Weekly Review

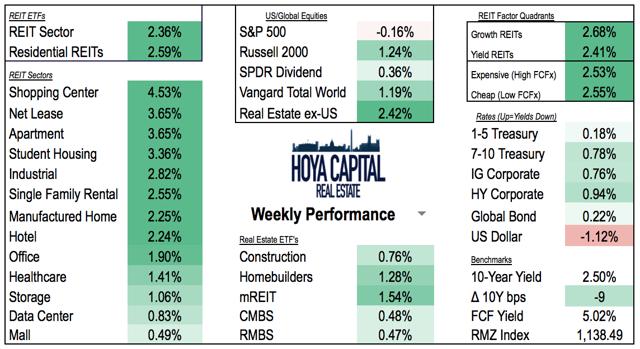

The REIT ETF indexes (NYSEARCA:VNQ and NYSEARCA:IYR) finished the week higher by 2.4%, following a 6% decline over the past two week. The S&P 500 (SPY) fell 0.2%. Construction ETFs were higher on the week. The homebuilder ETFs (XHB and ITB) rose 1.3%, sparked by strong homebuilder confidence and good housing starts data. The commercial construction ETF (PKB) rose 0.8%.

(Hoya Capital Real Estate, Performance as of 12pm Friday)

Across other areas of the real estate sector, mortgage REITs (REM) finished the week higher by 1.5% and the international real estate ETF (VNQI) gained 2.4%. Through two months of 2017, REITs are lower by 0.3%, underperforming the S&P 500 by 600bps. REITs ended 2016 with a total return of roughly 9%, lower than their 20-year average annual return of 12%.

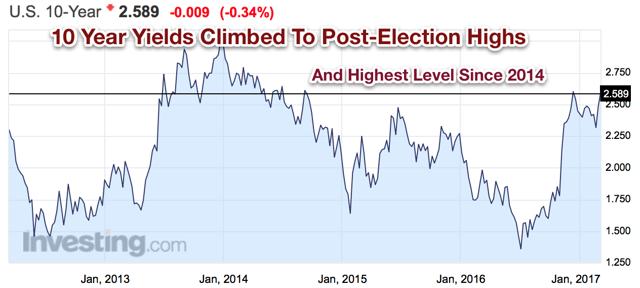

The 10-Year Treasury yield (IEF) declined 10 basis points on the week after climbing to post-election highs last week. Investors interpreted the Federal Reserve's comments after the rate hike as "dovish" which lowered the implied probability of future rate hikes this year. Moderate inflation data, which we discuss below, also contributed to the decline in yields.

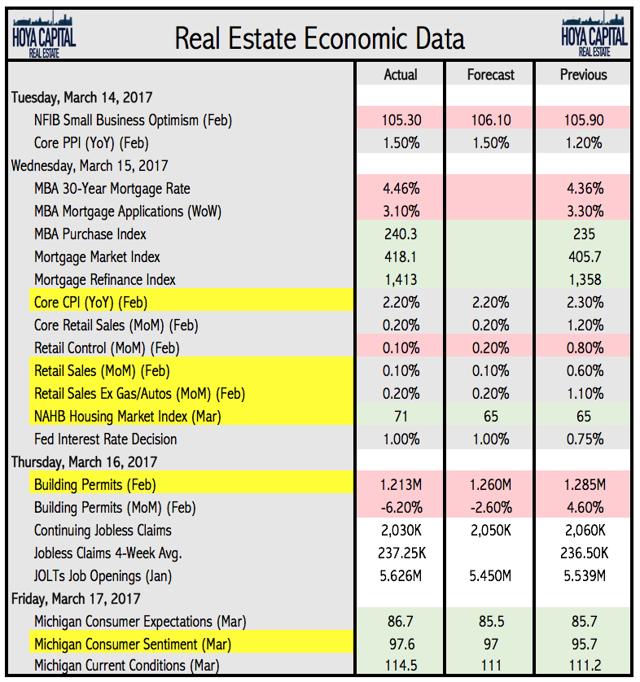

Economic Data

(Hoya Capital Real Estate, HousingWire)

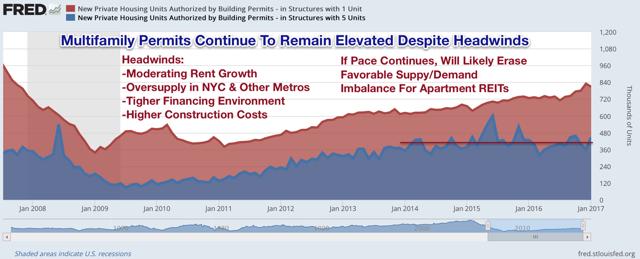

Housing Permits & Starts: Multifamily Declines But Remains Elevated

Total building permits for February came in at 1.21 million, missing expectations of 1.26 million. This was 6.2% below the annualized rate in January, but 4% above February of last year. Multifamily permits took a step down this month after a strong January. We note that multifamily permits still remain rather elevated considering that apartment rents have already showed notable softness and most surveys indicate that the financing environment has tightened considerably. Multifamily permitting topped 451k in 2015, the highest since 1986, and declined only modestly in 2016 to 392k. Through two months of 2017, multifamily permits are averaging 395k.

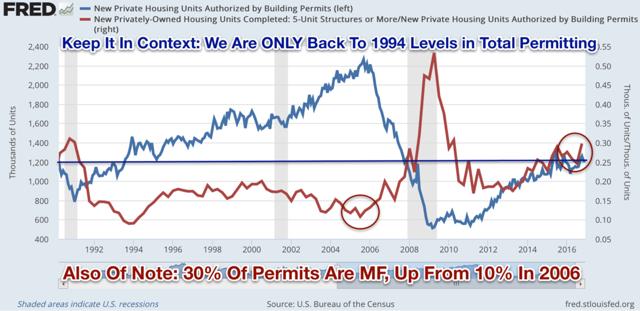

Let's keep it in context, though. When we zoom into only the post-recession period above, it appears that supply is plentiful. When we zoom out back to 1990, we see that total permitting (blue line) is only back to 1994 levels. We also find it interesting how the mix of permits has shifted significantly towards multifamily in recent years. In 2006, only 10% of permits were for multifamily units. In the most recent month, roughly 30% of permits are for multifamily (5+) unit structures.

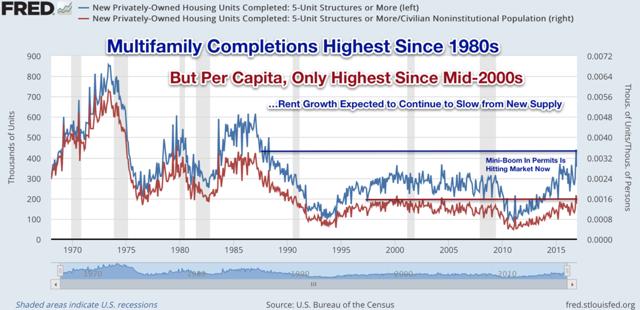

Multifamily completions over the past several months continue to be near their highest level since the late 1980s. The effects of the new supply have already been felt in the national rent growth metrics, which have showed rent growth slowing to the 2-3% YoY range. We expect this to slow further through 2017.

That said, it's important to remember that demographics over the next 10 years are highly favorable to apartment demand. Rent growth data will certainly be interesting over the next several years: it will be a battle between high levels of supply and high levels of demand.

Retail Sales: Continued Strength Despite Delay in Tax Refunds

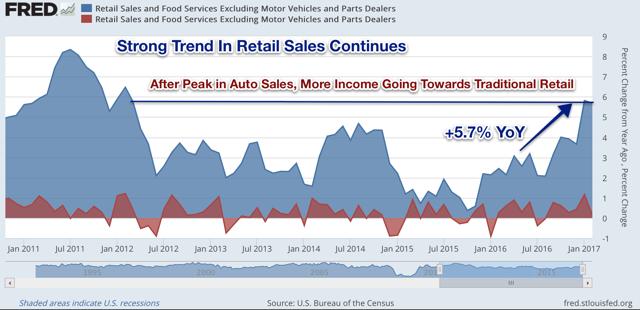

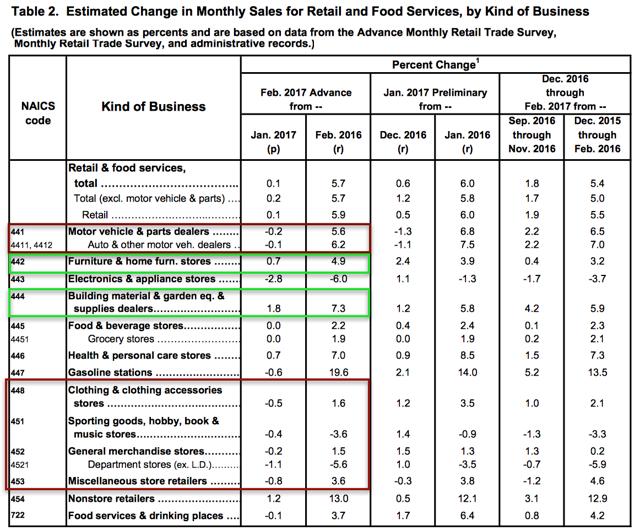

Despite issues with delayed tax refunds, February retail sales data was better than expected after factoring in the 0.4% upward revision in January, and continued a positive trend that began in late 2015. Retail sales ex Auto remained near its highest YoY growth rate since 2012. As we projected late last year, as motor vehicles sales slow following banner years in 2015 and 2016, consumers have allocated more disposable income towards traditional retail goods.

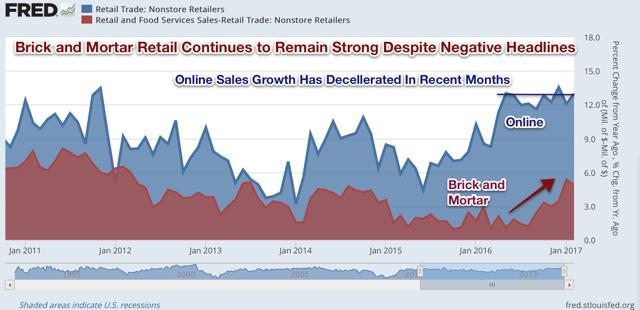

Online sales growth has moderated slightly in recent months while "brick and mortar" retail has shown considerable strength. In-store retail grew at 4.7% YoY rate in January. While there is no question that online sales growth present considerable challenges for general merchandise and clothing retailers, the financial media narrative that we are in a "retail apocalypse" is simply unsupported by the data.

Diving deeper into the data, we noted last month the possible inflection point in motor vehicle and part sales, which has their worst month since March 2016. The negative trend continued this month with a 0.2% decline from January.

Last month we also noted the considerable strength in brick-and-mortar retail, which came at the expense of online sales. That trend reversed a bit this month, as the traditional brick-and-mortar retailers (the clothing, sporting goods, general merchandise, and miscellaneous categories) were all down modestly. Online (nonstore) gained 1.2% after a 0% increase in January.

Home improvement continues to be the brightest category in retail. Furniture stores have recorded nearly 5% growth over last year while building materials and garden stores have recorded a 7.3% YoY increase.

Inflation: Picking Up In Recent Months, But Barely

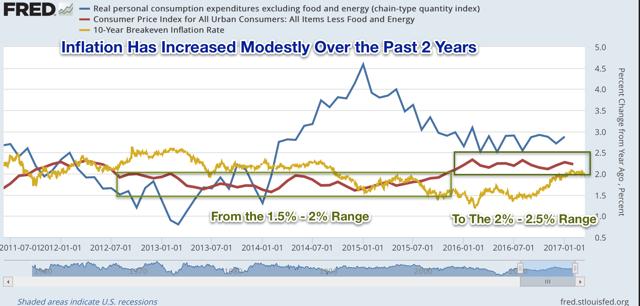

After appearing to pick-up considerably in the immediate aftermath of the election, inflation has moderated once again and remains only slightly higher than the post-recession average. Core CPI is 2.2% higher than last February, which was in line with expectations. We show below that Core CPI was consistently recorded in the 1.5-2.0% range from 2012 to 2016 before breaking out into the 2.0-2.4% range over the past year.

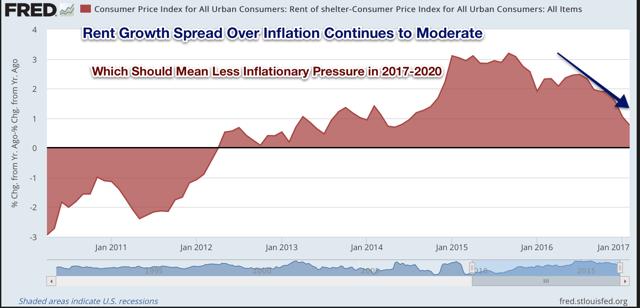

Shelter inflation accounts for nearly 30% of CPI, and the robust growth in rents since 2013 has explained much of the recent rise in inflation. We track the rent growth spread over inflation below, which shows that at its peak, rent inflation was over 3% higher than the overall level of inflation. In fact, in early 2015, rent inflation was the only thing keeping overall inflation in positive territory. The robust levels of multifamily completions that will sustain through 2017 should bring this rent spread down towards zero, which will have the effect of keeping overall inflation rather low.

Combined with lower oil prices and the potential for lower healthcare costs, we see more downside pressure on inflation than upside pressure from tight labor markets. These three components (rents, energy, healthcare) are primary drivers of inflation. Lower inflation would be positive for fixed income securities and keep interest rates lower for longer.

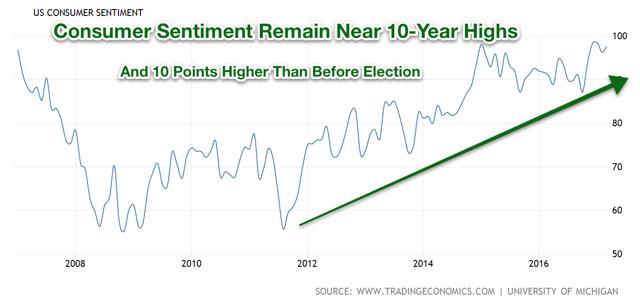

Sentiment Remains Near Multi-Decade Highs

"Soft" economic data measures (confidence surveys) continue to exceed expectations as Trump-Euphoria has not yet relented. Consumer sentiment remains near 10-year highs.

Homebuilder confidence surged past post-recession highs this week and is back to levels not seen since 2005.

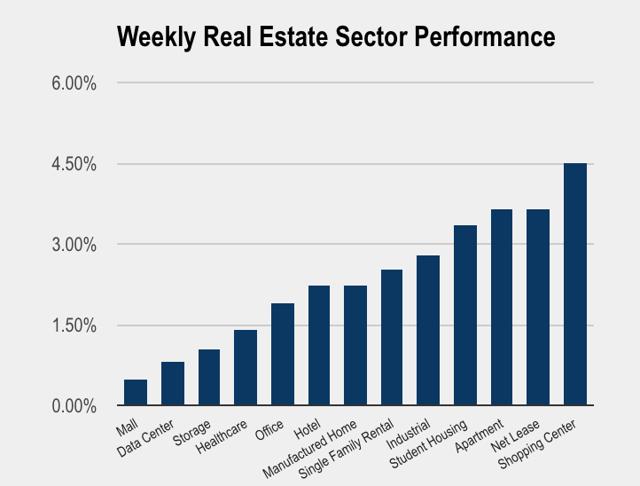

Sector Performance

All REIT sectors were higher on the week, led by the shopping center and net lease sectors.

The best six performing REITs on the week were Regency Centers (REG), Federal Realty (FRT), Weingarten (WRI), Mid-America (MAA), Retail Properties of America (RPAI) and National Retail (NNN).

Bottom Line

This week we updated our REIT Rankings for the Apartment and Healthcare sectors.

For the healthcare sector, we noted that no real estate sector faces as much uncertainty in 2017 as healthcare REITs. The repeal/replace of the ACA, and its impact on healthcare REITs, remain highly unpredictable. Amid this uncertainty, Healthcare REITs continue to trade at the mercy of US and global interest rates. Q4 earnings were quite strong, but forward guidance was weaker than expected. Headwinds include higher skilled labor costs, oversupply of senior housing, uncertainty over the ACA, and reimbursement challenges. Valuations appear quite attractive, and much of the uncertainty appears to already be discounted.

For the apartment sector, we noted that Apartment REITs enjoyed robust rent growth between 2013 and 2015 resulting from the post-recession period of under-building. The recent surge in high-end apartment construction, though, continues to moderate apartment rents. While rent growth has moderated, it has shown signs of stabilization in recent months. Apartment REITs have outperformed so far in 2017 on positive indications about rental conditions. Q4 earnings were generally quite good. Of the seven apartment REITs, three beat expectations, three met, and one missed. Like other REIT sectors, forward guidance was very cautious. The election introduced uncertainty in the sector. Tougher immigration policies may slow population growth, but a stronger economy may encourage more legal immigration. The net effect is difficult to project.

Last week we published our monthly pricing update, "Volatility Returns To The REIT Sector," where pointed out that, until the past two weeks, the post-election volatility in the REIT sector was historically low despite the backdrop of political uncertainty. We pointed out that after that steep sell-off, REITs were (and still are) trading significantly below their five-year average FCF multiple.

Please add your comments if you have additional insight or opinions. We encourage readers to follow our Seeking Alpha page (click "Follow" at the top) to continue to stay up to date on our REIT rankings, weekly recaps, and analysis on the REIT and broader real estate sector.