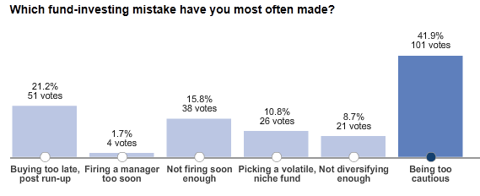

Investors are interesting creatures. Studies of fund flows show that investors tend to buy near peaks and to sell near low points. This year investors have been piling into bond funds. Yet when the Wall Street Journal ran an online poll to ask investors what their biggest investing mistake had been, it was this: too much caution. And it wasn’t even close — excessive caution won out by a large margin. (Of course, buying near the peak had a decent second-place showing.) Here’s the accompanying graphic:

Source: Wall Street Journal (click on image to enlarge)

I find it fascinating that investors in aggregate report that caution has been their biggest mistake, all the while piling into bond funds over the past few years as the equity market had spectacular returns!

Investing for comfort is generally a poor idea. Markets are inherently uncomfortable — if you’re comfortable, in other words, you’re probably not doing it right.

Being too cautious is an insidious problem. Individual investors can end up with sub-par returns if they don’t expose their portfolio to growth assets. Growth assets tend not to be very comfortable. While volatility levels can be reduced somewhat by good diversification, it’s still the uncomfortable assets that will generate much of your return over time. When you put together an asset allocation, it should have as much exposure to growth as possible, given the constraints of the individual client.

Why, then, is caution so prized? I suspect it is because people wish to have positive self-regard and because mistakes reduce that self-regard for many people. They err on the side of caution because they are trying to avoid mistakes. While this may be psychologically wonderful, it is counterproductive in financial markets. In fact, research shows that you are actually more likely to make a mistake through excessive caution than from being overly aggressive. Investors, judging from the poll results, seem to understand this in retrospect — although maybe not prospectively.

If you invest, you are going to make mistakes. There is no way to sugarcoat it. Not everything is going to work out. We think the best way to avoid excessive caution is to adopt a systematic investment process. If you have a systematic way to determine what to buy, when to buy it, and when to sell it, you may be less likely to pull your punches.