Extremes Become The Norm

There have been a litany of articles written recently discussing how the stock market is set for a continued bull rally. While Trump was initially expected to be extremely bad for the market, post-election he somehow became extremely good for it. The are some primary points in common among each of these articles which are: 1) interest rates are low, 2) corporate profitability is improving, 3) oil prices are rising, and; 4) Trump's fiscal policies will supplant the Fed's monetary policies.

While the promise of a continued bull market is very enticing it is important to remember, as investors, that we have only one job: "Buy Low/Sell High." It is a simple rule that is, more often than not, forgotten as "greed" replaces "logic." It is also the simple emotion of greed which fosters exuberance and extremes which ultimately reverts into devastating losses.

Therefore, if your portfolio, and ultimately your retirement, is dependent upon the thesis of a continued bull market you should at least consider the following charts which are a collection of current "extremes" in the market.

Extreme Valuations

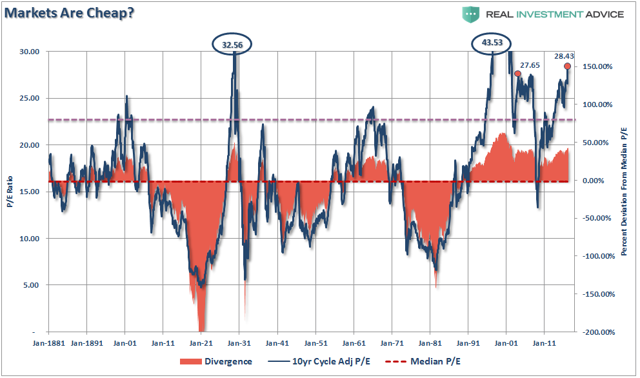

It is often stated that valuations are still cheap. The chart below shows Dr. Robert Shiller's cyclically adjusted P/E ratio. The shaded area is the current deviation of P/E's above or below their long-term median P/E.

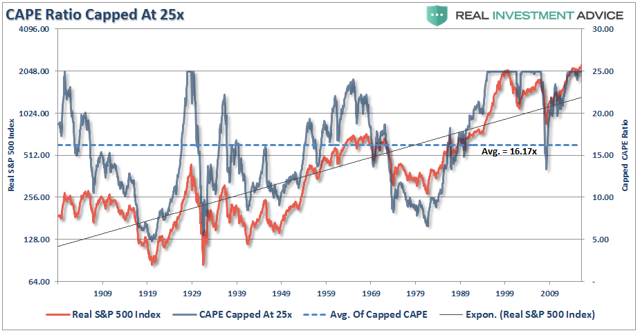

Currently, valuations are pushing levels only witnessed in 1928-1929 and 2000. However, it is often suggested the current valuations are nowhere near the "dot.com" level so obviously stocks are just mildly overpriced. The problem is current valuations only appear cheap when compared to the peak in 2000. In order to put valuations into perspective, I have capped P/E's at 25x trailing earnings as this has been the level where secular bull markets have previously ended. I have noted the peak valuations in periods that have exceeded that level.

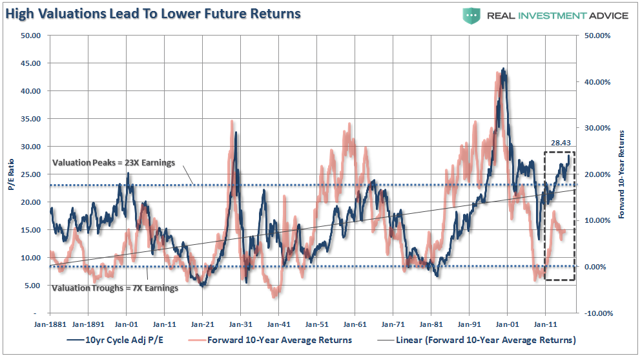

With valuations at levels that have historically been coincident with the end, rather than the beginning, of bull markets, the expectation of future returns should be adjusted lower. This expectation is supported in the chart below which compares valuations to forward 10-year market returns.

The function of math is pretty simple - the more you pay, the less you get.

Extreme Prices

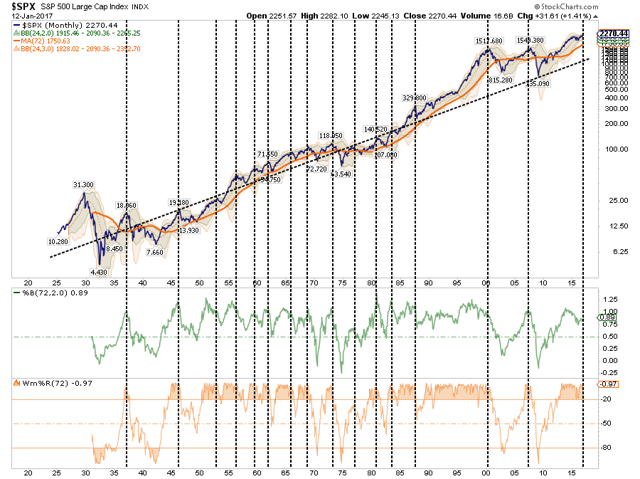

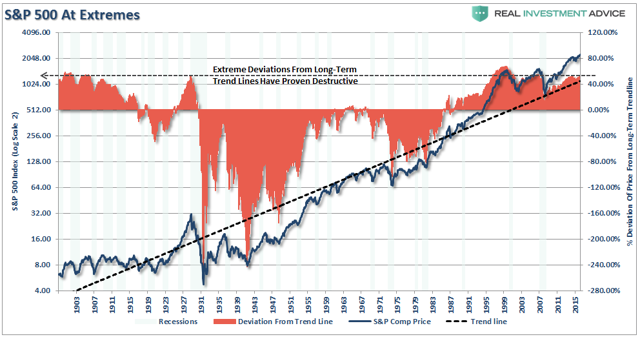

I have often compared market prices to the equivalent of "stretching a rubber band." Prices can only deviate so far from the long-term trend line before a mean reverting event eventually takes place. Much like a "rubber band," prices can only be stretched so far before having to be relaxed to provide the ability to be stretched again.

The chart below shows the long-term trend in prices has compared to its underlying growth trend. The vertical dashed lines show the points where extreme overbought, extended conditions combined with extreme deviations in prices led to a mean-reverting event.

This is shown a bit clearer below which compares the deviation of the S&P 500 from the long-term growth trend. Currently, while only slightly below the peak of the 2000 "dot.com" bubble, the deviation is at levels that have ALWAYS coincided with a negative mean reverting event or very poor, and highly volatile, forward returns.

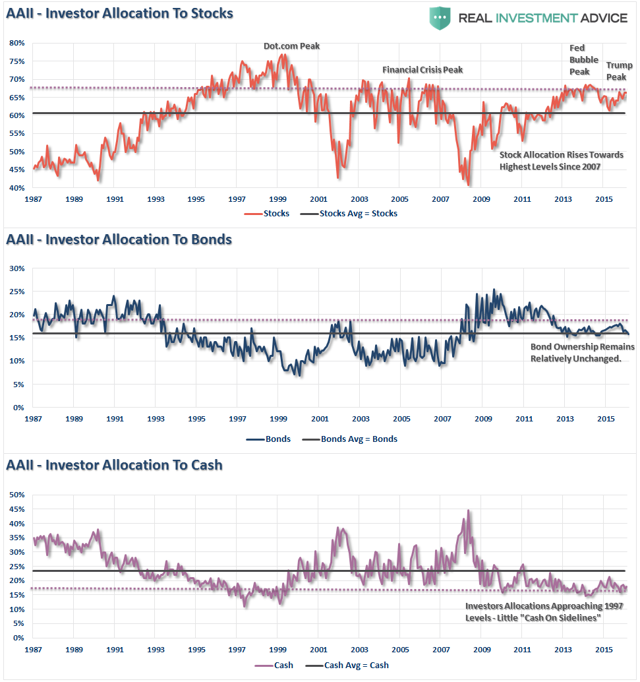

Extreme Allocations

Another argument I hear made consistently is that retail investors are only just now beginning to jump into the market. The chart below shows the percentage of stocks, bonds and cash owned by individual investors according to the American Association of Individual Investor's survey. As you can see, equity ownership and near record low levels of cash suggest that the individual investor is already likely "all in."

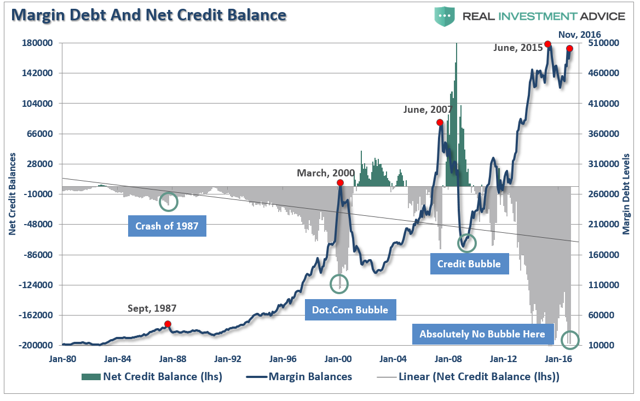

Extreme Leverage

Of course, with investors fully committed to stocks it is not surprising to see margin debt at record levels as well as investors leverage up to chase returns.

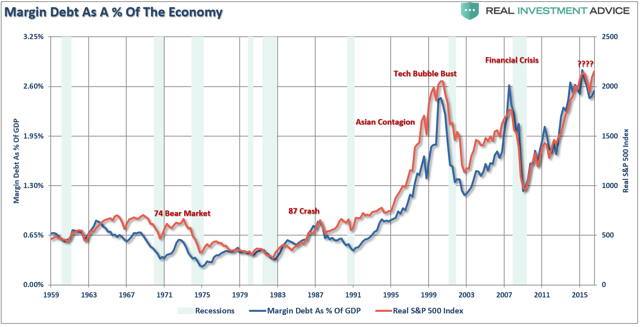

When we look at the levels of Margin Debt/GDP ratio as compared to the S&P 500, we find a high correlation between peak levels of debt and subsequent market returns. Not surprisingly, extreme levels have been more indicative of "ends" rather than "beginnings."

Extreme Sentiment

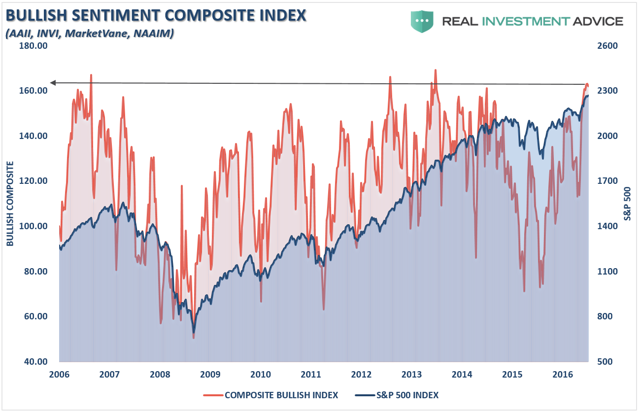

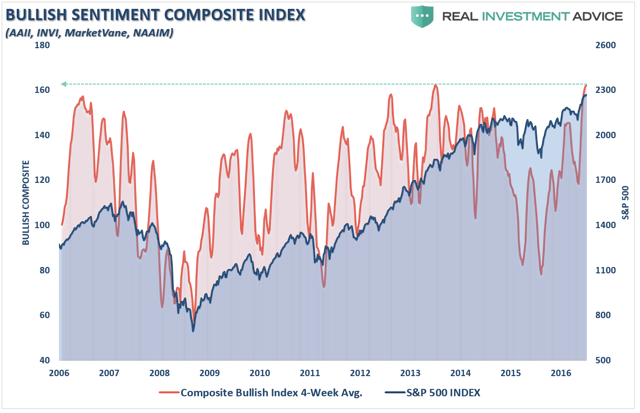

Bob Farrell's rule #9 states that when everyone agrees; something else is bound to happen. The next two charts show the level of "bullishness" of both individual investors (AAII Survey) and professional money managers (MarketVane, NAAIM & INVI Surveys). Surprisingly, investors are currently more exuberant than just about at any other time on record.

If we smooth the index with a 4-week average we get a better view of the current level of exuberance. Importantly, such levels of exuberance have been historically, once again, associated with short to intermediate-term, or worse, corrections.

When extremes become the norm, and are readily accepted as such, it has historically been associated with market bubbles.

- 1929 - Stock reach a permanently high plateau

- 2000 - This time is different

- 2007 - It's a Goldilocks Economy

While I am not suggesting the markets are about to crash tomorrow, I am suggesting that future returns are likely to be much lower than currently estimated by the majority of the financial media.

"But Lance, since you are all 'bearish and $#(%,' you are all in cash and missed out on the markets advance."

That would be incorrect.

As a money manager, I am currently long the stock market. I must be, or I potentially suffer career risk. However, my job as a portfolio manager is not only to make money for my clients, but also to preserve their gains, and investment capital, as much as possible. Understanding the bullish arguments is surely important, but the risk to investors is not a continued rise but rather the eventual reversion that will occur.

Unfortunately, since most individuals only consider the "bull case," as it creates confirmation bias for their "greed" emotion, they never see the "train coming."

Currently, with everyone on the "same side of the trade," any exogenous event which triggers a movement in the opposite direction tends to result in a stampede. Hopefully, these charts will give you some food for thought.

Remember, every professional poker player knows how to spot a "pigeon at the table."

Make sure it isn't you.

This Is Interesting

I want to repeat this little blurb from Tuesday, only because it ties into last weekend's newsletter as well.

"In 'The Problem With Forecasts,' I noted the Dow is currently working on completing an advance of 5000 points over a 24-month span. The last time such a compressed advance occurred was during the 1998-1999 period.

But what about the S&P 500?"

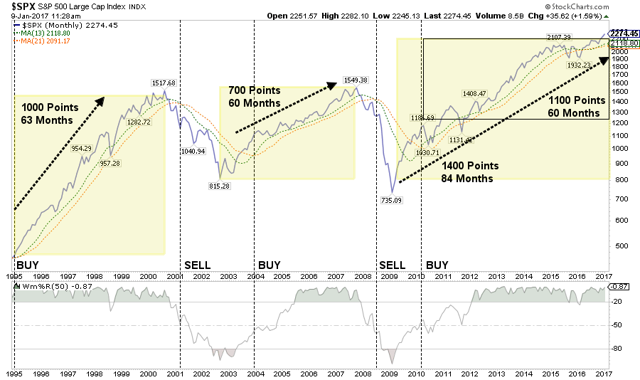

"Following the 1994 market lull, the S&P 500 began its first serious bull market advance as a wave of investors flooded into the market due to the introduction of online trading and the official opening of the "Wall Street Casino." From 1995 to its peak in March of 2000 the market advance (whole number basis only) by 1000 points over that 60-month period.

Of course, the subsequent correction of the "dot.com" mania reset the market by roughly 50% of that previous advance.

Following the crash, investors reluctantly began to return to the markets in mid-2003. As the Federal Reserve, and deregulation of Wall Street advanced, so did investors speculation in the markets as a real estate sub-prime lending took hold. Beginning in 2003, the market began a 60-month trek higher of 700-points before once again finding the limits of "fantasy and reality."

So, here we are once again. Over the last 60-months the markets have advanced by 1100-points, and 1400-points over the last 84 months, as Fed-induced monetary stimulus and suppression of interest rates have once again led investors to believe "this time is different."

Throughout history, as shown in the chart below, prices have ALWAYS, and I repeat ALWAYS, eventually found their limits. There has never been a "permanently high plateau" that inoculated investors from devastating consequences of misconceived and poorly managed investments."

As I noted above, when "extremes become the norm" that is the point in time where "danger lurks."

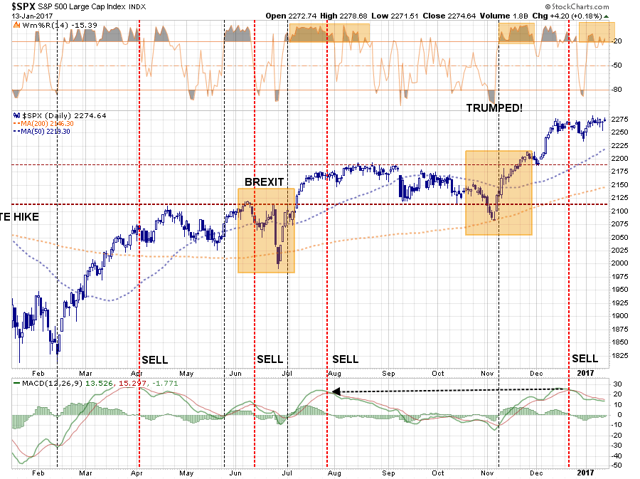

Technical Update

From a purely technical standpoint, there are a couple of things investors should be aware of as we head into next week.

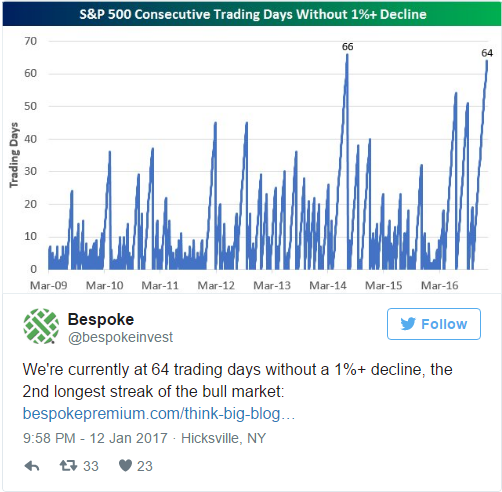

First, as noted on Friday by Bespoke Investments:

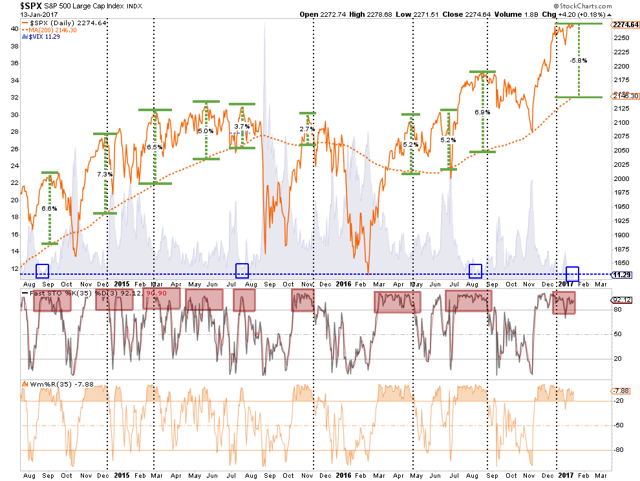

Not surprisingly, given the period of advance without a 1% decline, which has pushed prices to an extreme deviation above the 200-dma, the volatility index has dropped to levels that have historically denoted short to intermediate-term market peaks.

On a very short-term, daily, basis, the market registered a "sell-signal" from a very high level, something I discussed several times previously. While such a sell-signal does not always translate IMMEDIATELY into a correctional process, it has done so, particularly from these levels, more often than not.

This suggests that profit taking is still advisable until a new "buy signal" is registered.

With Trump's inauguration next week, and an immediate flurry of action promised within the first 100-days, there is a significant degree of risk that an action, combined with extremes of the market as discussed above, could send market participants running for cover.

Some caution is advised until there is better clarity on a risk/reward basis.

Market & Sector Analysis

Data Analysis Of The Market & Sectors For Traders

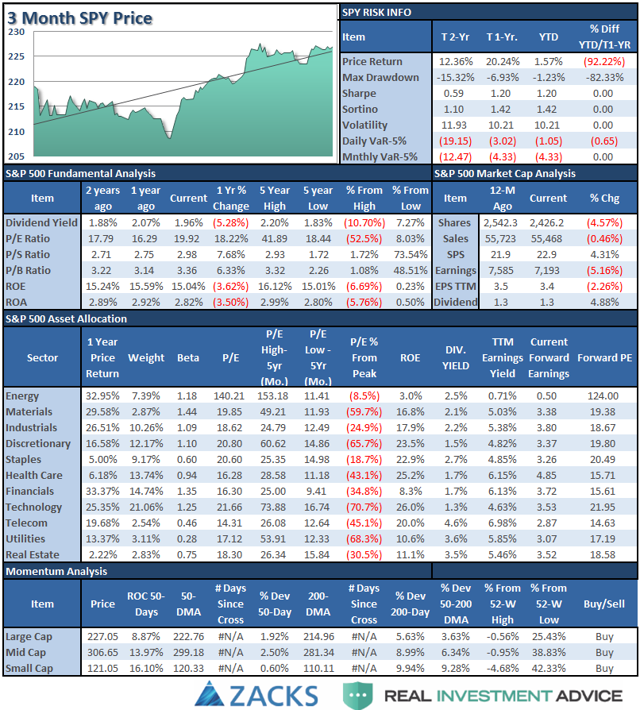

S&P 500 Tear Sheet

Thank you for your recent suggestions, while not all requests are possible to fulfill due to data limitations, I do appreciate the input.

Update: Request to color code extremes in measures is in progress.

If you have any suggestions or additions you would like to see, send me an email.

Sector Analysis

Comments

Well, once again, it was "Almost Dow 20,000." But once again the week finished shy of that lofty goal and the mainstream media had to put the hats and party favors back into their lockers for another week.

For the week, the S&P Index finished the week lower by 0.1% or -2.34 points. It was a literal bloodbath as investors ran for cover. (Once again: #SarcasmAlert)

Again, I have little doubt, at this juncture, there will be concerted effort to strike Dow 20,000 before the month is over. However, despite it being a "milestone" victory, and something for the media to cheer about, it has relatively little meaning with respect to portfolio and risk management.

Speaking of portfolio management, I wanted to repost the video from last week in case you missed it.

"The video below shows the historical "rotation" of sectors over the last 3-years. As you will notice sectors have consistently "swarmed" in a clockwise rotation going from strongly outperforming the S&P 500 index to strongly underperforming. If you watch to the end of the video you will see the post-presidential election anomaly form."

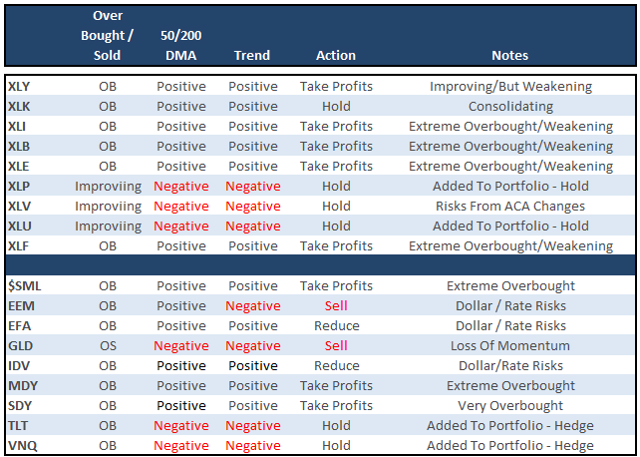

I have notated on the Sector Rotation model below, the early stages of the reversion process of the extreme bifurcation between sectors below. Notice interest rate sensitive sectors and Financials are beginning to trade momentum.

This rotation is likely very early in its movement. As noted above, while RISK bullishness has reached extremes, SAFETY has been completely disregarded. Reversions tend to be rapid.

While Financials have continued to outperform the S&P overall, the sector strength has weakened. Small and Mid-cap stocks remain strong at the moment, while Energy, Materials, and Industrials have also begun to weaken.

As shown below, Technology improved last week as the major technology players (FANG stocks) pushed the broad index higher. Discretionary also picked up the pace but is still lagging the index as a whole. Industrials, Materials, Energy, Staples, Financials, and Utilities stagnated last week, while Health Care picked up performance.

(Note: I have changed the sector and major market analysis charts to a 50/200 DMA crossover signal and embedded an overbought/sold indicator.)

The table below shows thoughts on specific actions related to the current market environment. (These are not recommendations or solicitations to take any action. This is for informational purposes only related to market extremes and contrarian positioning within portfolios. Use at your own risk and peril.)

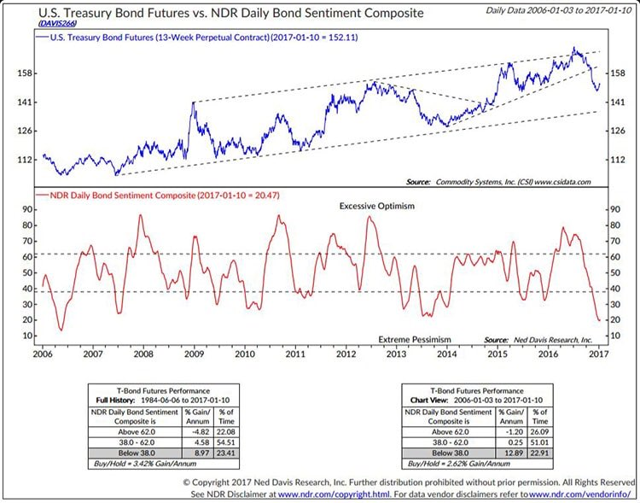

Six weeks ago, as suggested, we hedged our long-equity positions with deeply out-of-favor sectors of the market (Bonds, REIT's, Staples, Utilities) which have continued to perform well in reducing overall portfolio volatility risk.

As I have been warning over the last couple of months, the stronger dollar and the rise in rates should not be dismissed.

Everything is currently pointing to this being a very late stage advance, so profit taking, hedging, and rebalancing remains strongly advised.

The Real 401k Plan Manager - A Conservative Strategy For Long-Term Investors

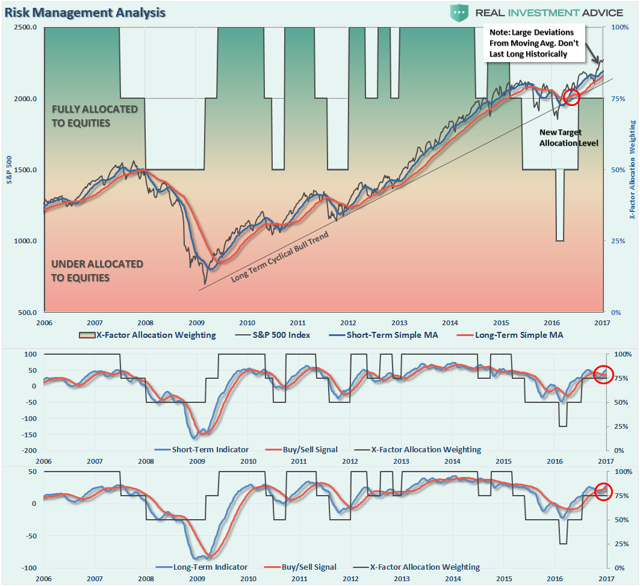

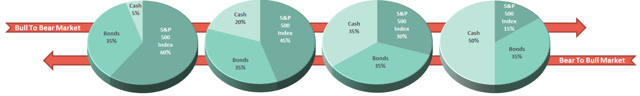

There are 4-steps to allocation changes based on 25% reduction increments. As noted in the chart above a 100% allocation level is equal to 60% stocks. I never advocate being 100% out of the market as it is far too difficult to reverse course when the market changes from a negative to a positive trend. Emotions keep us from taking the correct action.

One Week To Inauguration

Next week is another holiday-shortened trading week, with the awaited inauguration of President-elect Donald Trump on Friday. The markets have continued to mostly tread sideways since the beginning of the year as uncertainty around the new President's potential actions weigh on risk-taking.

As I stated last week:

"With buy signals on all three indicators registered currently, any corrections are likely to be somewhat limited back to the rising short to intermediate-term moving average. This would suggest a correction back to 2200 would likely be a "buyable" trading level. As noted in the chart above, the current extension above the moving average will likely be corrected in fairly short order and we can use that correction to rebalance allocation models for the beginning of this year."

As noted in the main body of this week's missive, the current extremes on many fronts suggest investment risk remains elevated which is why I have not increased the allocation model to 100% as of yet. This is also why I have suggested over the last couple of weeks to use this current advance, and extension, as an opportunity to clean up portfolios. (Use guidelines noted previously.)

- Tighten up stop-loss levels to current support levels for each position.

- Hedge portfolios against major market declines.

- Take profits in positions that have been big winners

- Sell laggards and losers

- Raise cash and rebalance portfolios to target weightings.

If we can get a correction that resolves the overbought, extended and excessively bullish backdrop to the markets currently, I WILL increase the allocation model to 100%. For now, we will wait and let the markets tell us what it wants to do next.

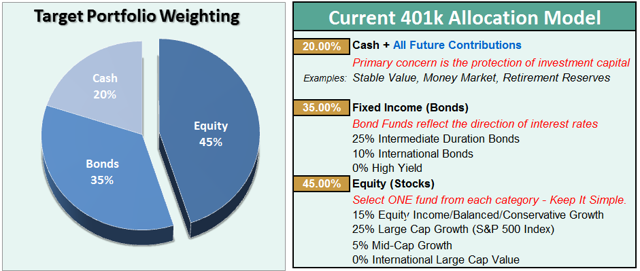

Current 401-k Allocation Model

The 401k plan allocation plan below follows the K.I.S.S. principal. By keeping the allocation extremely simplified it allows for better control of the allocation and a closer tracking to the benchmark objective over time. (If you want to make it more complicated you can, however, statistics show that simply adding more funds does not increase performance to any great degree.)

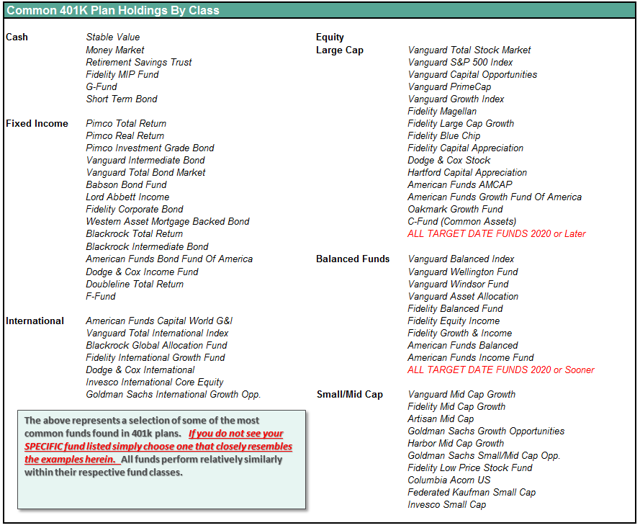

401k Choice Matching List

The list below shows sample 401k plan funds for each major category. In reality, the majority of funds all track their indices fairly closely. Therefore, if you don't see your exact fund listed, look for a fund that is similar in nature.