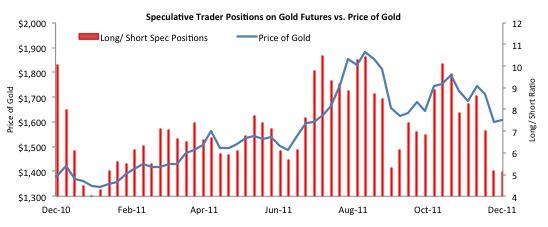

Some of the price decline in gold this year was due to heavy selling by speculative traders in the futures market. The Commodity Futures Trading Commission provides weekly data on the number of contracts outstanding on gold futures. By dividing long contracts by short contracts, we get the long/short ratio.

As the graph below shows, speculative traders became much less bullish on gold in the latest four weeks. Their net long position on gold futures fell to 5.1-to-1 on December 27 from 8.6-to-1 on December 6. This position is in the top 35% of all recorded positions, but it’s in the bottom 10% of positions since September 2008, when gold began its steep ascent.

To counteract the biases of outliers when using the mean, or arithmetic average, analysts often use the median. The median is the value at the exact middle point of a data set. So if we have 1,000 observations, the median is the value of the five hundredth observation when all observations are ranked from lowest to highest. In the case of gold, the median long/short speculative ratio before September of 2008 was 2.5-to-1, while the median ratio after September 2008 is a whopping 8.5-to-1. The median ratio of all recorded positions is 3.3-to-1.

I want to stress that I’m focusing on just one factor that affects the price of gold in the futures market. In finance as in life, many factors determine the price of things. Moreover, it’s not just multiple factors that affect the price of things but the interaction of those factors.

We also have to be mindful that correlation does not equal causation. When using correlation analysis to explain price movements, it’s important to note that an independent variable can cause a dependent variable to move in a certain direction or vice versa. And another variable not even included in our analysis could be affecting the price.

For more information about the world of finance and investments, please take a look at our other posts on the TrimTabs Money Blog. And stay tuned for future episodes, when we’ll dive deeper into commodity prices.

Leon Mirochnik, CFA

Research Analyst

TrimTabs Investment Research