Right or wrong, eBay's quarterly results are often used as a barometer for Amazon results. While Amazon is a more diversified company, both companies rely heavily on the business model of matching buyer and seller without actually buying inventory. Further, the collision course between eBay and Amazon has been well documented, especially as it relates to eBay's attempts to poach Amazon 3P sellers. Do these similarities actually show up in results?

Comparing Quarterly Growth

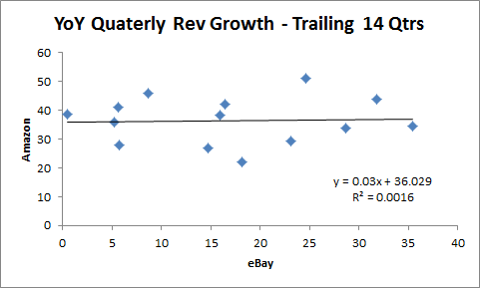

Looking back 14 quarters, there does not appear to be a strong correlation between the two companies. A "best fit" line is flat and the goodness of fit measure (R2) nonexistent. Back in the 2009/2010 period, eBay was sputtering along with negative to positive single digit growth while Amazon was humming along growth in the 20-40% range.

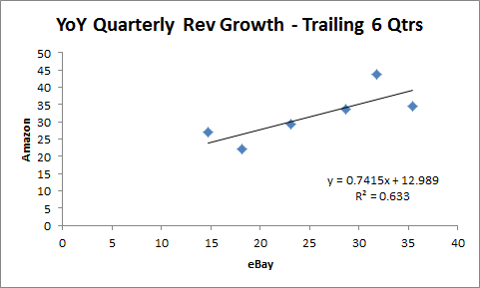

Comparing just the last six quarters looks a but different, however. Visually, there is a more defined positive correlation between quarterly revenue growth rates and the R2 measure rises to a more respectable level.

If one were to forecast Amazon's Q1 sales growth based on eBay's 14% growth reported last week, Amazon should report a reversal in its declining sales growth trend. This aligns with some analyst of the analyst sentiment that the growth decline will end.

The Nitty Gritty

If you regress Amazon's growth rate on eBay's, you get a line equation of: y = .74% * x + 13%. Evoking grade school math, a line equation is y = m*x + b

- m is the slope

- b is where the line crosses the vertical axis, or 'intercept'

- x in this case is the value of eBay's growth rate

- y then is the predicted value of Amazon's growth rate

An intercept of 13 in the above equation means Amazon's growth rate would be 13% if eBay's was 0%; the slope of .74% means that Amazon's growth rate increases by .74% for every 1.00% increase in eBay's growth rate. eBay reported a 14% growth rate, so that would add ~10 percentage points to Amazon's base growth rate of 13%... meaning that Amazon's reported growth rate should be ~23% next week if it can truly be predicted from eBay's growth rate. Amazon's growth rate last quarter was 22%.

Original equation:

Y = .74% * x + 13%

Equation with eBay's growth rate of 14% plugged in:

23% = .74% * 14% + 13%

The Caveats

Of course, there is a range of confidence with any prediction. The R2 number of .63 is the percentage of variability in Amazon's growth explained by eBay's growth, which is a loose testament to the notion that many things impact eBay and Amazon differently. In addition, the 95% confidence range of the slope coefficient is -.04% to +1.52%. In other words, the degree to which Amazon's growth rate moves with eBay's could vary between those two values at the 95% confidence level.

Conclusion

Amazon itself is probably less concerned than investors with seeing its revenue growth decline end. The company will seems to be satisfied as its able to kick off enough operating cash flow to fund its capex requirements.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.