Wal-Mart Stores, Inc. - Not Such Good Guys but Profitable - for Who?

Wal-Mart has been less than one of the leading the leading Dow 30 - Industrials composite Companies for a long time. It is on a Strong Hold but my Indicators are breaking down. It made new highs in early December and has pulled back since. I Forecasted a mini-rally in the near-term and believe that will be quite tale-tail as to its future direction. This is why I have HELD and why Patience is worth the effort. I see more down-side coming, followed by a rally that will likely convince me to Sell.

My previous articles on WMT (just click) will provide you with the exact history of my Forecasting accuracy and much more.

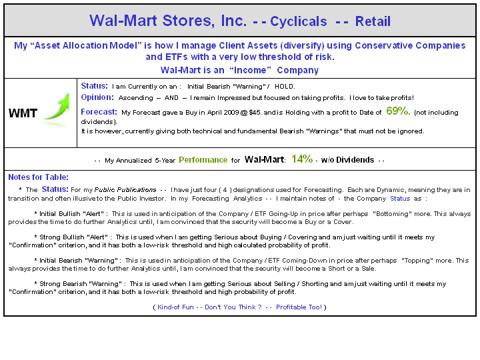

My Performance please view the below table for Income Allocation Model Portfolios. I believe it accurately shares the rather (less than) positive results of my Forecasting and hence Wal-Mart's growth - it is not a Company I often recommend. I hope you will understand my point.

My management objective is to identify changing trends for my Forecasting Analytics. Simple stated, I want to have current notes to quickly refer to on the anticipated direction of this Sector and Industry Group.

A Special Note for Seniors & Retired Investors - Dividend Yield for (WMT): 2.47%

I believe you folks deserve much better service and investment direction and guidance that either Wall Street or the Brokerage Community is / has been providing. Being a retired Asset Manager / Financial Analyst is a joy for me to assist you and meet your investment - needs, goals and objective. Peace of Mind for you is my mission.

Forecast w/ Performance:

Wal-Mart Stores, Inc. and other Retailing Sector Companies are tracking well. Although (WMT) has been in Up-Trend for since 2009 it is not always an excellent contributor to my Analytics. Forecasting provides an insight and often good lead time as to making investment decisions. Right now is one of those times to get serious about whether or not to sell or hold.

Forecast w/ Performance:

Note: The below Table is for your review, questions and perhaps thoughts. If you are seeking to "Invest Wisely" in my "Income - Asset Allocation Model" - - please Email me to open a dialog on how I go about providing super performance with a very low threshold of Risk.

My Current Forecast is that Wal-Mart is that it is Topping and not as brilliant as it was just a year ago! This has to do with the state of the General Market and that is also not as 'bright as you may think." Please study my 20 year chart offered below - - when the General Market is Bearish so is (WMT) !

If you own or are considering owning Big Retailing Companies, the securities have definitely become a mixed bag of both good and not so good. Wal-Mart is relatively strong both Fundamentally and Technically, however, I have placed it on my Initial Bearish Forecast - "Warning."

My Current Opinion is to HOLD in anticipation of taking profits. Taking profits can be effectively accomplished, just as Buying can by doing your Forecasting well. When there is a "Big Blow-to the downside" for the General Market Forecast (in the wind), as a very experienced financial advisor and asset manager, I will always seek a safe harbor and that for me is Cash. I hope you are of such a mind-set too.

Fundamentally - ( weighting - 40% ): My Analytics (weighting) for my Fundamental Valuation play a vital role in profitable managing money. At this time my Valuations of (WMT) are quite positive but that in and of itself does not mitigate caution.

Technically - ( weighting - 35%): Even with this not so fine Company, my Indicators are notably breaking down. It is only currently slightly off its November highs of $81. Nine months of moving basically sideways - that's not a good sign in a Market like what we have experienced!. It is now selling for $76. the next rally and it will tell a compelling story as to the future direction of the price of (WMT).

Consensus Opinion - ( weighting - - 25% ): My third pillar of Research is one that is ALWAYS distorted to the Positive by most all financial analysts. That's because they are afraid of being Bearish. I Am NOT! My articles on "Reality" are supportive of the below 20 year Chart.

I will personally and promptly reply to any serious investor's inquiry as to my very cautious position for (WMT) !

- - -

A Twenty Year Perspective of Wal-Mart Stores, Inc. (WMT)

It has NOT always been like you are being told by so many who do not take the time to "Investing Wisely" and doing their homework well. Wal-Mart Stores, Inc. (WMT) has taken some big hits over the years.

URL for (20-years of -(WMT): http://stockcharts.com/h-sc/ui?s=WMT&p=W&yr=20&mn=0&dy=0&id=p18736113138&a=312039540

Selectivity

Here are a number of the Component Companies / Peers in the Food / Discount Store Industry Group that I focus on rather frequently: (WMT), (SVU), (SWY), (TGT), (KR), (WFM), (CBD), (TJX), (DG), (COST), (ROST), (FDO), (DLTR), (SHLD), (BIG).

For a Daily Input and Deeper View of my Work / Analytics you might want to Click, and scroll down to my "Thumb-Nail" articles:

Personal Blog. I post every day. Just Click - - > http://investingwisely-rotation.blogspot.mx/?spref=tw

If I can be of help with guidance and direction for your Portfolio(s) just Email me. Serious Investors Only - Please!

senorstevedrmx@yahoo.com

Smile, Have Fun, "Investing Wisely,"

Dr. Steve

WMT, SVU, SWY, TGT, KR, WFM, CBD, TJX, DG, COST, RIST, FDO, DLTR, SHLD, BIG