Shares of Netflix, Inc. (NASDAQ:NFLX) have plummeted 74.21% over the past 12 months, amid increasing competition in the online video streaming field. At $54.96 per share, the stock is trading very close to its 52-week low of $54.33 achieved recently. In this article, I will illustrate some thoughts that helped my investment decision on Netflix.

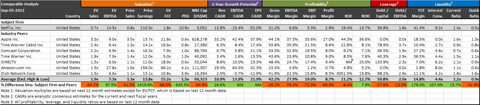

My value analysis discussed below includes a set of Netflix's comparable peers engaged in online video and content delivery businesses, and their average trading multiples are used to determine the stock valuation (see below).

After the significant plunge, some positive factors have emerged that are likely to support the stock price:

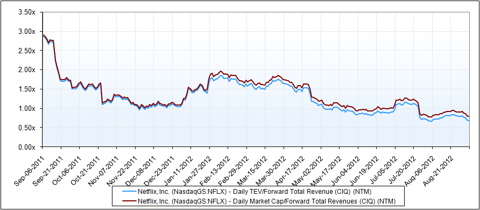

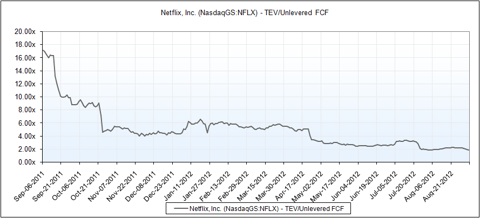

1. The stock's EV/sales, P/S, and EV/FCF multiples have dropped substantially over the past 12 months (see charts below). Compared with the peer averages, those multiples are also significantly lower. At the current share price, EV/Sales, P/S, and EV/FCF are 0.7x, 0.8x, and 1.8x, respectively, much lower than the peer averages of 1.9x, 1.3x, and 15.2x (see table above).

2. Netflix has a robust cash flow generating capability with an LTM FCF margin of 41.4%, substantially higher than the peer average of only 14.8% (see table above). This has helped the company accumulate a large cash pile. Per the latest released balance sheet, the company is sitting on a net cash position of $413M, representing 13.5% of the current market capitalization.

3. The company's size (an enterprise value of approximately $2.6B), cash position, and its cash flow generating ability make it an attractive takeover target. Although Netflix' business has become less favorable, acquirers can still enjoy some financial flexibility to implement the turnover initiatives. Taking over Netflix may also enable a strategic acquirer to quickly establish a solid market share in the online video streaming business.

However, the negativity surrounding the stock appears to outweigh the positives:

1. Although Netflix's revenues are estimated to grow at a 2-year CAGR of 13.8% over the current and next fiscal years, the firm's EBITDA and EPS are predicted to drop by 2-year CAGRs of 15.4% and 52.0% over the same period. Accounting for the earnings estimate, the stock trades at a whopping 10.9x PEG, ridiculously higher than the peer average of only 1.5x, reflecting an overvaluation relative to the projected earnings growth (see table above).

2. Asides from the lackluster growth prospects, Netflix has a low profitability. All of the firm's margin measures are significantly below the peer averages. But the ROE and ROIC metrics are somewhat comparable to the averages (see table above). I expect NFLX' profitability to remain low or even deteriorate primarily because the company appears to have a strategy to chase revenue growth by temporarily sacrificing profits, as it has been spending heavily in acquiring video contents. As the competition landscape in the industry becomes fiercer, it would be more difficult to implement strategies to boost profits.

Nonetheless, the stock is trading at 14.5x the NTM EBITDA and 210.5x the NTM EPS, which are at a unsustainable level if compared to its peers average of 7.3x and 13.8x, respectively (see table above).

Bottom line, it would be prudent to consider Netflix's high EBITDA and earnings multiples before acquiring the shares based solely on some acquisition rumors or the stock's low sales and FCF multiples. I am of a view that the stock price will continue to be volatile, and as such I recommend avoiding the shares, especially for conservative investors.

Comparable analysis table is created by author, valuation multiple charts are sourced from Capital IQ, and all financial data is sourced from Morningstar and Capital IQ.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.