It's been a difficult few years for Hubbell Incorporated (NYSE:HUBB). The maker of electrical products has seen sales in its high-margin oil and gas-facing products fall away amid significant price declines in both commodities. Meanwhile, Hubbell fell behind in its shift to LED lighting, and continues to face pricing pressure that has impacted margins in that business as well.

As a result, Hubbell's profit growth has essentially stalled out. Adjusted EPS the last four years has been $5.47, $5.54, $5.52, and $5.66 in 2016; guidance implies the figure likely will stay below $6 in 2017. Organic sales growth has been minimal - just 1% in 2016, per the 10-K. Meanwhile, adjusted operating margins have declined in each of the last three years, falling 130 bps over that period.

And yet HUBB trades right near multi-year highs:

There are a couple reasons why HUBB's resilience makes some sense. An investor could argue that recent growth has been pressured largely by temporary factors, the O&G bust most notable of them. In late 2015, Hubbell consolidated its shares into a single class, removing super-voting shares; that would seem to open the door for a potential acquisition of Hubbell by a larger player. And Hubbell does seem reasonably well-positioned for a Trump presidency, given some exposure to infrastructure and O&G, and a largely US-only revenue base (90%, per the 10-K).

Barring an acquisition, however, I'm skeptical. Hubbell's recent performance can't be chalked up to just external factors - at least without ignoring trends that should have benefited margins and profits. Restructuring benefits have been almost entirely offset by margin weakness; they are wrapping up in 2018 (at least per current commentary). Input costs are rising, lighting pressure isn't abating, and a stabilization in O&G doesn't boost margins on its own. With HUBB's multiples high relative to historic levels, there seem much better stocks with which to capture cyclical upside.

A Challenging Few Years

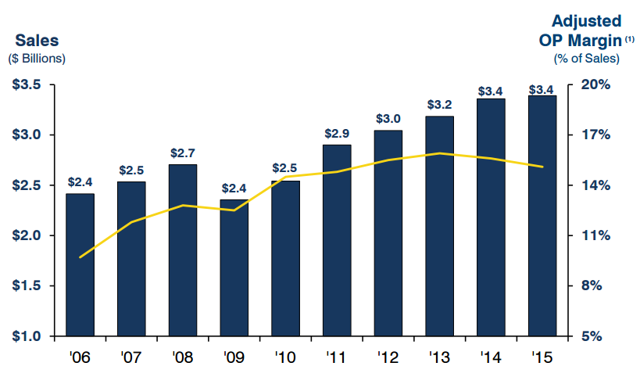

Source: Hubbell 2016 Investor Day presentation, March 2016

The figure above is a year old, but 2016 didn't change the trend. Overall sales increased 3%, to $3.5 billion; adjusted operating income was almost exactly flat (up $1 million, or 0.2%). Adjusted operating margin continued to drift downward, declining 50 bps to 14.6%.

The two key culprits have been lighting and O&G. Hubbell was late in anticipating the shift to LED lighting, which led to a big jump in warranty and obsolescence costs in Q3 2014. Pricing pressure continues in that business, which accounted for 29% of revenue in 2016. In the Q&A of the Q4 2016 call, CFO Bill Sperry said an analyst estimate of $0.25 in EPS pressure in 2017 from lighting price alone was "in the right ballpark". Sperry said a 2 point decline was the cause - which is the same rate of decline seen in 2016, according to the 10-K.

Meanwhile, "harsh and hazardous" products have been impacted by sharply lower O&G exploration spend. Hubbell's H&H group makes communications, monitoring, alarm system, and lighting products for onshore and offshore applications - and sales unsurprisingly have come down quite a bit. 2016's decline appears to have been in the high double digits, at 30% decremental margins per the Q4 call. That business still drives a low double-digit percentage of Hubbell's overall total:

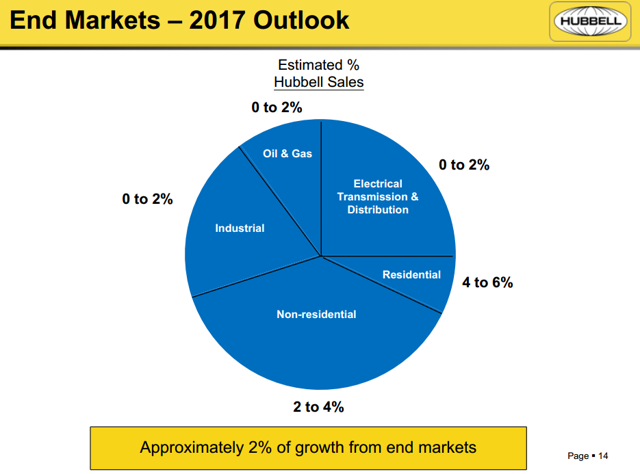

Source: Hubbell Q4 earnings presentation

Add in some weakness in electrical transmission from product delays, and the recent stagnant growth seems like it could be mostly from external factors.

In fact, to turn bullish on HUBB, I think that interpretation pretty much is required - but I don't quite see it that way. As I've argued several times in the past in different contexts, oil and gas isn't "weak" at the moment; it's weak-er than it was in 2012-2013 simply because the exploration bubble has popped. Hubbell is seeing signs of stabilization in the business, which is helpful near term, and as noted above sees ~flat end markets in 2017. But there isn't a V-shaped recovery on the horizon for H&H.

As for lighting, there's at least some aspect of the pressure there that is secular, not cyclical. Cree (CREE) is bouncing off multi-year lows. Acuity Brands (AYI) posted a concerning Q4. Hubbell still is driving very solid volume growth: 6% in 2016, including 13% in the residential business. But pricing is coming down, and it doesn't appear that 2014's warranty and obsolescence issues were one time: Hubbell filings don't remark on a rebound against what should be an easy comparison on that front.

To my eye, then, "normalizing" 2012-2013 results for extraordinary strength in higher-margin H&H implies that underlying margins probably were relatively consistent the past few years, if not down just a bit. And Hubbell is guiding for roughly flat margins in 2017 as well - with continued pressure in lighting offset by improvements elsewhere, including help from aggressive restructuring of late.

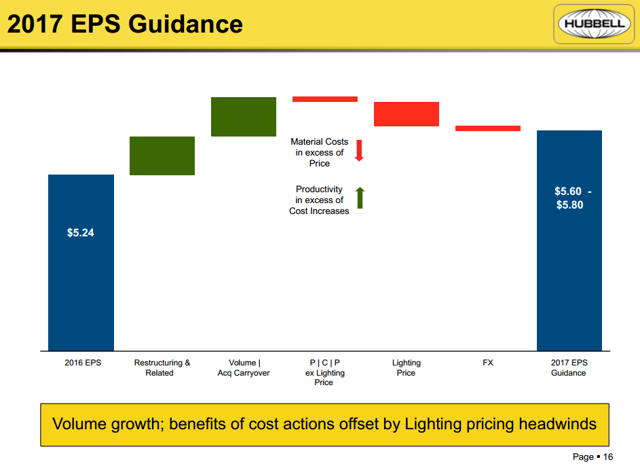

But Hubbell should have had some tailwinds of late, notably on input costs. Material costs are about two-thirds of COGS, according to Hubbell filings, and were beneficial in both 2015 and 2016, as was productivity. That's starting to reverse:

Source: Hubbell Q4 earnings presentation

Roughly speaking, Hubbell's major external pressures can be seen as canceling one another out. The benefit from restructuring - an incremental $0.30 in 2016 - basically has been offset by pricing pressure in lighting. Lower material costs should help gross margin, but mix shift away from H&H has pushed gross margin down.

The problem is that margins haven't been flat - they've been declining. And if lighting pressure sustains into 2018 - when restructuring benefits are guided to just $0.15-$0.20 on an incremental basis, essentially the last of the benefits from recent activity - then that trend continues into 2018. And that trend doesn't support HUBB at $120.

How This Gets Better

Obviously, there's a lot more to Hubbell than just those few factors, and there is still a path to jumpstarting profit growth. Getting the lighting business under control would be a notable first step, and comparisons do get easier in 2H 2017. Hubbell is consolidating two existing factories in part to get its cost structure better aligned with the new reality.

In H&H, rig counts are starting to improve, albeit modestly, and that portends growth for Hubbell products. Again, margins there are much higher; a modest acceleration past the 0-2% expected growth in 2017 can boost consolidated operating margin. Hubbell historically has been fairly steady in making 'tuck-in' acquisitions, and in an accretive manner: the company has spent ~$700 million over the past five years in buying 21 companies at an average of 8x EBITDA. Against a current valuation near 12x, that seems like money well spent, and a lightly leveraged balance sheet means HUBB has more dry powder going forward.

And looking forward, Hubbell should benefit if Trump Administration policies a) are enacted and b) work as planned. Utility transmission projects continue to be delayed; they could pick up as part of a nationwide infrastructure initiative, an apparent desire of the new administration. Industrial demand is down; a more normalized operating environment could help there. Certainly, the GOP-controlled government would appear more likely to open new drilling areas, a potential catalyst for H&H revenue.

Meanwhile, 90% of Hubbell revenue and ~73% of its warehousing and manufacturing footprint is domestic, which would seem to limit the impact of any border tax or trade issues. A stronger economy would boost construction demand, a nice tailwind for Hubbell. Add in corporate tax reform and Hubbell would seem to be one of the larger potential beneficiaries of Trump's surprise win.

I'm not sure that's quite enough for a bull case, however, particularly at current valuation. HUBB shares already have appreciated ~17% since the election, pricing in some of those benefits. There's a noticeable lag between any government policy and Hubbell's P&L, and incorporating any Trump Administration policy into valuation at this point strikes me as potentially optimistic. Meanwhile, any potential acceleration also is likely to be inflationary, which could offset some of the impact of accelerated revenue growth through higher COGS.

More broadly, there are plenty of cyclicals for which a similar case can be made. Given challenges in lighting and questionable execution on occasions the past four years, I'm not sure HUBB really stands out. There have been tailwinds the last few years as well, but the company hasn't really taken advantage. And I think investors would be wise to show some caution until Hubbell does so.

Valuation

The one potential catalyst beyond Trump is M&A. The share class consolidation made HUBB an easier potential target, and there was speculation that the move was made in part due to the interest of major shareholders in a sale.

And there are a number of potential acquirers. ABB Ltd. (ABB) makes some sense. Emerson Electric (EMR) could combine Hubbell with its Appleton division. The light balance sheet - net debt to EBITDA is under 1x - also means P-E interest could show up.

But Hubbell still has a "poison pill" to ward off any unwanted advances, and regardless it also seems like there's some sort of acquisition premium built in already. HUBB trades at 11.6x trailing Adjusted EBITDA (my calculation, adding back stock-based comp to the company's adjusted EBIT figure) and likely ~11x the NTM figure. Eaton (ETN) paid 12.9x for Cooper Industries. ABB paid ~10x for Thomas & Betts. Pentair (PNR) purchased ERICO to build out its electrical business, and paid 12x. It's tough to see Hubbell getting even a 2-turn premium in a buyout; even at 13x, a higher multiple than other similar transactions, Hubbell still is worth roughly $140, or about 17% upside.

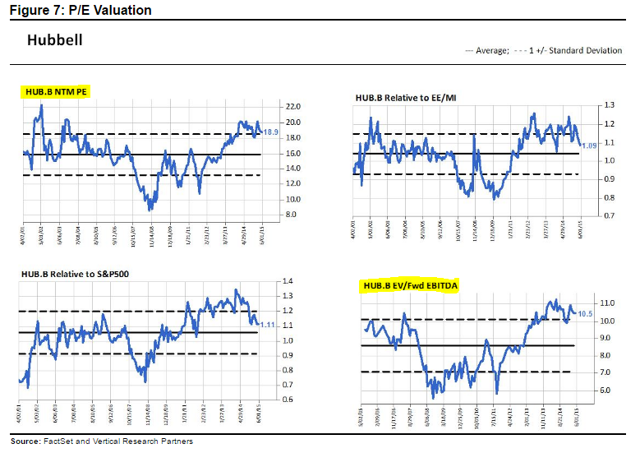

That seems an aggressive multiple, and not just on a peer basis. HUBB's current multiples of 11x+ NTM EBITDA and 20x+ forward EPS both are historically elevated:

Source: Vertical Research Partners

It's not impossible for HUBB to drive upside from current levels - but it certainly seems like a multi-step process to see real upward movement. Stabilization needs to hold in oil and gas. Lighting needs to normalize. Residential and non-residential construction need to continue to boost end market demand. Hubbell needs to execute both in terms of sales and margins; and an acquirer likely needs to come along in the mid-term. Simply beating the market - let alone other construction-exposed cyclicals - seems to require most of those outcomes to occur.

Again, that's not impossible - but it's hardly likely either. The combination of stagnant growth and elevated multiples generally is a bit of a warning sign. There's enough that can go right for Hubbell to call off a short (if only for the "better shorts elsewhere" argument), but it's hard for me to argue that $120 looks all that attractive. A more normalized multiple - high-teens P/E, ~10x EBITDA - would require HUBB to pull back to $100-$105, and there I can possibly see a bull case based on 2017 being noticeably better than the past few years.

But that also requires a bit better execution, and notably some sign of abatement in Hubbell's steady margin compression. Asking for a lower price and better execution might be too much to ask, to be sure. But without both, I simply don't think HUBB is all that attractive.

This article is part of Seeking Alpha PRO. PRO members receive exclusive access to Seeking Alpha's best ideas and professional tools to fully leverage the platform.