Okay, I recognize that this is somewhat unnerving, especially for us. But it is important to point out that as of Sunday night,our ratings officially branded the entire stock market at undervalued. Not specific sectors, not specific industries, not specific stocks… ALL STOCKS.

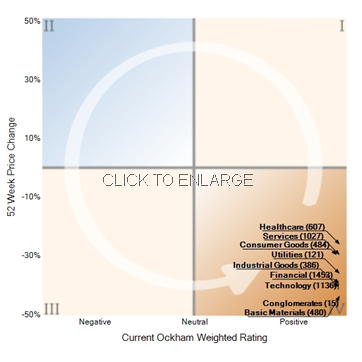

Surely we must be joking, right? Well, not really (and don’t call us Shirley). The reality of the math is that when reviewing all securities verse normal stock price movement and historical cash, sales, and dividend levels, we had reached a point that is almost unimaginable for many stocks. Friday’s trading last week was the straw that broke our back, and put us over the mathematical edge. We have not a single security (of more than 5,500) that is rated as fairly valued or overvalued.

So, Ockham, what does that mean? Well, we are basically screaming at the top or our lungs that investors should be buying stocks now. Given today’s price action (DJIA up 936.42) we may appear to be stating the obvious, but I quickly want to point out why our ratings are, in fact, so optimistic.

I also want to be very clear, we are not calling a bottom in any way. In addition to being a foolish act that only CNBC commentators should attempt, we do believe that continued macro-economic pressure will force specific sectors, industries, and stocks lower. However, a prudent investor is now choosing particular companies and industries which are likely to outperform significantly over the intermediate to longer term. We do not envision a depression for the US Market. So now is the time to start nibbling, nibbling, nibbling.

What is vital to also point out at this time is that not all under-valued securities are created equally. At Ockham, we recognize that logic and math may drive much of the market’s action on a regular basis. But in times like these, every investor must heed the warning signs that irrational behavior is in control. That is what can keep you from making bad decisions worse (i.e. selling at the bottom.)

When we review the stocks in our universe of coverage, some are rated as undervalued because of their own particular situation, and some are rated undervalued because their sector or industry as a whole has become oversold. It is important to understand the difference, and as such, we ask you to always review our explanations on each company. Don’t just look at the ratings and headlines, take the time to read more of our analysis to understand where cash levels, sales levels, and dividend rates are compared to normal levels.

So while we are saying the stock market hasn’t looked this attractive, in… well… ever (kidding), we are saying that you still must do your homework and understand why every stock you select is in your portfolio. Remember, this is just like chess, and in chess you don’t move until you know why you are choosing to make that move.