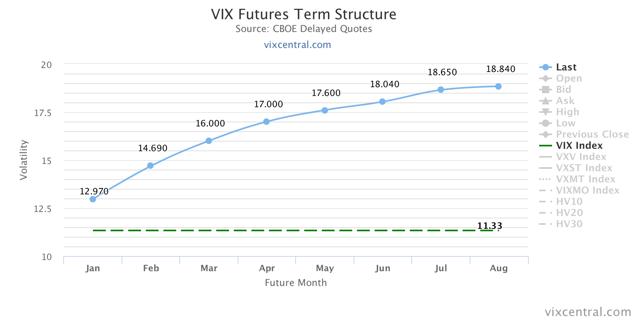

As the new year has opened with an overall upward move, volatility as measured by the CBOE Volatility Index or VIX has naturally moved lower. Spot VIX is currently in the mid 11s, while the two front month futures contracts are trading near 13 (January) and 14.70 (February). These futures are of particular importance to anyone trading in popular VIX ETFs such as BATS:VXX, XIV, TVIX, BATS:UVXY and BATS:SVXY because their fair values can be estimated using a combination of the two to come up with a 30 day forward VIX estimate.

With the VIX closing out 2016 at about 14 and the front month contracts closing at 15.125 and 16.575 respectively, the speculative long position that I highlighted in my last article has been a clear loser, at least so far. The only slight positive was that my article was published so late last Friday night (about 7:30 pm), that by the time the market opened the new year on Tuesday, anyone considering a long strategy would have seen VIX levels almost a point lower. And, they have continued lower. This did not work out well for yours truly, but that has been a recurring story over the past nine months or so as long VIX has, with only a few exceptions, usually not been a winner.

As many who closely follow the VIX know, most market prognosticators and "experts" forecasted much more volatility last year than actually came to pass. The most likely explanation for the lack of volatility was the absence of Fed rate hikes throughout the period which led many investors to believe that monetary policy would remain loose for the foreseeable future. The Fed told us at each successive meeting that the economy was improving, but just not enough to justify even a 25 basis point federal funds rate increase. Of course, that does not inspire much confidence in the economy, but it did lead investors to the conclusion that the Fed would continue to backstop the market. And, while the Fed has signaled its intention to hike rates three times in 2017, investors are generally suspicious given the Fed's recent track record.

So, it is natural to question whether the VIX long strategy is dead. Many have made a case for this in the past, many times right before a VIX spike. Any author's unlucky timing aside, VIX spikes have been few and far between over the past year and have rarely broken above the 20s, the level that has been approximately the long term historical average (although more recent period averages have been lower). It seems that whenever a consensus forms, the market reminds us that our predictions may be of little value.

Short VIX strategies have been very profitable over the last year and for the last several years. For example, a simple buy and hold long position in the VelocityShares Daily Inverse VIX Short Term-ETN (XIV) would have yielded over an 80% return for 2016. The problem with a short VIX buy and hold strategy is that it susceptible to short term VIX spikes that can destroy returns just as easily and often more quickly than a long VIX position. This strategy is usually best implemented after a VIX spike.

So where does this leave us? Currently, the VIX and its futures are at the very low end of their ranges and moving lower as I write this article. This usually has me looking at a long position for a short term pop. But, since I still hold some of my position initiated last week, I am planning on riding it out through next week. I still believe there are many out there that are looking to take profits on their "Trump trade" now that we are in the 2017 tax year, and also due to the market being clearly stretched by most valuation measures. Also, the catalysts I mentioned last week are all still valid. I do wish I had waited a few days longer to put on the trade, but as I see few upside catalysts for the market, I am still inclined toward the long trade as we near the upcoming inauguration.

As always, I strongly urge anyone considering this type of investment to fully investigate the performance characteristics of any security they are planning to use before implementing any trading strategy. If you find my articles interesting, informative and useful, please follow me by clicking on the follow button at the top of the article. To view my past articles, you can look here. Thank you.