Business Overview

IRIDEX (NASDAQ:IRIX) manufactures and sells ophthalmic lasers used to treat various sight-threatening eye diseases. The company's business can be divided into two distinct revenue components: non-recurring (54% of revenue) and recurring (46% of revenue). Laser consoles are usually one-time purchases, hence they represent the non-recurring component. Disposable probes (which connect to the laser) represent the recurring component, as these must be replaced regularly.

IRIDEX traditionally focused on the treatment of retina diseases, such as diabetic retinopathy. But this all changed with the introduction of the CYCLO G6 in early 2015. This new laser treats glaucoma (a disease of the optic nerve), which is the second leading cause of blindness globally, affecting some 70 million people. G6 has two key technological advantages over the competition: (1) it's one of the only FDA-approved lasers that can treat early-, mid-, and late-stage glaucoma; and (2) unlike conventional, continuous-wave lasers, its proprietary micro-pulse technology prevents heat-caused tissue damage.

In short, it's the best glaucoma laser on the market and, with the exception of conventional lasers, it has no serious competition. This ideally positions IRIDEX to swallow up a substantial share of the glaucoma treatment market in the coming years. In fact, since the February 2015 launch, the G6 laser and probe product line's quarterly revenue growth rate has exceeded 50%. It already accounts for nearly 15% of total revenue (as of Q2 2016), and should reach 50% within the next several quarters.

Enormous Growth Opportunity

To get a rough idea of G6's long-term potential, consider that there are 1,740 locations that perform glaucoma surgery in the U.S. And the number of locations internationally is at least 3x that (or 5,220), which sums to a total global location count of 6,960. Since many of these surgery centers have multiple treatment rooms, they require multiple lasers. A very conservative estimate is two lasers per location. This means that the maximum number of G6 lasers IRIDEX can sell is 13,920. Subtracting the 401 lasers sold since the 2015 launch, including the 90 sold in Q3 2016, equates to a total untapped opportunity of 13,519 lasers.

With this number in mind we, can now estimate IRIDEX's revenue opportunity. The average selling price for a G6 laser is roughly $10,000. Multiplied by 13,519 lasers, it implies a ~$135 million revenue opportunity. Again, remember that this revenue is largely non-recurring in nature - aside from occasional replacements/upgrades, a laser is generally a one-time purchase.

However, the disposable G6 probes are a recurring revenue stream, since they must be replaced after 90 minutes of use (each procedure takes about two minutes). Obviously, then, the more lasers IRIDEX sells, the larger its recurring revenue stream will get. With that said, a typical surgery center requires approximately 10 probes per month, or 120 per year. Each probe costs around $250. Thus, IRIDEX's annual recurring revenue opportunity is 13,920 lasers (including those sold) * 120 probes per laser per year * $250 cost per probe = ~$418 million.

With little in terms of serious competition (most conventional lasers treat only one stage of glaucoma) and an expanding sales force, there's little stopping IRIDEX from capturing a substantial chunk of these two gigantic revenue streams. Even a modest 10% share of just the recurring probe business would roughly double the company's annual revenue. In other words, IRIDEX's growth potential is enormous relative to its current size.

Retina Business Provides Stability

Let's not overlook the legacy retina lasers and probes, which still represent over 80% of revenue. This is a stable, mid to high single-digit growing business that will continue to benefit from two key long-term trends.

The first is the rapidly aging world population. The number of people aged 60+ is projected to more than double from 901 million in 2015 to 2.1 billion by 2050. With age come all sorts of health problems. Age-related macular degeneration (a disease of the retina) is a very common one. The risk of getting AMD increases from 2% for those ages 50-59 to nearly 30% for those over the age of 75.

Rising prevalence of diabetes, particularly obesity-driven type 2 diabetes, is the other key trend. The number of diabetics worldwide is expected to increase from 415 million in 2015 to over 640 million by 2040. Diabetes can cause various eye problems. One of the most serious is diabetic retinopathy (high blood sugar-caused retina damage). Nearly half of all diabetics develop some degree of retinopathy during their lifetime.

Significant Margin Expansion Potential

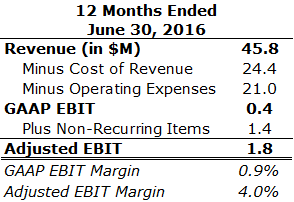

IRIDEX's EBIT margins have historically hovered around the 4-6% range. However, due to an unusual supply chain issue, trailing 12-month EBIT margins are well below that range, at under 1%. In short, this issue forced a temporary slowdown in laser shipments (impacting revenue) and created additional expenditures (impacting profitability). The good news is that this problem has now been fixed, so margins should revert back to normal going forward. (The table below shows IRIDEX's adjusted EBIT, which excludes all non-recurring items related to the supply chain problem.)

Note: Non-recurring items weren't broken out in the conference calls or in the SEC filings. They had to be estimated as follows: normalized COGS + OpEx is 96.0% of revenue. Trailing 12-month COGS + OpEx was much higher at 99.1%. In dollar terms, the difference is ~$1.4 million.

Source: A North Investments, IRIDEX's SEC filings and conference calls

Taking a longer-term view, IRIDEX's margins are likely to see significant expansion. That's because management's goal is to gradually shift the company's revenue mix from 54/46 laser versus probe sales to roughly 40/60 laser versus probe sales. This shift will have major implications for profitability since gross margins on probes (~80%) are significantly higher than gross margins on lasers (~50%). Higher gross margins will also drive higher EBIT margins. Management expects EBIT margins to more than triple to 15%+ within the next few years.

Attractive Valuation

With an enterprise value (or EV) of $114 million and an adjusted EBIT of $1.8 million, IRIDEX is trading for well over 60x EV/EBIT. While this might look expensive, it's important to remember that the company's accelerating growth and expanding margins will eventually bring this EV/EBIT multiple down to a much more attractive level. In other words, this stock is a lot cheaper than it currently looks.

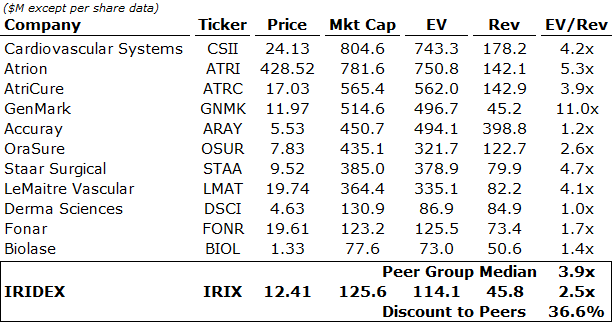

With that said, one of the best ways to value this company right now is on an EV/revenue basis. Based on this, IRIDEX is trading at just 2.5x EV/revenue, which is a substantial 37% discount to medical device peers shown below.

Note: (1) Recent M&A data also indicates that companies in this space sell for around 3-4x EV/revenue. For example, Valeant (VRX) paid more than 3x EV/revenue to acquire Synergetics, a manufacturer of laser probes and other ophthalmic devices. (2) EV = market cap - cash and short-term investments + total debt (including capital leases) + preferred stock + minority interest.

Source: A North Investments, Company SEC filings

A discount of this magnitude is excessive for several reasons: (1) Unlike most of its competitors, IRIDEX has a relatively stable revenue stream thanks to its "razor/blade" (or laser/probe) business model; (2) the company's new G6 product line has been very well received, with demand surpassing production capacity in some quarters, which should help drive long-term growth acceleration; (3) IRIDEX is likely to see significant margin expansion as probes become a larger and larger revenue contributor going forward; and (4) the company has a squeaky clean balance sheet with $11.5 million in cash and zero debt.

All things considered, IRIDEX shares can comfortably support a 3.5x EV/revenue multiple (a still sizable discount to peers). This implies a fair value of $17.00/share, or approximately 37% upside potential from the recent price of $12.41/share.

Even an in-line with peers ~4x EV/revenue multiple could be justified given the company's impressive growth acceleration and margin expansion prospects. This equates to a fair value of $19.25/share, representing 55% upside potential from recent price levels.

Key Investment Risks

All investments come with some level of risk, and IRIDEX is no exception. Here are the key risks to consider before investing in this stock:

- The ophthalmic market, on the whole, is enormously competitive. IRIDEX must compete against both other laser manufacturers and pharmaceutical alternative eye treatments such as Lucentis/Avastin (made by Genentech), Eylea (Regeneron (REGN)), Visudyne (Novartis (NVS)), Macugen (OSI Pharmaceuticals), and Ozurdex (Allergan (AGN)).

- The company recently filed an S-3 allowing it to raise up to $50 million via equity offering, which could hurt its stock price. Moreover, it's not totally clear what this cash will be used for. Most likely, management is planning to make some sort of acquisition in the near future.

- Insiders control roughly 40% of the shares outstanding, so outside investors have little say in what happens at the company.

- IRIDEX's average daily trading volume hovers around 26,000 shares. While this is plenty of volume for most retail investors, some larger or institutional investors could have difficulty entering/exiting trades in a timely fashion.

Conclusion

IRIDEX is a wonderful little company that's currently being undervalued by Mr. Market. This mispricing is unlikely to persist as the company's revenue growth continues to accelerate and EBIT margins expand. Investors who buy this stock below $13/share are likely to reap tremendous long-term gains: valuation points to upside of 35-55%+ over the next several quarters.