Intel (NASDAQ:NASDAQ:INTC) presented its growth strategy at its 2017 Investor Meeting. The strategy involves realigning priorities and investments away from the traditional PC business and toward growth areas such as the data center and Internet of Things. Intel is taking a calculated risk that gains in the growth areas will offset declines in PCs.

Source: Intel

No Breakthroughs

To begin my reflections on Intel's Investor Meeting, I'd first like to point out some things that didn't happen at the meeting.

First and foremost, there was no announcement of a breakthrough in chalcogenide device technology as has been predicted by SA contributor Stephen Breezy. Breezy had suggested that such a breakthrough could lead to an abandonment of the planned 10 nm process (see Intel Has No Plans for 10 Nanometer Chips). Far from abandoning 10 nm, investors were updated on the roadmap for 10 and 7 nm production, as I'll describe below.

I'll just briefly reiterate my view that Breezy may have misinterpreted some technical information regarding chalcogenide devices and doesn't understand their inherent physics limitations (see here for a more detailed discussion). Insofar as use of the technology is concerned, there appears to be no other application than 3D Xpoint. 3D Xpoint, now called Optane, is Intel's solid state storage technology that makes use of a phase change material that is probably a chalcogenide.

Another announcement that didn't happen was of a licensing deal with Advanced Micro Devices (NYSE:AMD) for GPU technology to be incorporated into Intel systems on chip (SOCs). The supposed licensing deal has been a staple of the AMD Rumorverse with a report on March 18 from Wccftech as well as repeated claims by Kyle Bennett of HardOCP that it was a done deal.

The rumors have been fueled by a persistent misconception in the Rumorverse that the graphics licensing deal between Intel and Nvidia (NASDAQ:NVDA) would "expire" in March 2017. As I've pointed out, the licensing deal doesn't expire and the agreement is structured in such a way as to give Intel effectively perpetual rights to any existing Nvidia patents including patents only in the filing stage as of March. What comes to an end is Intel's right to use any Nvidia patents filed after March.

Since patents being filed up to the end of March 2017 may not be granted for years, this gives Intel continuing access to new patents that may be granted to Nvidia for years to come. Since there is often a delay of years before patented technology finds its way into consumer products, Intel will have a large and fairly current reservoir of Nvidia patents on which to draw.

It can't be argued absolutely that there is no deal with AMD. However, if a deal had been concluded, one would have thought that the Investor Meeting would have been the right place to announce it. Such a deal would be material to investors' interests.

Client Computing Ambivalence

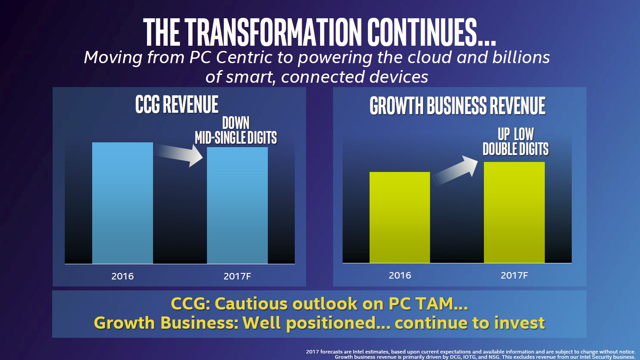

An AMD licensing deal also appears to be inconsistent with Intel's strategy regarding the Client Computing Group (CCG). Intel's ambivalence regarding CCG was very apparent during the Investor Meeting. On the one hand, CCG is still a very important source of revenue and profit for the company. On the other hand, Intel foresees no growth in the CCG TAM. This was captured in CFO Swan's projection of a mid single-digit revenue decline for CCG in 2017:

The shift in priorities is visible in the reallocation of operating expenses from CCG to Intel's "Growth Businesses" as shown below:

According to Brian Krzanich's presentation, maintaining a "Strong and Healthy" client business is a top priority for 2017:

But what does that mean, exactly? Especially when you're already planning for a y/y revenue decline? I think it means maximizing net profit from the segment rather than growing revenue or gaining market share.

In the past, CCG was represented as the engine that would drive innovation throughout Intel, especially in segments such as the Data Center Group (DCG). The linkage was fairly direct and obvious. New CPU architectures and process nodes would be introduced through CCG first, then make their way to other business areas.

This is no longer going to be true. Starting with the 7 nm process node, Data Center Products will be first on the node. This was disclosed by Diane Bryant, head of the Data Center Group, in her presentation as a Data Center First strategy. The shift in strategy is perhaps the most significant disclosure of the Investor Meeting.

10 nm, Finally

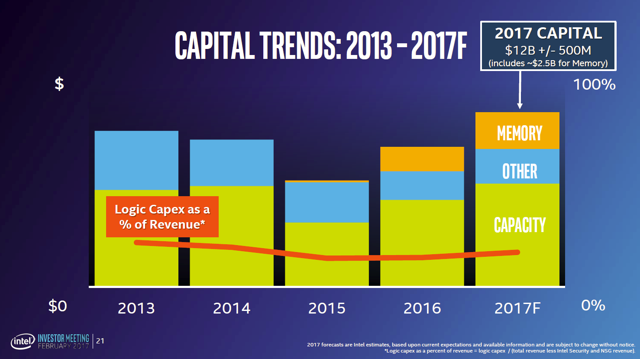

Another way in which CCG investment has been scaled back has been in capex for process nodes, especially the 10 nm node. Fortunately, for 2017, "Logic Capex" is going back up, as shown below:

Intel management still seemed to want to be a little cagey about exactly when 10 nm parts would start to come out. During Q&A, Dr. Murthy Renduchintala, who oversees CCG as well as the Internet of Things Group, stated that guidance on 10 nm was still the same as what had been given during the Q4 conference call. He restated that 10 nm parts would be "available by the end of the year, with volume in the first half of the year."

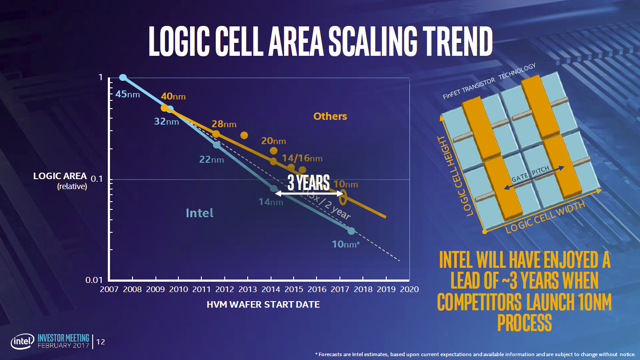

It was the last part of the statement that caught my attention. First half of which year? 2018? That's what it sounded like. Then I took a good hard look at this chart from Renduchintala's presentation:

From looking at recent history on the 22 nm and 14 nm starts, it appears that the High Volume Manufacturing (HVM) Start Date shown on the graph corresponds to Intel's official volume production start announcements. However, actual commercial volume availability has typically lagged about six months behind the official HVM start announcement. For instance, the chart shows 14 nm HVM start early in 2014, but the first 14 nm Core M parts would not become available until September.

The chart shows 10 nm HVM start early in the second half, and that would agree reasonably well with Renduchintala's statement of volume availability in the first half, if we assume the first half of 2018. This means no 10 nm processors in the hands of consumers this year.

AMD's Near-Term Opportunity

It was always a foregone conclusion that Intel's first 10 nm parts would be Core M types for mobile 2-in-1 notebooks. So it was unlikely that Intel would have desktop, let alone server parts on 10 nm available this year. However, the indicated schedule suggests that 10 nm desktop parts might not appear until mid-2018, with 10 nm server parts even later. During her presentation, Diane Bryant made repeated references to Data Center being "first on the third wave" of 10 nm.

The fact that there is a "third wave" of 10 nm and that it will incorporate Xeon server parts should at least lay to rest another bizarre notion of the AMD Rumorverse that somehow Intel's 10 nm process is not a "high performance node" or is otherwise unsuitable for large area desktop and server chips.

However, the slowness of the 10 nm rollout does appear to give AMD an opportunity to make some market share gains in desktop processors. How large an opportunity remains to be seen. Renduchintala promised an "8th Generation" Core series of 14 nm processors in the second half of the year. These are assumed to be Coffee Lake processors that will launch earlier than rumors had reported.

Will these 8th Gen processors be enough to blunt the impact of AMD's Ryzen desktop processors? I don't know. Of course, Intel still claims a significant process node advantage in its 14 nm process compared to the 14-16 nm foundry nodes of Samsung (OTC:SSNLF), Global Foundries and TSMC (NYSE:TSM).

Renduchintala also pointed out that as an Integrated Device Manufacturer (IDM), Intel's control over its manufacturing process allows it to tailor the process to optimize a given processor design, rather than using a "one size fits all" process from a foundry.

Still, the claimed improvement of > 15% compared to Kaby Lake doesn't seem like much, and if AMD undercuts Intel in price, market share gains will probably follow. It appears that Intel is more or less resigned to losing some share in desktops.

I think we'll see Intel fight a lot harder for its Data Center business. Intel will be upgrading its Broadwell architecture Xeons to Skylake, and this should close the performance gap that may exist between AMD's Zen server chips (Naples) and Broadwell E.

Intel appears to be more confident about its prospects for DCG, projecting high single-digit revenue growth for 2017. Nevertheless, much of the projected growth is coming from adjacencies such as storage and optical communication.

Strategic Shift

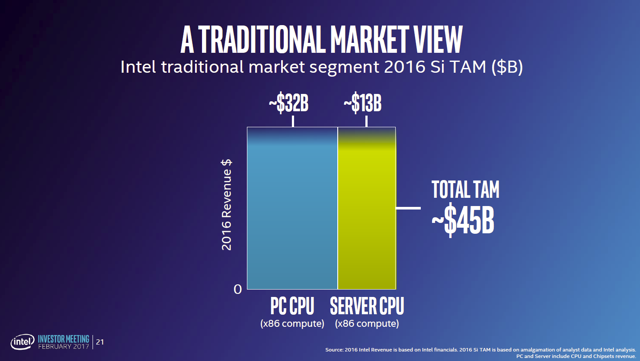

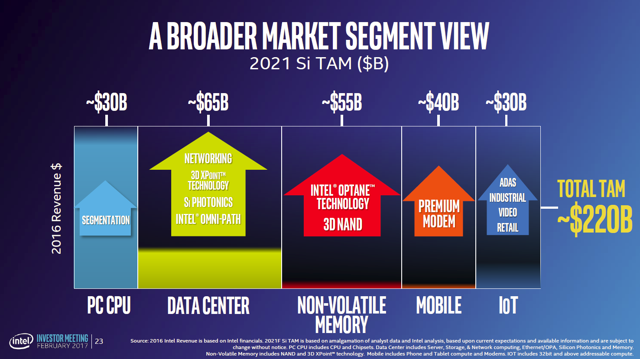

Intel's strategic shift is neatly summarized in two charts from Krzanich's presentation. The first shows a traditional processor-centric view of Intel's market:

The second shows a much larger opportunity:

The charts capture the dramatic shift in emphasis away from processing technology. I find this a little disquieting. The move away from Intel's core competence in CPUs to adjacent markets carries some risk. All of these adjacent markets are still very processing intensive, and in many cases, there are processing challengers in the form of AMD x86, ARM architecture, Power Architecture from IBM (NYSE:IBM), and GPUs from both Nvidia and AMD.

Intel seems to want to use the adjacencies to prop up the CPU business. In the data center, Intel wants to offer "rack scale" solutions rather than simple CPU components. This might seem like a good strategy to Intel, but it's not clear that the large hyperscale cloud providers would be interested. Most already manufacture their own custom designed racks.

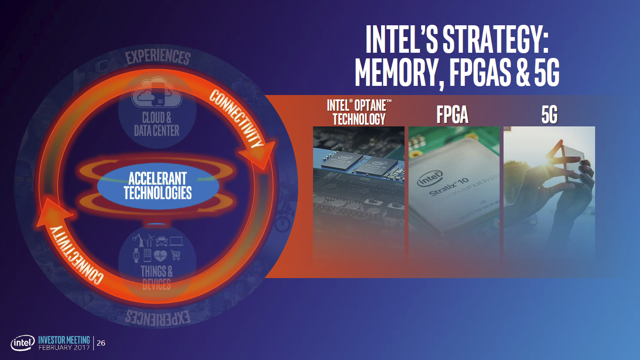

And when Intel talks about "Accelerant Technologies" for its targeted growth markets of cloud and IoT, CPUs aren't even mentioned:

This seems a de facto acknowledgment of the waning of the x86 era, yet Intel doesn't seem to know or isn't willing to acknowledge what comes after. Especially with respect to ARM, the ability to compete in IoT and autonomous vehicles is questionable. The bets that Intel is making in IoT, including autonomous vehicles, appear to be long shots.

Investor Takeaway

Intel is clearly taking some calculated risks in the strategic shift. Intel management probably realize that the de-emphasis on CCG is going to cost it some revenue and market share. Clearly, the hope is that the investments in the perceived growth areas will more than compensate in the long run. For 2017, Intel is hoping to come out slightly ahead with "low single-digit" revenue growth.

The allocations are rational for Intel, given the growth objectives, but they do carry some risk. Intel may not meet its growth projections in Data Center and IoT.

2018 looks considerably better. Intel's 10 nm process will arrive in force for desktop and servers, and I don't expect AMD to have an answer to this. I don't expect Global Foundries to deliver on its promised 7 nm process in 2018. So, 2018 looks like the year that Intel reasserts process leadership with a 10 nm node superior to 10 nm nodes available from the foundries.

As the "Data Center First" strategy takes hold, and Intel moves on to 7 nm, Intel's future looks bright. Intel investors have to be in it for the long term. I continue to rate Intel a hold, with the understanding that investors have to look beyond possible declines in the stock in 2017. Intel is definitely only for those with a 3-5 year investment horizon.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.