Do you prefer stocks that pay reliable dividend income? For ideas on how to start your own dividend stock search, we ran a screen.

We began by screening for stocks paying dividend yields above 2% and sustainable payout ratios below 50%. We then screened for stocks with strong liquidity, with current ratios above 3. The current ratio is current assets/current liabilities, so ratios above 3 indicate the company has at least 3 times the liquid assets to cover their short-term liabilities.

Then to analyze these companies' profitability, we ran DuPont analysis on the names. DuPont analyzes profitability by breaking up return on equity (net income/equity) into three components:

ROE

= (Net Profit/Equity)

= (Net profit/Sales)*(Sales/Assets)*(Assets/Equity)

= (Net Profit margin)*(Asset turnover)*(Leverage ratio)

Because increases in net margin and asset turnover are considered good things, DuPont focuses on companies with these positive characteristics: Increasing ROE along with,

•Decreasing leverage, (i.e. decreasing Asset/Equity ratio)

•Improving asset use efficiency (i.e. increasing Sales/Assets ratio) and improving net profit margin (i.e. increasing Net Income/Sales ratio)

Those companies that pass DuPont are seeing positive trends in the sources of their increasing profitability, which adds further weight to the idea that the names are profitable.

Do you think these stocks pay reliable dividends? Use this list as a starting point for your own analysis.

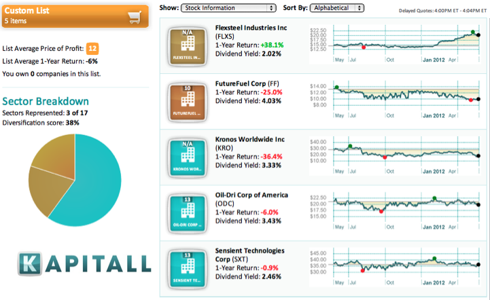

List sorted by dividend yield.

1. FutureFuel Corp. (FF): Engages in the manufacture and sale of specialty chemicals and bio-based products primarily in the United States. Market cap at $409.89M, most recent closing price at $9.92. Dividend yield at 4.03%, payout ratio at 42.12%. Current ratio at 6.28. MRQ net profit margin at 8.29% vs. 4.92% y/y. MRQ sales/assets at 0.218 vs. 0.162 y/y. MRQ assets/equity at 1.343 vs. 1.352 y/y.

2. Oil-Dri Corp. of America (ODC): Engages in the development, manufacture, and marketing of sorbent products in the United States and internationally. Market cap at $142.16M, most recent closing price at $19.80. Dividend yield at 3.43%, payout ratio at 33.76%. Current ratio at 3.58. MRQ net profit margin at 5.38% vs. 3.11% y/y. MRQ sales/assets at 0.346 vs. 0.332 y/y. MRQ assets/equity at 1.782 vs. 1.873 y/y.

3. Kronos Worldwide Inc. (KRO): Engages in the production and marketing of titanium dioxide pigments in North America and Europe. Market cap at $2.09B, most recent closing price at $18.0. Dividend yield at 3.33%, payout ratio at 17.51%. Current ratio at 3.43. MRQ net profit margin at 24.39% vs. 14.34% y/y. MRQ sales/assets at 0.272 vs. 0.236 y/y. MRQ assets/equity at 1.955 vs. 2.323 y/y.

4. Sensient Technologies Corporation (SXT): Manufactures and markets colors, flavors, and fragrances worldwide. Market cap at $1.78B, most recent closing price at $35.74. Dividend yield at 2.46%, payout ratio at 34.18%. Current ratio at 3.69. MRQ net profit margin at 7.91% vs. 7.55% y/y. MRQ sales/assets at 0.215 vs. 0.213 y/y. MRQ assets/equity at 1.576 vs. 1.589 y/y.

5. Flexsteel Industries Inc. (FLXS): Manufactures, imports, and markets residential and commercial upholstered and wooden furniture products in the United States. Market cap at $134.71M, most recent closing price at $19.81. Dividend yield at 2.02%, payout ratio at 20.86%. Current ratio at 4.37. MRQ net profit margin at 3.65% vs. 2.89% y/y. MRQ sales/assets at 0.522 vs. 0.519 y/y. MRQ assets/equity at 1.288 vs. 1.318 y/y.

*Accounting data sourced from Google Finance, all other data sourced from Finviz.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.