On the copper scene, Imperial Metals (OTCPK:IPMLF) produced 18.7 million pounds of copper and almost 10,000 ounces of gold at the Red Chris mine, as the average head grade of the ore was 0.44% copper and 0.26 g/t gold, which is pretty good but most definitely not as good as the previous quarter! The Mount Polley mine (which received quite a bit of attention a few quarters ago after a dam failure) produced 7 million pounds of copper and 12,763 ounces of gold, and the company's full-year target for Polley remains at 27-29 million pounds of copper and approximately 50,000 ounces of gold.

B2Gold (BTG) produced almost 150,000 ounces of gold in the third quarter and this was sufficient to boost the quarterly revenue to a new record, whilst Klondex Mines (KLDX) now expects to produce 145,000-150,000 gold-equivalent ounces in Nevada, and approximately 10,000 ounces of gold at its True North mine, the previously acquired Rice Lake mine.

Hochschild Mining (OTCQX:HCHDF) (OTCPK:HCHDY) produced 9.9 million silver-equivalent ounces in the third quarter of the year, bringing the YTD production to 26.9 million silver-equivalent ounces (containing 13.2 million ounces of silver and 184,500 ounces of gold), and this excellent performance allowed the company to hike its full-year guidance to 35 million silver-equivalent ounces, to be produced at an AISC of just $11-11.5 (!).

UR-Energy (URG) has also released an update from its Lost Creek uranium operations. The higher flow rate compensated for the 5% reduction in grade, and the company also sold some of its inventory. The total production rate was almost 142,000 pounds uranium, but approximately 200,000 pounds were sold.

That's all you'll get from The Investment Doctor this week, and good old Itinerant will be back for the next few weeks.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.