Dividend growth investing is lots of fun, especially if you have a systematic process to determine which dividends are safe and which ones aren't. That is why we created a forward-looking assessment of dividend safety through our innovative, predictive dividend-cut indicator, the Valuentum Dividend Cushion™ for the financial advisor. In this article, we will evaluate the investment merits of International Paper (NYSE:IP), as well as its dividend under this framework.

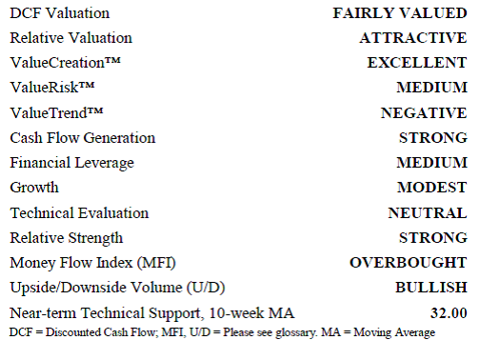

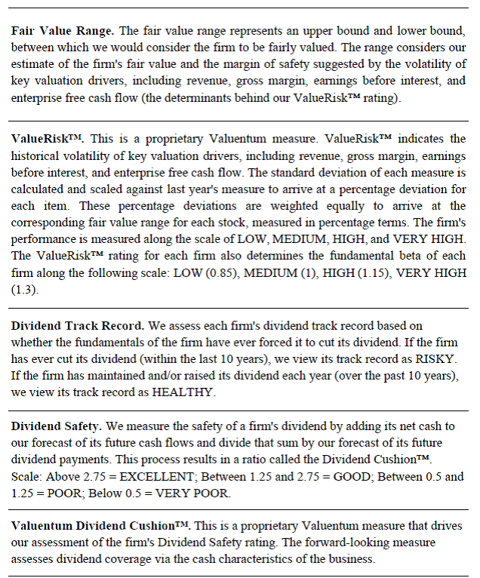

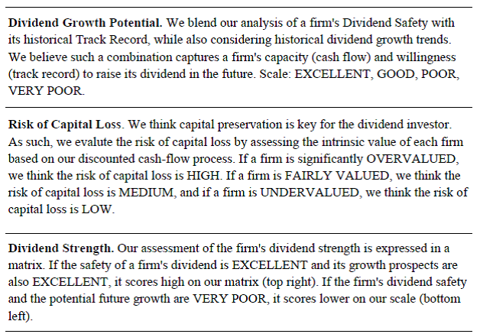

Investment Considerations

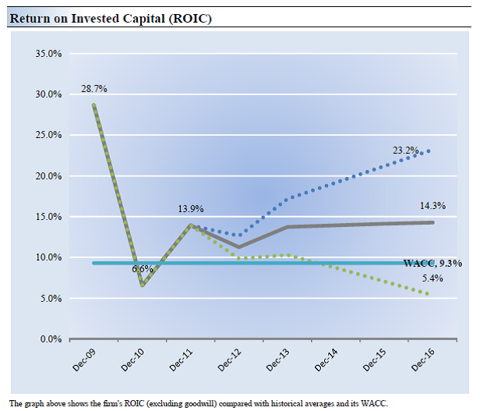

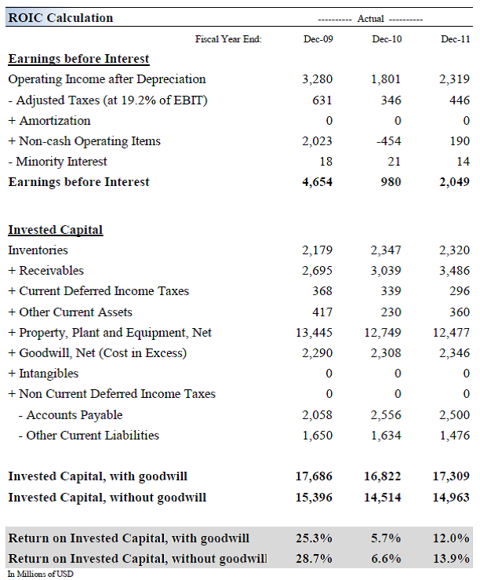

Return on Invested Capital

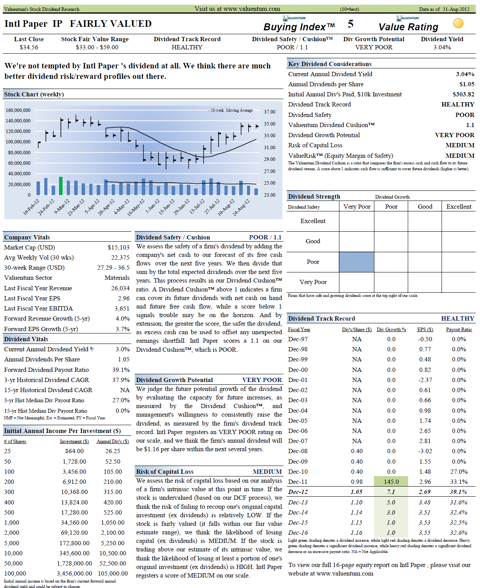

International Paper's Dividend

International Paper's dividend yield is above average, offering just above a 3% annual payout at recent price levels. We prefer yields above 3%, and don't include firms with yields below 2% in our dividend growth portfolio. To read how we calculate the intrinsic value of International Paper and other equities in our coverage universe, please click here.

Despite this above-average yield, we think the safety of International Paper's dividend is poor (please see our definitions at the bottom of this article). We measure the safety of the dividend in a unique but very straightforward fashion. As many know, earnings can fluctuate in any given year, so using the payout ratio in any given year has some limitations. Plus, companies can often encounter unforeseen charges (read hiccups in operations), which makes earnings an even less-than-predictable measure of the safety of the dividend in any given year. We know that companies won't cut the dividend just because earnings have declined or they had a restructuring charge that put them in the red for the quarter (year). As such, we think that assessing the cash flows of a business allows us to determine whether it has the capacity to continue paying these cash outlays well into the future.

That has led us to develop the forward-looking Valuentum Dividend Cushion™. The measure is a ratio that sums the existing cash a company has on hand plus its expected future free cash flows over the next five years and divides that sum by future expected dividends over the same time period. Basically, if the score is above 1, the company has the capacity to pay out its expected future dividends. As income investors, however, we'd like to see a score much larger than 1 for a couple reasons: 1) the higher the ratio, the more "cushion" the company has against unexpected earnings shortfalls, and 2) the higher the ratio, the greater capacity a dividend-payer has in boosting the dividend in the future.

For International Paper, this score is 1.1 , revealing that on its current path the firm can cover its future dividends with net cash on hand and future free cash flow. However, it doesn't have much room for operating error, which is why we assign the poor rating to its dividend safety. The beauty of the Dividend Cushion is that it can be compared apples-to-apples across companies. For example, Wal-Mart (WMT) scores a 1.4 on this measure. Also, for firms that have a score below 1 or that have a negative score, the risk of a dividend cut in the future is certainly elevated. In fact, the Valuentum Dividend Cushion caught all dividend cuts in our non-financial coverage universe, except for one, which subsequently raised its dividend above pre-cut levels (meaning it shouldn't have cut it in the first place). The Dividend Cushion also caught the recent cuts by J.C. Penney (JCP) and SuperValu (SVU). Please check this article out here to read how we warned advisors in advance of SuperValu's dividend cut. We use our dividend cushion as a key decision component in choosing companies for addition to the portfolio of our Dividend Growth Newsletter (please see our links on the left sidebar for more information).

Now on to the potential growth of International Paper's dividend. As we mentioned above, we think the larger the "cushion" the larger capacity it has to raise the dividend. However, such dividend growth analysis is not complete until after considering management's willingness to increase the dividend. As such, we evaluate the company's historical dividend track record. If there have been no dividend cuts in 10 years, the company has a nice growth rate, and a nice dividend cushion, its future potential dividend growth would be excellent, which is not the case for International Paper. We rate the firm's future potential dividend growth as Very Poor. We think the company will be able to up its dividend during the next couple years, but the long-term trajectory is certainly of question. The firm has little room for operating error, when comparing its balance sheet and future free cash flow generation with dividends paid.

And because capital preservation is also an important consideration, we assess the risk associated with the potential for capital loss (offering investors a complete picture). In International Paper's case we think the shares are fairly valued, so the risk of capital loss medium. If we thought the shares were undervalued, the risk of capital loss would be low. All things considered, we think there are better dividend profiles than International Paper. Still, the firm is worth keeping on your watch list should its score on the Valuentum Dividend Cushion increase.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.