Over the last few weeks, most large gold miners have declined substantially, significantly underperforming both the broader equity markets and gold itself.

Over the last few years, gold appreciated substantially, while many gold miners did not. A great deal of the disconnect between the performance of gold and that of the gold miners is related to broad expectations that gold could not maintain its price range or trajectory. Despite its prior underperformance, throughout 2011 and so far into 2012, gold miners have consistently underperformed gold when it appreciated, and fallen more significantly than gold when it declined, as it has been lately.

At the moment, several large-cap miners provide a dividend that beats the average interest rate available on a savings account, and possibly even a 5-year CD. Of course, many of those dividends only became so competitive due to declining share prices over the last few quarters. Moreover, gold and these derivative mining equities are considered by many to be both a potential stock market and currency devaluation hedge. Such investors usually point to global money printing and expanding sovereign debt levels as reasons for individuals to maintain personal gold reserves.

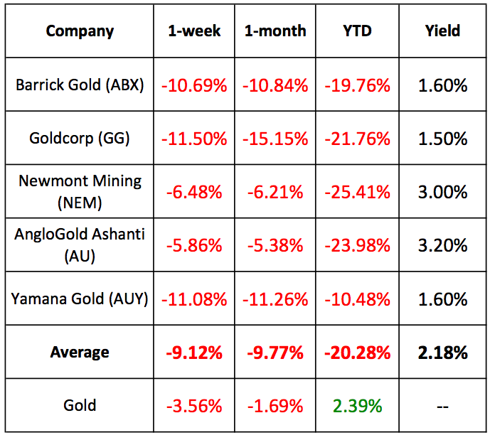

Below are five large-cap gold miners traded in the United States: Barrick Gold (ABX), Goldcorp. (GG), Newmont (NEM), AngloGold Ashanti (AU) and Yamana Gold (AUY). I have provided their present yields, as well as their 1-month, YTD and 6-month equity performance rates. I have also provided the performance rates for gold via the Gold ETF (GLD).

Some anticipate that this miner's underperformance should eventually catch up to gold, provided gold does not decline. Of course, those individuals have been anticipating that for a while now. Nonetheless, the disparity thus far is significant, with these miners averaging a 9.12 percent decline over the last week, while gold has fallen less than half as much. Moreover, these miners have averaged a 20.28 percent decline since the start of 2012, compared to gold still being positive so far this year.

Notable differences between miners and gold exist, including that mining companies may suffer risks that a commodity investment cannot, such as political risks, mine productivity issues, bad weather, management negligence, fraud and bad luck. Mines can be shut down by hostile governments, bad weather, an earthquake and many other foreseeable and risks. Such issues regularly present themselves, which partially accounts for the average miner's underperformance.

Another notable difference between shares in these miners and shares in the gold ETF is that these large miners provide a dividend that probably beats the interest rate most individuals are getting on cash. The above-listed gold miners all yield over 1.5%, with an average yield of 2.18%. Gold does not provide a yield, and also usually requires investors to pay storage costs or management fees.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Additional disclosure: Disclaimer: This article is intended to be informative and should not be construed as personalized advice as it does not take into account your specific situation or objectives.