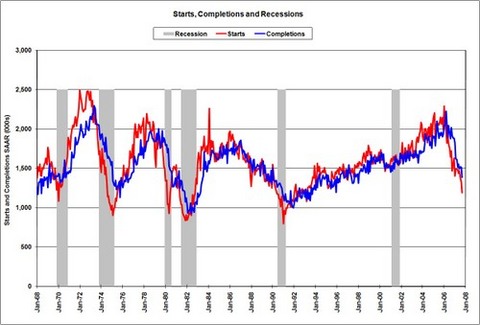

A few quick words on Wednesday's Housing data: Of course, it was god-awful. Despite the incessant bottom-calling by the clueless, spin-miesters, and industry insiders, we are nowhere near the end of the cycle.

If we are lucky, this is now the middle -- as opposed to the 2nd year of a decade long slump.

As to Wednesday's data -- it was a mixed blessing. The manifest problems in Housing are twofold: Prices are too high, and inventory is too great. These are, of course, related. Once prices come down further, the supply problems will begin to clear up. So the enormous drop in permits/starts is, perversely, a good thing.

Let's go to the data:

New construction of homes in the United States fell 10.2% in September (seasonally adjusted 1.19 million units)

The drop in housing starts was the 4th consecutive monthly decline.

Starts of single-family homes fell 1.7% to 963,000 (annualized); We are now at the lowest level for new home construction since March 1993.

Construction of large apartment units plummeted 34.4% to 228,000.

Building permits fell 7.3% to a seasonally adjusted rate of 1.23 million -- the lowest level since July 1993.

So there is no bottom anywhere in sight. The scary question is whether we are in the 5th/6th inning, or the 1st/2nd inning.

For a real good read, Dan Gross goes postal on Treasury Secretary Paulson: Dan claims that the subprime collapse didn't bother the Bush administration until Wall Street bankers started whimpering: Protecting Paulson's Pals.

Lastly, considering how much denial there was for the longest time, I found some of the Wall Street economists comments at Real Time Economic terribly amusing. This crowd has not yet begun to panic . . .

Housing Starts amd Completions

chart courtesy of Calculated Risk

Sources:

New Residential Construction

(Building Permits, Housing Starts, and Housing Completions

http://www.census.gov/const/newresconst.pdf

New construction falls 10.2% to fewest housing starts since '93

ALEJANDRO BODIPO-MEMBA

Detroit Free Press, October 17, 2007

http://www.freep.com/apps/pbcs.dll/article?AID=/20071017/BUSINESS07/71017022

Protecting Paulson's Pals

Daniel Gross

Slate, Tuesday, Oct. 16, 2007, at 5:52 PM ET

http://www.slate.com/id/2175724/

Economists React: ???Horrific??? Housing

October 17, 2007, 10:25 am

http://blogs.wsj.com/economics/2007/10/17/economists-react-horrific-housing/

Standard & Poor's Ratings Services Reviews Ratings on Certain U.S. Residential Mortgage-Backed Securities Issued in 2007 http://www.prnewswire.com/cgi-bin/stories.pl?ACCT=104&STORY=/www/story/10-17-2007/0004684220&EDATE=