Just like Brexit, the market was heavily discounting the possibility of President Trump. Interestingly, the oddsmakers had almost identical odds for Trump winning as they did for a possible "leave" vote for Britain: 24% probability and this soon changed on October 28th. The odds of a Trump presidency have now increased to 35% based on fivethirtyeight.com's forecasts. Now if you are like me, you are probably looking to understand the angles in order to understand the potential impact on gold (NYSEARCA:GLD). Thankfully, the FBI's "October Surprise" provided a very good read-through for what the market might look like under President Trump and I am going to attempt to decompose three important barometers which are all important for determining the path that gold will take. These three being the dollar index, volatility and the yield curve.

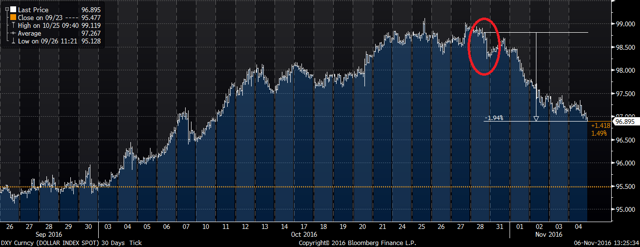

The first gauge is the U.S. Dollar Index. Of course you know that the U.S. dollar is inversely tied to gold. A stronger dollar = weaker gold right? The answer is mostly true. As you can see below, following October 28th, the U.S. dollar index has declined by almost 2%.

In that same time frame, the price of gold has increased by almost 3.5%.

What this tells me is that over half of the gold move was actually tied to factors other than the U.S. dollar. Gold benefits from uncertainty as you may well know. And with the S&P (SPY) trading lower over nine straight sessions since October 28th, uncertainty is high as the spot VIX has now moved higher by almost 57% since October 28th.

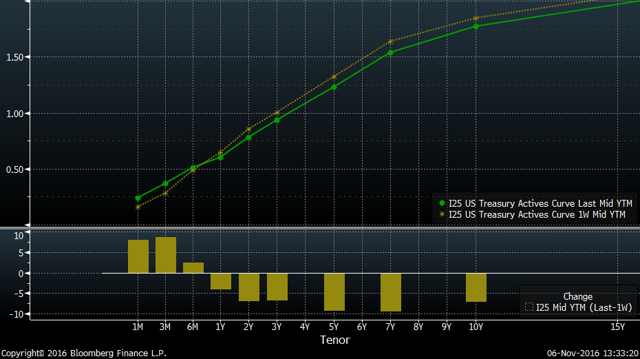

So about 50% of the gold move has been tied to a lower US dollar and the other half has been tied to increased uncertainty. What sort of uncertainty are we talking about here? It is the uncertainty tied to the anti-trade rhetoric which has pervaded Donald Trump's campaign. Where the potential impact manifests most is in the expectations for future growth. Think about this - if you start slapping large tariffs on foreign-made goods that are coming into the country, the price of that particular good goes up. When you have this happening en masse, the cost of day-to-day life goes higher rapidly in the short term as everyday items from tupperware containers to cutlery to curtain rods to computers in the short term. Over the longer term, and we are talking about years, maybe decades, not months, factories within the country would begin producing these items, but at a higher cost so the total consumption still remains lower as the price of these goods is higher. When you have lower consumption, one would expect GDP to be reduced and the best way to gauge lowered growth expectation is in the yield curve. The yield curve has indeed flattened out over the past week.

But this is not where the yield curve will sit with a Trump presidency. One would argue that it has potential to flatten out more if Trump indeed holds true to his word and looks to reduce trade. If US trade moves lower and the US GDP growth begins moving lower the likelihood of a weaker US dollar goes up. This is positive for gold as far as looking at it from a dollar lens is concerned, but it is simply a reflection of the US dollar's reduced buying power. Furthermore, if Trump holds true to his word and begins racking up large deficits to finance his infrastructure spending, this will put a further damper on the U.S. dollar especially if the deficit spending doesn't produce productivity improvements.

The outlook for gold as a result of a Trump presidency is positive for gold, albeit highly volatile. It is likely a result of gold re-asserting itself as a safe haven asset. The weakening US dollar trend which began on October 28 may continue under President Trump and potentially produce reduced purchasing power for the American consumer. The potentially anti-trade policies will result in increased economic uncertainty and a flatter yield curve may reduce bank lending, another positive for gold. The knock-on effects and unintended consequences will take some time to fully price in as a result of which US equities as well as global equities will likely become more volatile, which is another positive for gold. So the answer to the question that the article poses is a strong yes. Trump will be good for gold, but I cannot help but think whether I will indeed be richer, in real terms.