In December this monthly report series began applying dog dividend methodology to each of eight major market sectors. The sectors were, in alphabetical order: basic materials; consumer goods; financial; healthcare; industrial goods; services; technology; utilities.

A ninth sector, conglomerates, according to Yahoo Finance, contained just eight firms, five of which paid dividends. The editorial decision was not to apply dogs of the index metrics to a sector containing fewer than ten dividend paying equities.

Dogs of the Index Metrics Selected Ten Top Services Stocks by Yield

Two key metrics determined the yields that ranked these sector dog stocks: (1) stock price; (2) annual dividend. Dividing the annual dividend by the price of the stock declared the percentage yield by which each dog stock was ranked.

Historically dividend dog investors utilized this ranking system to select portfolios of five or ten stocks in any one index, sector, or survey to trade. They awaited the results from their investments in the lowest priced, highest yielding stocks and prayed that the price of every stock they now owned climbed higher (having locked in a high yield percentage at purchase).

This Dogs of the Index strategy, popularized by Michael B. O'Higgins in the book "Beating The Dow" (HarperCollins, 1991), revealed how high yielding stocks whose prices increased (and whose dividend yields therefore decreased) could be sold off once a year to sweep gains and reinvest the seed money into higher yielding stocks in the same index.

Comparative Methods Used

First, the entire list of services sector companies was sorted by yield as of May 16 using Ycharts.com to reveal the top thirty. Market performance of these thirty selections was then reviewed using four months of historic projected annual dividend history from Yahoo Finance along with annual divided projections adjusted for market realities.

Thereafter, this article assessed the relative strengths of the sector top ten services dividend dogs as of May 1 opening prices vs. the Dogs of the Dow May 11 stock list. Annual dividends from $1000 invested in the ten highest yielding stocks in the sector and index were compared to the aggregate single share prices of the top ten stocks in each.

Services Dividend Dogs

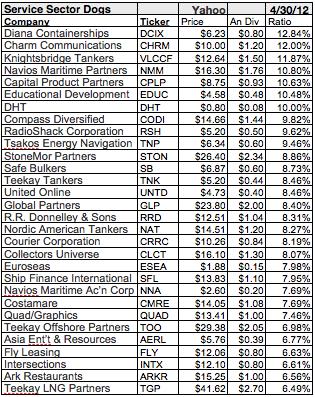

The top ten services sector stocks showing the biggest dividend yields in April represented five industries. Top sector stock Diana Containerships (DCIX) was one of six representing the shipping industry. The other five shippers were: Knightsbridge Tankers (VLCCF); Navios Maritime Partners (NMM); Capital Product Partners (CPLP); DHT Holdings (DHT); Tsakos Energy Navigation (TNP). The remaining four sector representatives were all from separate industries: Charm Communications Inc. (CHRM), advertising agencies; Educational Development Corporation (EDUC), wholesale, other; Compass Diversified Holdings (CODI), staffing & outsourcing services; RadioShack Corporation (RSH), electronic stores.

Up and Down Moves by Services Dividend Dogs

Estimated annual dividends adjusted for market realities somewhat quelled the pattern of speculative and unsubstantiated dividend payers showing up to claim the top dog yellow tint. On that note the former top dog Alon Holdings - Blue Square Israel (BSI) saw its estimated annual divided trimmed to 33.3% from $.30 to $.20 pushing it out of the top 30.

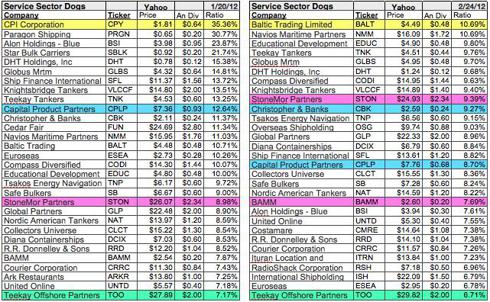

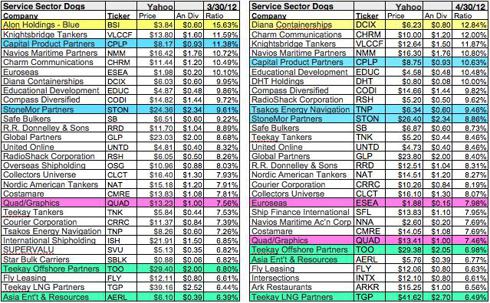

Color code shows: (Yellow) firms listed in first position at least once between January and April 2012; (Cyan Blue) firms listed in tenth position at least once between January and April 2012; (Magenta) firms listed in twentieth position at least once between January and April 2012; (Green) firms listed in thirtieth position at least once between January and April 2012. Duplicates were depicted in color for highest ranking attained.

Bullish upward price moves among the top ten services dogs since March 30 included three gainers: Top dog Diana Containerships delivered a 3.32% gain in price while its dividends gushed 33.3%; Capital Product Partners landed a 7.1% gain. StoneMor Partners (STON) a top ten equity from March gained 8.37%, enough to exit the top ten.

Bearish downward moves for the same period were experienced by nine firms from the March and April top ten: Alon Holdings - Blue Square Israel dropped 9.1% in price while its forward looking annual dividend yield broke down 33.3%; Charm Communications posted a 12.6% decline and its dividend history just began in March; Knightsbridge Tankers tanked 8.4%; Navios Maritime Partners price fell .73%; Educational Development degraded 5.95%; DHT Holdings dropped 2.44%; Compass Diversified sagged 1.08%; Euroseas (ESEA) price went down 5.05% and its divided projection fell 25%; RadioShack Corporation price was off 14.05%.

All in all the services dog losers outnumbered gainers nine to three since March.

Dividend vs. Price Results Compared to Dow Dogs

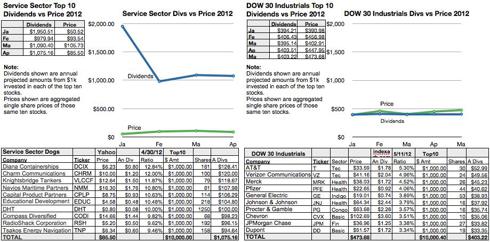

Below is a graph of the relative strengths of the top ten services sector dividend stocks by yield as of market close 5/1/2012 compared to those of the Dow. Using four months of historic projected annual dividend history from $1000 invested in the ten highest yielding stocks each month and the total single share prices of those ten stocks created the data points for each month shown in green for price and blue for dividends.

Conclusion: Services Sector Dogs Swamped in April

The services collection of 10 top dividend payers showed a 69.24% increase in aggregate single share prices over the four monthly points surveyed. Dividends from $1k invested in each of the top ten declined 44.88% for that period. In the month past however single share aggregate price dropped 19.04% while dividends from $1k invested in each of the top ten also sank 1.4% based on reshuffling the pack of ten top dogs.

Meanwhile, the Dow index moved back to near convergence as dividends from $1k invested in the top ten came to within $8 of their aggregate total single share prices in March. Since then however the Dow aggregate single share price for the top ten has rallied up 17.56% into May.

As of April 30 services sector top ten dogs showed $672, or 166.7%, more dividends from $1k invested in each of the top ten stocks by yield (with equally bigger risk) at a $318, or 78.86% lower aggregate share price than those of the Dow.

A monthly summary will soon compare results in yield and price for all eight sectors reported in this series: basic materials, consumer goods, financial, healthcare, industrial goods, services, technology, and utilities.

Disclaimer: This article is for informational and educational purposes only and shall not be construed to constitute investment advice. Nothing contained herein shall constitute a solicitation, recommendation or endorsement to buy or sell any security. Prices and returns on equities in this article are listed without consideration of fees, commissions, taxes, penalties, or interest payable due to purchasing, holding, or selling same.