With only a few weeks to go, 1Q17 is already shaping up as an interesting one.

Much of the attention has fallen on admittedly important issues such as the Fed's likely rate hike on 3/15 and the intersection of politics and the economy as the Administration and Congress work through healthcare policy, tax cuts, and the budget.

There has also been interest in the eighth anniversary of the major market trough on 3/9/09, which set in motion the significant bull run for equities. This carries a little less interest for us as small-cap specialists because, as we observed before, the ageing bull is a large-cap phenomenon-the small-cap cycle has been noticeably different.

Others have been more focused on volatility-or the distinct lack of it. This is a topic more in our wheelhouse.

In fact, we see the current eerie stillness in terms of low volatility -the S&P 500 VIX is near its lowest levels in more than a decade-as being akin to the calm before the storm, especially in the context of the rich valuations many stocks, both large and small, are currently sporting.

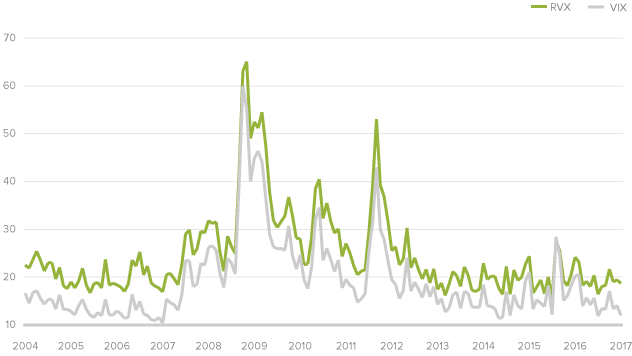

As the graph below shows, volatility for small-caps, while also low, has shown a different, more extreme pattern, as one would expect.

Another Look at Small-Cap and Large-Cap Volatility

CBOE Russell 2000 Volatility Index (RVX) versus CBOE S&P 500 Volatility Index (VIX) from 1/31/04 through 1/31/17

The CBOE Russell 2000 Volatility Index (RVX) measures market expectations of near-term volatility conveyed by Russell 2000 stock index option prices. The CBOE S&P 500 Volatility Index (VIX) measures market expectations of near-term volatility conveyed by S&P 500 stock index option prices.

We are anticipating more volatility. Markets simply do not stay steady, predicable, and/or placid for extended periods.

Moreover, the current environment, one marked by ample political volatility and but little market volatility, looks unsustainable to us. Something has to give at some point-and with stock prices running high, it seems to us that a correction is likely.

Again, however, context is key. We see little likelihood of a significant downturn in excess of 15% and expect any correction to be a normal, even healthy intra-cycle move that would in fact create some potentially profitable buying opportunities-which have been in short supply over the last several months.

We also see no rotations in long-term sector or style leadership and expect that the three reversals we have been talking about-with positive long-term returns for small-cap, value leading growth, and cyclicals beating defensives-will remain in place. In addition, the economic news is still positive, and the earnings outlook remains bright.

In the meantime, 1Q17 is currently looking a lot like 3Q16 from a small-cap perspective-with small-cap growth and defensive sectors rebounding.

To be sure, much is uncertain-but this uncertainty is not yet fully reflected in share prices. When that process begins, we are prepared to act.

Our long-term focus mean that we seek to take advantage of market dislocations when they occur, identifying attractively low valuations and/or discounted quality in a market that we believe will remain strong both for small-cap cyclicals and valuation-sensitive strategies.

Stay tuned…

Important Disclosure Information

Mr. Gannon's thoughts and opinions concerning the stock market are solely his own and, of course, there can be no assurance with regard to future market movements. No assurance can be given that the past performance trends as outlined above will continue in the future.

The CBOE S&P 500 Volatility Index (VIX) measures market expectations of near-term volatility conveyed by S&P 500 stock index option prices.

The CBOE Russell 2000 Volatility Index (RVX) measures market expectations of near-term volatility conveyed by Russell 2000 stock index option prices.

The Russell Investment Group is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. Russell® is a trademark of Russell Investment Group. The Russell 2000 Index is an unmanaged, capitalization-weighted index of domestic small-cap stocks. It measures the performance of the 2,000 smallest publicly traded U.S. companies in the Russell 3000 Index. The Russell 2000 Value and Growth indexes consist of the respective value and growth stocks within the Russell 2000 as determined by Russell Investments. The S&P 500 is an index of U.S. large-cap stocks selected by Standard & Poor's based on market size, liquidity, and industry grouping, among other factors. The performance of an index does not represent exactly any particular investment, as you cannot invest directly in an index.

This material is not authorized for distribution unless preceded or accompanied by a current prospectus. Please read the prospectus carefully before investing or sending money. Smaller-cap stocks may involve considerably more risk than larger-cap stocks. (Please see "Primary Risks for Fund Investors" in the prospectus.)