It appears to this commentator that the price of gold has started a short term move up as part of a multi-year move to the upside.

Here are a few ways to look the current situation:

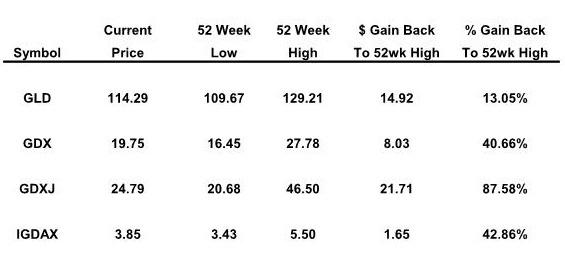

The potential gains afforded merely by moves back to the 52 week highs by these investments are impressive and offer quite a wide range of possible, perhaps likely, returns.

There is a pretty fierce debate regarding the value of GLD in the event of another severe recession. GLD is referred to as "paper gold" by some SA commentators.

GDX & GDXJ are ETFs invested in gold miners and junior gold miners, respectively. They offer investors a way of investing in the actual metal without buying, storing & securing bars or coins.

IGDAX is an Invesco fund primarily invested in gold miners. It has a four star rating with Morningstar and ostensibly offers the benefit of a competent management team.

I presently own IGDAX in a 401(k). If those funds were free to be invested anywhere, I would have to give GDXJ serious consideration.