Ford Motor Company - Back to Basics and Back to Holding Cash

Two Months Ago I Said: "Ford is among a number of Companies that are hanging in there with the Major Indices and greatly out-performing - them! My Fundamental - Valuations support this very well and is a vital component to enjoying consistent annual profits. However, this posting is beginning to tell me a more negative story. When a strong company has "flat" performance for several months, we should definitely take note."

That was "On the Button" and so is this: A rally is in progress and - IF - it is not very positive - - Cash - - is your next place to be.

Currently it had taken the hit I Forecast but a rally is in place that will - Tell-All.

My previously written articles on F (just click) provide you the history of my forecasting, its accuracy and support for my performance. For over 50 years my management objective is to identify changing trends for my forecasting analytics. I simple want to have current notes to quickly refer to on the anticipated direction of this company and its industry peers.

My previously written articles on F (just click) provide you the history of my forecasting, its accuracy and support for my performance. For over 50 years my management objective is to identify changing trends for my forecasting analytics. I simple want to have current notes to quickly refer to on the anticipated direction of this company and its industry peers.

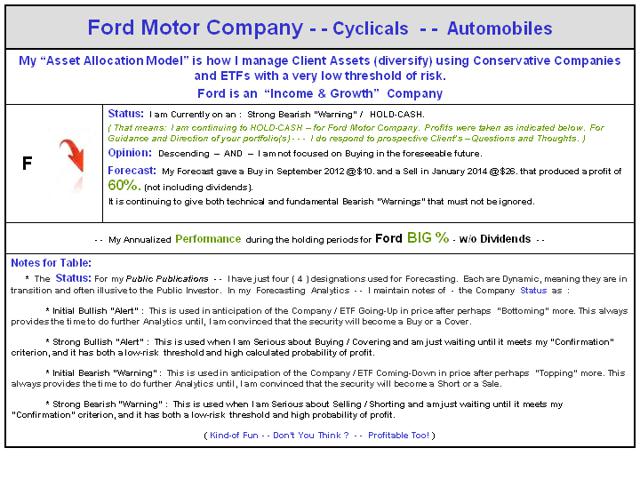

My Performance please see my below table as well as (my 5-Year Table) for Ford is available by clicking:

My Performance please see my below table as well as (my 5-Year Table) for Ford is available by clicking:

My management objective is to identify changing trends for my Forecasting Analytics. Simple stated, I want to have current notes to quickly refer to on the anticipated direction of this Sector and Industry Group.

Income & Growth Investors - Ford Motor Pays a: 3.22% Dividend

Forecast w/ 5 Year Performance

Ford Motor Company and other Auto Manufacturing Companies are tracking well. (F) is in a strong Rally it is always an excellent contributor to my Analytics. My Forecasts have been deadly accurate for Ford for a very long time. We are in the second rally since 2009 and that too should tell you something important about my Forecasting.

Note: The below Table is for your review, questions and perhaps thoughts. If you are seeking to "Invest Wisely" in my "Income & Growth - Asset Allocation Model" - - please Email me to open a dialog on how I go about providing super performance with a very low threshold of Risk.

My Current Forecast is very bright and only a major Bear Cycle within the General Market can change my mind ! Unfortunately a major Bear Market is in the Making. The effect of that last sentence is something I will keep you well appraised of in my flow of daily articles and in my Private Blog.

If you own or are considering owning Automobile Companies, the securities require "Selectivity" (see below). Ford Motor Company is currently strong Technically. I have no reservations about my Fundamental Valuations, therefore, in summer 2012 - I placed it on an Strong Bullish Forecast - "Alert."

If you own or are considering owning Automobile Companies, the securities require "Selectivity" (see below). Ford Motor Company is currently strong Technically. I have no reservations about my Fundamental Valuations, therefore, in summer 2012 - I placed it on an Strong Bullish Forecast - "Alert."

My Current Opinion is Hold !

Fundamentally - ( weighting - - 40% ), my Valuations for Ford remains strong but are producing cautionary declining projections.

Technically - ( weighting - - 35% ), My Indicators are notably breaking down. It is currently off its highs of $17+ selling at $16.. It is interesting to note that in early 2011 it was also at the $17. level and subsequently dropped to under $9. Ford is selling for $15.

Consensus Opinion - ( weighting - - 25% ), my third pillar of Research is one that is ALWAYS distorted to the Positive by most all financial analysts. That's because they are afraid of being Bearish. I Am NOT! My articles on "Reality" are supportive of the below 20 year Chart.

I will personally and promptly reply to any serious investor's inquiry as to my very cautious position for (F) !

A Twenty Year Perspective of Ford Motor Company (F)

It has NOT always been like you are being told by so many who do not take the time to do their homework and "Invest Wisely." Ford Motor Company (F), like most all other quality Companies, has taken some big hits over the years.

URL for (20-years of) (F): http://stockcharts.com/h-sc/ui?s=F&p=W&yr=20&mn=0&dy=0&id=p29958047832&a=300758177

Selectivity

Here are a number of the Component Companies / Peers in the Auto Manufacturing Industry Group that I focus on: (F), (GM), (HMC), (OTCPK:NSANY), (TSLA).

For a Daily Input and Deeper View of my Work / Analytics you might want to Click, and scroll down to my "Thumb-Nail" articles:

Personal Blog. I post every day. Just Click - - > http://investingwisely-rotation.blogspot.mx/?spref=tw

If I can be of help with guidance and direction with your portfolio(s) just Email me. Serious Investors Only - Please!

senorstevedrmx@yahoo.com

Smile, Have Fun, "Investing Wisely,"

Dr. Steve

F, GM, TM, HMC, NSANY, TSLA