Last week, we found out that Apple (AAPL) made a $1 billion investment in Chinese ride hailing firm Didi Chuxing. Apple CEO Tim Cook talked about how the investment allows the technology giant to learn more about the Chinese consumer. That makes sense given the importance of the China segment to Apple's business, and how services like Apple Pay could benefit going forward. While many have talked about this deal in isolation, I think investors should see it as the start of a much greater opportunity for Apple.

Didi dominates the Chinese market, so you might expect that Apple could always cash out of this investment for a nice gain down the road. Apple gets to broaden its appeal in China, which hopefully will mean more than just the potential gain on equity. Given how strong Apple's margins are, every dollar of revenues the company gets down the road will flow fairly well to the bottom line.

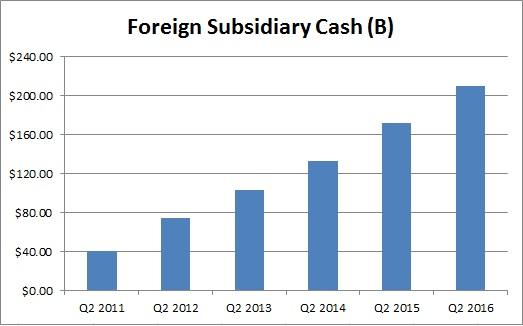

As Apple detailed in its most recent 10-Q filing, its cash and investments balance only averaged 1.74% of interest in the latest quarter. The company had almost $209 billion in the cash pile located outside the US, seen below, and Apple has been unwilling to repatriate those funds home and face a huge tax bill. This deal is less than one half of one percent of the cash pile. With so much overseas money earning basically nothing in interest, one billion seems like a rounding error, so this appears to be a very good use of capital.

(Source: Apple quarterly filings page)

Many articles on the Didi deal out there will talk about the deal in isolation, and I think that's perfectly fine. However, if you are looking at Apple overall, I think this is just the start. Tim Cook mentioned on the latest conference call that management is willing to be more aggressive on the M&A front, and potentially at larger deals than we've seen in the past.

It's not just about buying companies that can instantly increase Apple's top or bottom line. Strategic deals like this can pay off too, even if you can't necessarily trace the results into the financial statements completely. It would not surprise me to see more deals like this in the next couple of months, as management continues to use that large international cash pile. Apple could probably do 25 or so of these billion dollar deals by the end of 2016 and still have over $200 billion in foreign cash. I doubt we'll see that much activity, but the company certainly has the financial flexibility to do so and more.

Apple's deal to buy a stake in Didi should help the company expand its presence in China, and hopefully it will benefit the fast growing service business. This is an important market for Apple, and could soon be the company's largest geographical revenue segment. Also, I think this deal is just the start for Tim Cook and Co., who are looking to put the ever growing cash pile to work. With cash earning less than 2% interest, why not try more strategic deals like this?