Authentidate Holding Corp. (ADAT) announced a non-binding letter of intent for the acquisition of all of the outstanding membership interests of AEON Clinical Laboratories, a profitable testing facility that provides health care practitioners with medical toxicology, pharmacogenomics, cancer genetic testing, and molecular biology tests. The deal was well-received by the market as the stock price rose 140% on 6 million shares traded on August 25. The positive reaction is merited as it helps an unprofitable company running out of cash like ADAT rise from the ashes but I believe this deal should value ADAT at a minimum of $1 based on the new-found profitability and synergies between the two combined companies. AEON is prompted to accept this merger as it allows for an immediate public listing and it has growth targets, where if met, allows it to take over the majority of the company it what turns out to be a reverse takeover.

The details of the proposed merger filed with the SEC are as follows:

The Letter of Intent contemplates the AEON members will be issued such number of Series E Shares as shall be convertible into 19.9% of the outstanding shares of the Company's Common Stock on the date of the closing of the merger transaction, and an additional 5% of the outstanding shares of the Company's Common Stock upon approval of the merger transaction by the shareholders of the Company. Additional Series E Shares will be issued to AEON members in 2016 and 2020 if AEON achieves certain financial results. The additional 2016 Series E Shares will be convertible into 24% of the outstanding shares of the Company's Common Stock on the date of the closing and will be issued to the AEON members provided AEON achieves $16 million of EBITDA in calendar year 2015. The AEON members will be issued another tranche of Series E Shares in 2020 which, including the previously issued Series E Shares, will be convertible into 85% of the outstanding shares of the Company's Common Stock (on a partially diluted basis) provided AEON achieves $65.9 million in EBITDA, in the aggregate, in calendar years 2017 and 2018, or $99 million in EBITDA, in the aggregate, for calendar years 2016, 2017 and 2018. The Letter of Intent also provides for the issuance of Series E Shares as bonus shares for the achievement of $117 million in net income for the four fiscal years ending December 31, 2019, convertible into 5% of the outstanding shares of the Company's Common Stock (on a partially diluted basis). The holders of the Series E Shares will have certain preferential rights, including the right to vote separately as a class to nominate and elect one director for each 10% of the outstanding shares of Authentidate's Common Stock into which the outstanding Series E Shares shall be convertible.

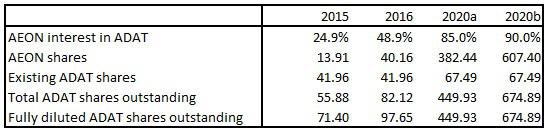

Upon closure of the deal, AEON members will own 24.9% of outstanding shares. Assuming the 2016 EBITDA target of $16 million is met (which looks like a strong possibility based on 2014 financials), AEON will own 48.9% of the outstanding shares of the company. Should further EBITDA and net income targets be met, AEON members would own 85% or 90% of the merged company on a partially diluted basis. Based on this information I have developed a chart of the share float outstanding at various time periods throughout the length of this deal:

2015 and 2016 are fairly straightforward calculations. ADAT currently has 41.96 shares outstanding. To achieve the interest in the merged company as outlined in the proposal, AEON would receive 13.9 million shares in 2015 and an additional 26.3 million in 2016 for a total of 40.2 million shares. The total amount of shares outstanding would be 82.1 million.

ADAT has Class D Preferred Shares outstanding which can convert to 6.1 million common shares. The company also has 26.2 million warrants outstanding, with 9.4 million of those being exercisable at less than a dollar per share. The result is that the fully diluted share count would be 97.7 million in 2016 assuming a $1 stock price, all in-the-money warrants are exercised and the preferred shares are converted. With the new working capital available to it, ADAT now has the ability to redeem rather than convert preferred shares.

The term "partially diluted basis" is a bit ambiguous to me, but I assume that means the percentages are calculated after the conversion of the preferred shares and any in-the-money warrants. In addition to that I have added a 10 million buffer to the share count by 2020 to account for stock options or any additional warrants exercised. The end result is a 67.5 million float exclusive of pre-existing shares submitted to AEON. If AEON was to achieve all of the profit targets set for it, it would own 90% of the company or 607.4 million shares. The total amount of shares outstanding would be 675 million.

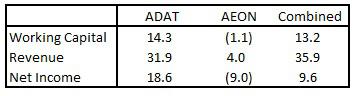

While all of this sounds like a dilutive mess, the huge upside in this deal comes from the current profitability of AEON along with the synergies that can take place between the two companies. Within the news release it is stated that AEON achieved the following results for calendar year 2014:

- $31.9 million in revenue

- $18.6 million in net income

- $14.3 million in working capital

The news release warned that these results have not been audited and may differ materially once that audit occurs. Assuming that these numbers do not change materially once audited, the following is an estimate of what the combined company's financial results for 2015 may look like if the financial performance of AEON is the same as last year's and the existing ADAT business continues along at a ~$1 million per quarter revenue run rate and a little over $2 million per quarter burn rate.

The combined company has about $36 million in annual revenue and $10 million in net income with a vastly improved working capital of $13 million to fund further growth or shore up the balance sheet through preferred share or debt redemption. Assuming a fully diluted share balance of 98 million by the end of 2016, the market cap of $34 million based on a stock price of $0.35 appears to be quite cheap. That would lead to a price to earnings ratio of just 3.5 and a price to sales ratio of less than 1. Even at a $1 stock price, the newly formed ADAT would look rather cheap with a P/E ratio of just 10 for a health care stock.

There are three issues which may be holding back the stock price from the value implied in this deal. First would be the approval of the shareholders of each company so that this non-binding proposal gets completed. Second would be providing audited or at least reported results in an upcoming set of financials that showed the combined balance sheet and income statement of the merged companies. Third would be the dilution that is set to occur upon achievement of the profit targets.

The first two issues can be settled within the next 6 months which should provide enough near-term upside in the stock price. The third issue is a mix of a silver lining and a black cloud over the heads of current ADAT investors. Current shareholders actually benefit the most if AEON continues to grow but fails to meet the targets laid out for it and thus the float stays around the 100 million mark instead of ballooning to over 600 million. On the flip side, AEON members would be extremely motivated to ensure that the profit numbers are met. Even with the threat of high dilution, ADAT shareholders can be happy with owning a shrinking piece of a much bigger and profitable pie. AEON interests would take an ever increasing role at the company which should be seen as a positive development considering the relative historical financial performance between the two companies.

The most difficult target to meet would be the one for the final 5% of the company which states that AEON must achieve $117 million in combined net income for the four years ended December 31, 2019. That averages out to $29.25 million in net income each year starting from 2016, a 57% increase on what the company earned in 2014. If AEON was to meet this goal, it would almost certainly come in the form of a steady increase every year from $18.6 million, so that 2019's net income target would need to surpass $30 million in order to increase the average.

I believe it's also fair to assume that by 2020 the legacy ADAT business will either be at least breakeven, completely absorbed in AEON's business or phased out if its not deemed to be profitable or a good source of growth. If ADAT as a whole is able to achieve $35 million in net income, the fundamentals would be able to support a $1 stock price even with 675 million shares outstanding. A $675 million market cap would lead to a 19 P/E.

I believe ADAT is an excellent choice for speculative investors to research for a possible investment to see if it fits within their risk tolerance and time horizon. While the stock has already more than doubled since the announcement, I believe that shareholder approval, combined financials and a greater understanding of the value proposition and market opportunity that these combined companies offer will drive up the stock price even further over the next several months.