By Dee Gill

Forecasting being what it is, it's not extraordinary to hear one pundit effuse happy talk about the stock market's fantastic future while another predicts a collapse of all that investors hold dear. But it's much more enlightening when we get great examples of both extremes in one 24-hour news cycle, as we did last weekend. It shows us how everyone gets to feel righteous.

Seth Masters, chief investment officer at Bernstein Global Wealth Management, spoke out for the optimists in a huge way on Saturday by forecasting a Dow at 20,000 within five years. That's a more than 50% gain, which really goes beyond the dare-to-dream hopes of even the most optimistic investors.

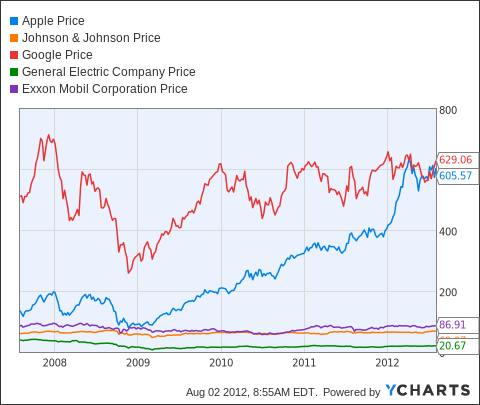

Dow Jones Industrial Average data by YCharts

A 50% rise would, by extension, give us Apple (AAPL) at $800, Johnson & Johnson (JNJ) at $100, Google (GOOG) at $910, General Electric (GE) at $30 and Exxon (XOM) at $127, as seen in this stock chart.

Fox News quickly rebutted with Peter Morici, an economist at the University of Maryland who is not likely to cheer up a party with his predictions. His piece on FoxNews.com was entitled "The coming economic collapse."

Of course, both men related perfectly reasonable data sets to back their contrary assumptions. Masters points out that getting to Dow 20,000 - or S&P 500 2,000 - wouldn't require company earnings to perform any better than they have typically in the past. Earnings growth, he contends, could be slightly below the 7% long-term average if share price valuations ticked up only slightly.

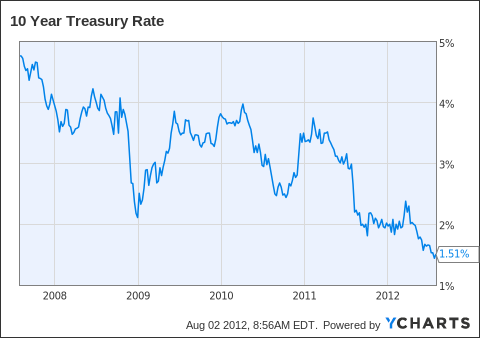

Masters views much of the world's problems today -- the Euro trouble, contracting economies and slower emerging markets, for example -- as temporary setbacks that have caused investors to oversell the market. Investors are acting like the world is about to end, as he put it, when really these problems will eventually be resolved. Meanwhile, he suggests that the poor value of bonds will turn more investors to stocks and help boost share prices.

10 Year Treasury Rate data by YCharts

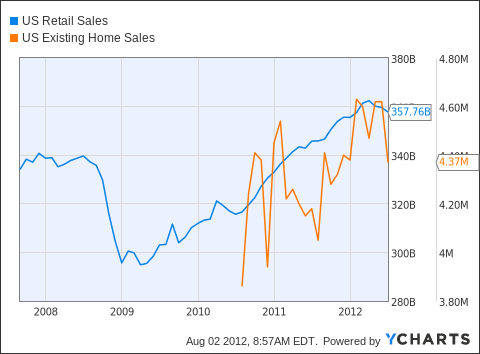

Morici's piece doesn't make a stock market forecast, but his description of the U.S. economy as "teetering on the brink of another recession" is a real thrill kill for investors. His piece offers a litany of every bit of bad news we've heard about the economy lately, including slow economic growth, slowing home sales, weakening manufacturing reports, and low consumer spending.

US Retail Sales data by YCharts

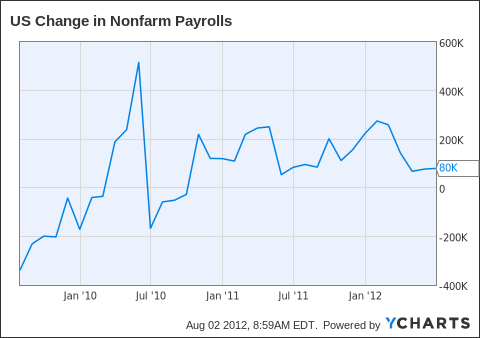

He also dismisses the idea that new industries like social media will ever create a lot of jobs, or that innovative technology, such as smartphone advancements, will ever create a lot of jobs anywhere but overseas. He points out that no one is creating a lot of jobs here at the moment.

US Change in Nonfarm Payrolls data by YCharts

So what's an ordinary investor to make of these expert opinions? Perhaps they're not as contrary as they appear. Many of the biggest companies have been producing record profits in what is a continually crummy U.S. economy.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.