Back at the end of 3Q 2016, I contributed a chart to +Business Insider feature covering most important trends that analysts keep an eye over. You can see the chart here.

The key to global growth, in my opinion, will be recovery led by the emerging markets, and in particular - by world's largest emerging economies; the BRICs.

That was then, and this is now:

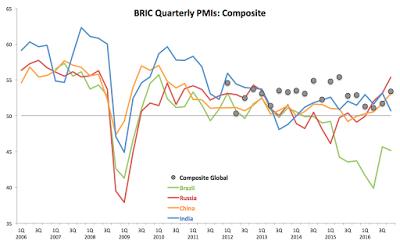

Observe the global growth trend implied by 4Q Composite PMIs:

- We have a second quarter uptick in global growth. What was fragile bounce back from the 2Q 2016 low of 51.1 to 3Q 2016 reading of 51.7 is now a robust push-up in growth terms to 4Q 2016 reading of 53.4 - the strongest growth signal since 3Q 2015.

- Two of the BRICs economies: Russia (4Q composite PMI average at 55.4) and China (4Q 2016 composite PMI average of 53.1) are leading the above trend.

- India is on a surprise downside, most likely attributable to series of policy errors (including demonetization), which (for now) is not yet a new trend to the downside. Should Indian economy get back to its 'normal' running order, BRIC's contribution to global growth will pick up and global PMIs will be supported even further to the upside.

- Brazil, however, is a long-term worry. Latin America's largest economy is in deep trouble, dragging down both BRIC growth prospects and the strength of the overall emerging markets' growth.

What are the headwinds to watch?

- China is the obvious one. The current level of activity, including that signalled by the PMIs, is simply too exposed to monetary and fiscal stimuli, and, thus, highly risky.

- Russia is another concern. Russian recovery from the recession is still fragile and requires continued confirmation, especially in manufacturing sector. On the brighter side: improving commodities prices and better prospects for monetary easing (due to significant decline in inflation pressures) are offering some hope forward. On the darker horizon, however, political cycle (2018 Presidential election) and geopolitical climate (elevated risks vis-a-vis Russian relations with the West and ongoing geopolitical rebalancing in Central Asia, Asia-Pacific, Eastern Europe and Middle East) present higher risks to the downside to growth.

- Brazil is simply a basket case that will have to go through a painful process of structural deleveraging and political re-balancing. However, as the rate of contraction in Brazil's economy moderates over time, BRIC's growth momentum will also improve as a group.

So keep a closer eye on those PMIs coming in 1Q 2017.