I'm kind of worried about volatility. I don't think there's enough of it to satisfy investor demand.

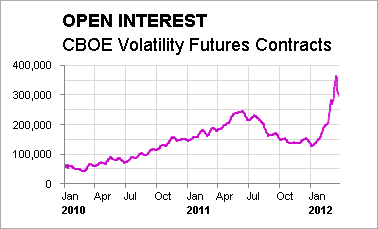

Here's a look at the open interest in CBOE Volatility Futures, per CBOE data - a 10-day average of open futures contracts (except for the past month, where I did not average the open interest)

Investors seem to want a lot of volatility. The open interest peaked at around 350,000 before falling off to just under 300,000 a few days ago.

Consider that there are only about 115,000 futures contracts open for silver on the CME - and that's something that can actually be delivered. Yes, there are some out there who believe there's not enough silver around to deliver on those contracts. I can't speak to that issue, but I do know there's certainly not enough volatility to deliver because volatility isn't a deliverable commodity. It's not even a commodity at all.

So why do people want so many of these ethereal volatility futures? Well it probably has a lot to do with the emergence of all these new volatility ETNs, the largest of which is the iPath VIX Short-Term Futures ETN (VXX).

According to xtf.com, VXX has seen a net inflow of $2 billion year to date. In fact, VXX is now about 5 slots away from being one of the top 100 exchange traded products ranked by net asset value.

This fund, and its sister fund iPath VIX Mid-Term Futures ETN (VXZ), among others, trade these volatility futures, so it helps to understand how funds like these work to generate their returns.

Volatility: Contango vs. backwardation

One reason why futures-based funds like the US Natural Gas Fund (UNG) deliver a return that's much less than the spot price of natural gas itself is because the fund continually rolls over futures contracts.

When the market is in contango, with distant contracts costing more than nearer-term contracts, the fund continually pays a premium for this rollover and that eats into returns. When the market is in backwardation, near-term contracts cost more, so the fund essentially gets paid for the rollover, enhancing returns.

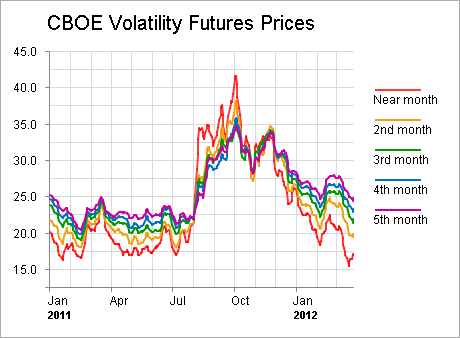

But volatility is usually in contango. Here's a chart showing the front month VIX futures contract and the next 4 months going back to XXX, from data I got from the CBOE.

Notice that when the market is freaking out, like last summer, distant VIX futures trades for less than nearer months, but otherwise the market stays in contango with distant term contracts trading for more.

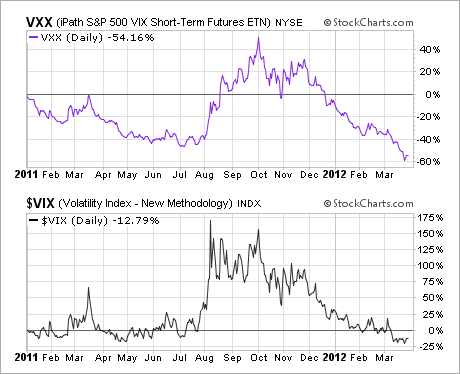

The VXX short-term ETN holds first and second month contracts. Here's a look at its performance against the VIX (although VIX "performance" is rather hypothetical because it's not really a deliverable commodity).

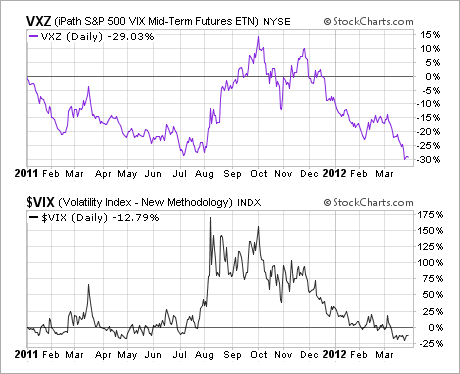

The VXZ, on the other hand, holds VIX futures contracts that expire in 4 to 7 months. Here's a similar performance chart for VXZ:

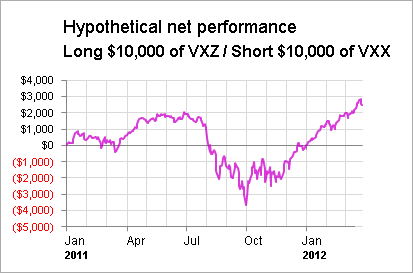

Neither of these funds in my view provide much in the way of a long-term hedge against a market decline and are only suitable for short-term tactical positions. But when the market panics and that panic eases off (which it always does), a long VXZ/short VXX position can work well.

Here's a look at the hypothetical performance a position like that since MMMM.

That's not a position you want when the shorter-term contracts soar compared to the more distant months, like last summer, but it performs well as "fear" peaks and the normal contango returns.

Futures on a mathematical calculation

I don't know why these volatility futures contracts and these ETNs became so popular, but I really hope that long-term investors aren't fooled into holding volatility funds over extended periods thinking they can perform as a long-term hedge against stock market declines.

These futures contracts, and the ETNs that trade them, represent nothing more than a bet on a mathematical calculation based on the VIX.

The VIX supposedly represents expectations for how much the market will bounce around over the next month. I say "supposedly" because it's not like anyone takes a poll. Remember, nobody puts implied volatility into the options pricing model. Implied volatility is derived from the options prices themselves. That's why it's "implied."

So if you're taking a stab at estimating what actual realized volatility will be in one month, what you're really estimating is the standard deviation you expect. Now ask yourself, can you estimate what the standard deviation of the daily price change in the S&P500 will be in June?

Well that's essentially the bet you're making if you buy (or short) a volatility futures contract that expires in say, July. And remember, we're not talking about what the actual mathematical calculation will be in June, but what traders think it will be in June.

If you decide to buy or sell a volatility-based ETN, pay careful attention to the volatility contango. That's way more important to your returns than the actual VIX level itself, let alone how much the S&P rises and falls.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.