Apple's (NASDAQ:AAPL) stock price rallied to $602.50 on March 21, partly due to the the company's decision to spread some of its huge pile of cash ($97.6 billion in cash equivalent with no outstanding debt at the end of 2011) in the form of dividend and a share buyback program.

Apple said it will pay a quarterly dividend of $2.65 per share, starting July 1, and plans to buy back up to $10 billion in stock over three years starting September 30. Apple is not the only one hoarding cash. According to Moody's, U.S. corporations, including Apple, amassed a record $1.24 trillion of cash last year post-2008 credit crisis.

Apple has been under pressure to reward shareholders as Apple's iProducts sales keeps feeding its cash mountain. So we most likely will see other large corporations follow suit declaring dividends and initiating share buyback programs in the coming quarters.

However, the more disconcerting question is this:

Given that Apple is the leader in technology innovation and creativity, are these two options (dividend and share buybacks) the best Apple can come up with to put its cash to good use?

After all, Apple shareholders have been rewarded very handsomely as Apple stock soared from a $5+ stock in 1996 to today's $600+ level. Apple stock went up 75% in the past 52 weeks alone. Do Apple stockholders really need more cash reward from Apple?

Would Apple not better off re-investing its cash in innovative technology and product R&D, and niche acquisitions? Better yet, how about giving some cash back directly to the employees at Foxconn (OTCPK:FXCNF) - Apple's iSweatshop - or Apple's own mid to low levels employees (i.e. non-executive and non-managerial ranks) to boost morale and productivity? After all, Apple owes a large part of its' enviable iSales and iMargins to the hardworking worker-bees at Foxconn and Apple. (Yes, we know U.S. corporations are paying wages at the "fair market rate" in oversea shops, but a little cash sprinkle now could go a long way.)

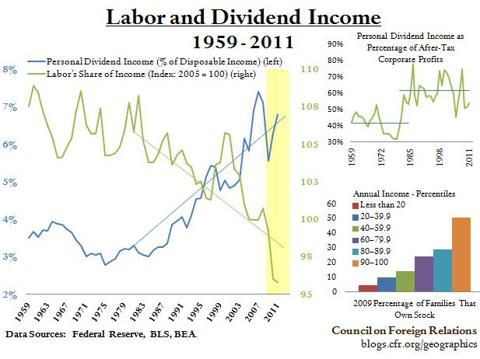

The chart below from Council on Foreign Relations (CFR) illustrates how labor's share of income in the United States has plummeted, while personal dividend income as a percentage of disposable income has soared since 2009.

Click to enlarge

In fact, CFR noted that dividend income along with corporate profits took the biggest jump in the early 1980s, a time in which labor's share of income has fallen almost continuously. Needless to say, fiscal, legal, and monetary policies enacted by the U.S. government and the Federal Reserve had a big hand in this divergence, as well as growing income inequality in the U.S.

How big is income inequality in the U.S. relative to the rest of the world? Here are some statistics from the Standard Center of Poverty and Inequality:

"The U.S. ranks third among all the advanced economies in the amount of income inequality. The top 1% of Americans control nearly a quarter of all the country's income, the highest share controlled by the top 1% since 1928."

Perhaps it is time for corporations to rethink more meaningful and productive long-term strategic use of their cash, instead of driving the income gap ever wider to appease the 1%.