Jim Simons retired from Renaissance Technologies in 2010, but he still owns between 25 to 50 percent of the hedge fund. Renaissance Technologies manages over $25 billion of assets in several funds and the firm's funds earned net returns higher than 30% in 2011.

Below we compiled a list of top 10 high-dividend stocks in Renaissance Technologies' 13F portfolio at the end of December. Renaissance Technologies holds a more than $10 million position in each stock in our list. All companies have at least $1 billion market cap and dividend yields higher than 4%. Jim Simons' other top holdings are listed on Insider Monkey. We obtained market data from Finviz and hedge fund holdings from Insider Monkey.

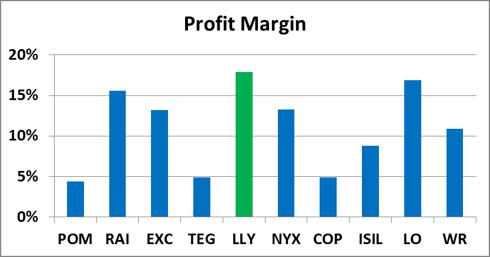

Stock | Market Cap | Sector* | Dividend Yield | P/E | Beta | Profit Margin |

Pepco Holdings, Inc. (POM) | 4.3 | 1 | 5.7% | 16.5 | 0.49 | 4.4% |

Reynolds American Inc. (RAI) | 23.3 | 2 | 5.5% | 18.0 | 0.57 | 15.6% |

Exelon Corporation (EXC) | 26.0 | 1 | 5.3% | 10.5 | 0.54 | 13.2% |

Integrys Energy Group, Inc. (TEG) | 4.3 | 1 | 5.0% | 19.0 | 0.86 | 4.9% |

Eli Lilly & Co. (LLY) | 47.9 | 3 | 4.8% | 10.7 | 0.68 | 17.9% |

NYSE Euronext, Inc. (NYX) | 6.6 | 5 | 4.7% | 10.9 | 1.65 | 13.3% |

ConocoPhillips (COP) | 71.9 | 6 | 4.7% | 6.2 | 1.14 | 4.9% |

Intersil Corporation (ISIL) | 1.3 | 4 | 4.7% | 19.4 | 1.26 | 8.8% |

Lorillard, Inc. (LO) | 17.4 | 2 | 4.6% | 16.7 | 0.4 | 16.9% |

Westar Energy, Inc. (WR) | 3.6 | 1 | 4.6% | 14.9 | 0.57 | 10.9% |

* 1-Utilities, 2-Consumer Goods, 3-Healthcare, 4-Technology, 5-Financial, 6-Basic Materials.

Pepco Holdings provides transmission, distribution and supply of electricity. Shares of Pepco recently traded at $18.78 with a trailing price to earnings of 16.51 and a forward price to earnings of 14.61. POM has a 5.69% dividend yield and gained 2.59% during the past 12 months. The stock has a market cap of $4.3 billion and total debt/equity ratio of 1.16. Pepco has an estimated growth rate of 4.84% for this year and 6.5% for next five years. Simons had $12 million invested in Pepco shares.

Reynolds American manufactures and sells cigarette and other tobacco products in the United States. Shares of Reynolds American recently traded at $40.55 with a trailing price to earnings of 17.96 and a forward price to earnings of 12.86. Reynolds American has a 5.49% dividend yield and gained 15.59% during the past 12 months. The stock has a market cap of $23.3 billion and total debt/equity ratio of 0.53. Reynolds American has an estimated growth rate of 7.46% for this year and 6.97% for next five years. Simons had $13 million invested in Reynolds American shares.

Exelon Corporation generates electricity in the United States. Shares of Exelon recently traded at $39.17 with a trailing price to earnings of 10.48 and a forward price to earnings of 12.84. Exelon has a 5.34% dividend yield and lost 1.08% during the past 12 months. The stock has a market cap of $26 billion and total debt/equity ratio of 0.94. Exelon has an estimated growth rate of 0.66% for this year and -1.08% for next five years. Simons had $58 million invested in EXC shares.

Integrys Energy is an energy holding company operating in the United States and Canada. Shares of Integrys recently traded at $54.29 with a trailing price to earnings of 19 and a forward price to earnings of 15.09. Integrys has a 4.95% dividend yield and gained 10.39% during the past 12 months. The stock has a market cap of $4.3 billion and total debt/equity ratio of 0.81. Integrys has an estimated growth rate of 4.9% for this year and 7.2% for next five years. Simons had $17 million invested in Integrys shares.

Eli Lilly provides pharmaceutical products worldwide. Shares of Eli Lilly recently traded at $41.35 with a trailing price to earnings of 10.68 and a forward price to earnings of 11.18. Eli Lilly has a 4.75% dividend yield and gained 16.5% during the past 12 months. The stock has a market cap of $47.9 billion and total debt/equity ratio of 0.51. Eli Lilly has an estimated growth rate of 13.89% for this year and -7.08% for next five years. Simons had $300 million invested in Eli Lilly shares.

NYSE Euronext operates securities exchanges. Shares of NYSE Euronext recently traded at $25.32 with a trailing price to earnings of 10.85 and a forward price to earnings of 8.71. NYSE Euronext has a 4.69% dividend yield and lost 33.89% during the past 12 months. The stock has a market cap of $6.6 billion and total debt/equity ratio of 0.32. NYSE Euronext has an estimated growth rate of 25.64% for this year and 11.1% for next five years. Simons had $27 million invested in NYSE Euronext shares.

ConocoPhillips is an integrated energy company operating worldwide. Shares of ConocoPhillips recently traded at $54.78 with a trailing price to earnings of 6.18 and a forward price to earnings of 6.31. ConocoPhillips has a 4.67% dividend yield and lost 24.33% during the past 12 months. The stock has a market cap of $71.9 billion and total debt/equity ratio of 0.41. ConocoPhillips has an estimated growth rate of 5.79% for this year and 5.62% for next five years. Simons had $39 million invested in ConocoPhillips shares.

Intersil Corporation provides analog and mixed-signal integrated circuits for applications in the electronics markets. Shares of Intersil Corporation recently traded at $10.44 with a trailing price to earnings of 19.43 and a forward price to earnings of 22.89. Intersil Corporation has a 4.66% dividend yield and lost 27.05% during the past 12 months. The stock has a market cap of $1.3 billion and total debt/equity ratio of 0.19. Intersil Corporation has an estimated growth rate of 164.71% for this year and 13.5% for next five years. Simons had $14 million invested in ISIL shares.

Lorillard manufactures and sells cigarettes in the United States. Shares of Lorillard recently traded at $133.8 with a trailing price to earnings of 16.67 and a forward price to earnings of 13.85. Lorillard has a 4.64% dividend yield and gained 30.48% during the past 12 months. The stock has a market cap of $17.4 billion. Lorillard has an estimated growth rate of 11.06% for this year and 11.23% for next five years. Simons had $207 million invested in Lorillard shares.

Westar Energy is an electric utility company. Shares of Westar Energy recently traded at $28.53 with a trailing price to earnings of 14.86 and a forward price to earnings of 13.93. Westar Energy has a 4.58% dividend yield and gained 11.31% during the past 12 months. The stock has a market cap of $3.6 billion and total debt/equity ratio of 1.09. Westar Energy has an estimated growth rate of 7.25% for this year and 6.28% for next five years. Simons had $15 million invested in Westar Energy shares.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.