Elevator Pitch

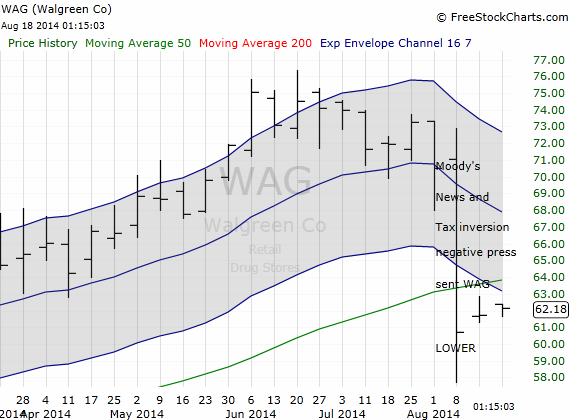

Walgreen's ticker WAG was sent lower earlier this month because of negative press from Moody's as well as a tax inversion decision also viewed as negative.

Thesis & Catalyst For Walgreen Co. (WAG)

Earlier this month WAG had some negative press with Moody's looking to downgrade WAG's debt. seekingalpha.com/news/1907165-moodys-cau... The stock plunged over 15% putting it on sale. Adding to WAG's woes was the negative press that it received when it fully acquired the remaining 55% stake in alliance boots. WAG was hit when it opted not to do a European tax inversion.

On one hand companies that have been doing tax inversion have been receiving negative press as high as from the president himself and yet when WAG decided not to do a tax inversion after acquiring the remaining stake in a foreign company shareholders were quick to punish the company.

Long term WAG is a winner. With the 76+ million baby boomers www.prb.org/Publications/Articles/2002/J... getting older drug stores like WAG are going to be the place to hang out now and in the years to come.

Valuation

Financial and technical keys: Financial VIA Charles Schwab and Charts Via freestockcharts.com

PE 21.02

FPE 18.68

PEG 1.43**

P/S 0.78**

ROE 14**

Dividend % 2.04

Payout Ratio 31.97

Current Ratio 1.42

Debt To Equity %17.50

The PE and FPE are on the high side, but are more than compensated for by all of WAG's other great fundamental data. A PEG of 1.43 with a ROE of 14?! AND you get paid a 2.04% dividend with a low payout ratio? Sounds like a screaming buy to me.

On the technical side:

You can clearly see the large drop in WAG presenting a wonderful buying opportunity.