Billionaire Mario Gabelli is the founder, chairman, and CEO of Gabelli Asset Management Company Investors (GAMCO Investors), which he established in 1976. Today, this public company has $30 billion in assets under management.

Gabelli is known as a major proponent of the value investors' Graham-Dodd school of security analysis. He applies a research-based investment analysis that attempts to identify investment opportunities in cases when stock prices do not reflect the companies' intrinsic values. His proprietary Private Market Value (PMV) with a catalyst methodology is a valuation metric that focuses on the company's cash flows rather than on accounting profits. PMV, which is used in leveraged buyouts, looks for a price that a potential buyer would be willing to pay for a company, including any synergies and premium for control.

In search of attractive value-oriented dividend plays, we took a closer look at Gabelli Funds, LLC, an advisory subsidiary of GAMCO Investors and mutual funds and closed-end funds company. Here is an overview of the Gabelli Funds' top five dividend-paying picks.

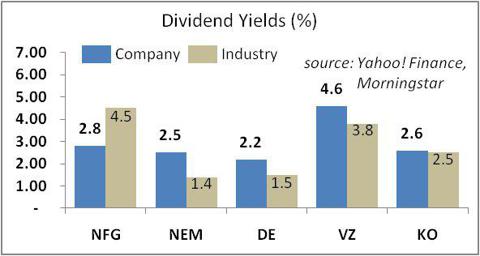

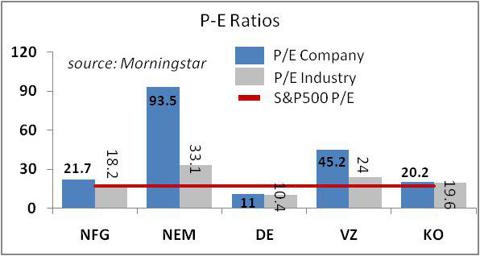

National Fuel Gas Co. (NFG) is the second-largest holding in Gabelli Funds, worth almost $175 million. National Fuel Gas is a $4.5-billion diversified energy company performing natural gas and oil exploration and production services as well as operating a gas utility, with natural gas transportation, storage, distribution, and sales. The company pays a dividend yield of 2.8% on a payout ratio of 58%. Its competitors Anadarko Petroleum Corporation (APC) and Consolidated Edison (ED) pay dividend yields of 0.5% and 4.1%, respectively. Peers like Energen (EGN) and AGL Resources (GAS) pay dividend yields of 1.0% and 4.5%, respectively. Over the past five years, NFG's EPS and dividends grew at average annual rates of 7.6% and 3.4%, respectively. Its EPS growth is forecast to average about 2% per year for the next five years. The stock has a ROE of about 11% and return on invested capital [ROIC] of 6.6%. On a forward P/E basis, the stock is trading below the gas distribution industry but above the utilities sector. George Soros acquired a small stake in the company in the second quarter.

Newmont Mining Inc. (NEM) is the third-largest position in Gabelli Funds, valued at a little more than $159 million. This $28-billion gold and copper miner pays a dividend yield of 2.5% on a payout ratio of 3 times its trailing earnings and 89% of last year's free cash flow. Its peers Barrick Gold Corporation (ABX) and AngloGold Ashanti Ltd. (AU) pay dividend yields of 1.9% and 1.2%, respectively. Over the past five years, the company's EPS contracted at an average annual rate of about 4% per year, while its dividends increased at an average annual rate of 28.5%. Analysts forecast a spectacular rebound in the company's EPS growth, which is expected to average 52% per year for the next five years. If this prognosis materializes, the company is likely to continue boosting its dividends at a high rate. The stock has a low ROE of 5.8% and ROIC of 3.7%. On a forward P/E basis, the stock is trading at a discount to the gold mining industry. Among fund managers, value investor Jean-Marie Eveillard (First Eagle Investment Management-check out its top positions) holds nearly $300 million in the stock.

Deere & Co. (DE) is the fourth-largest position in Gabelli Funds, worth close to $139 million. This $32-billion company, and the world's largest farm and forestry equipment manufacturer by revenue, is paying a dividend yield of 2.2% on a payout ratio of only 25%. Competitors AGCO (AGCO) and CNH Global (CNH) do not pay dividends, while Caterpillar (CAT) and Kubota (KUB) pay yields of 2.2% and 1.5%, respectively. Over the past five years, Deere & Co.'s EPS grew at an average rate of 16.6% per year, while dividends increased at an average annual rate of 15.3%. Analysts expect that the company's EPS growth will average about 10% per year for the next five years. The company's international growth is driving the top- and bottom-line growth. In the near term, the outlook is clouded by the general global economic weakness, while the company's future prospects remain positive. On a forward P/E basis, the company's shares are undervalued relative to its respective industry. Fund manager Donald Chiboucis (Columbus Circle Investors-check out its largest holdings) owns almost $146 million in the company's stock.

Verizon Communications Inc. (VZ) is the seventh-biggest holding of Gabelli Funds, worth almost $126 million. This telecommunications giant has a market cap of $130 billion and pays a dividend yield of 4.6% on a payout ratio of 203% of trailing earnings and 43% of last year's free cash flow. The company's archrival AT&T (T) has a dividend yield of 4.7%, while competitor Spring Nextel (S) does not pay any dividends. Over the past half decade, Verizon saw its EPS contract at an average rate of nearly 15% per year, while its dividends increased at an average rate of 4.3% per year. Analysts forecast that the company's EPS growth will average 9.2% per year for the next five years. Given that the company's free cash flow is expected to improve due to lower capital expenditures in the coming year, a higher-than-average dividend hike could be in the cards. The stock has a high free cash flow yield of 8.9%, a ROE of 7.5%, and ROIC of 3.4%. On a forward P/E basis, the stock is trading at a slight premium to its respective industry and the telecommunications sector. The stock is popular with fund managers Phil Gross (Adage Capital), Peter Rathjens (Arrowstreet Capital), and billionaire Cliff Asness.

The Coca-Cola Company (KO) is the eight-largest position in Gabelli Funds, valued at $119 million. The beverages giant, with a market cap of $171 billion, pays a dividend yield of 2.6% on a payout ratio of 54%. Its competitors PepsiCo (PEP) and Dr Pepper Snapple Group (DPS) pay higher dividend yields of 3.0% and 3.1%, respectively. Over the past five years, Coca-Cola Company's EPS and dividends grew at average rates of 11.3% and 8.5% per year, respectively. Analysts forecast that the company's EPS will grow at an average rate of 7.5% per year for the next five years. The stock has a free cash flow yield of 2.1%, a ROE of 26%, and ROIC of 18%. In terms of valuation, on a forward P/E basis, the stock is trading on par with its respective industry. Legendary investor Warren Buffett and fund managers Boykin Curry (Eagle Capital Management) and Ken Fisher are major investors in the stock.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.