Exxon Mobil Corp. - Big Oil is in Serious Trouble and Nobody Knows It

Exxon Mobil Corp. ceases to be one of the leading Dow 30 - Industrials composite Companies. It is now on a Hold-Cash.

My previously written articles on XOM (just click) provide you the history of my forecasting, its accuracy and support for my performance. For over 50 years my management objective is to identify changing trends for my forecasting analytics. I simple want to have current notes to quickly refer to on the anticipated direction of this company and its industry peers.

My previously written articles on XOM (just click) provide you the history of my forecasting, its accuracy and support for my performance. For over 50 years my management objective is to identify changing trends for my forecasting analytics. I simple want to have current notes to quickly refer to on the anticipated direction of this company and its industry peers.

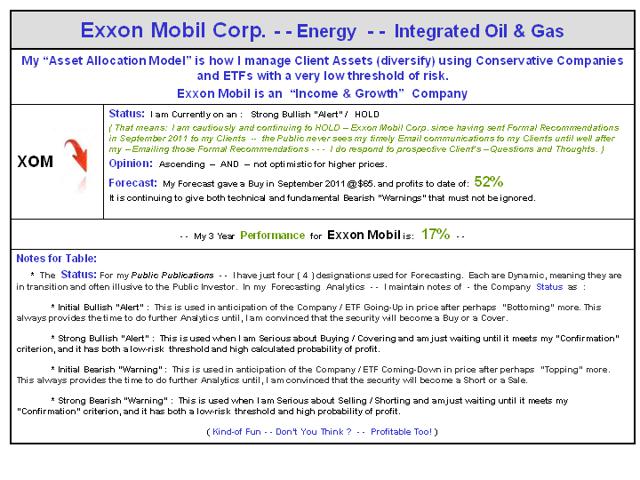

My Performance for Exxon Mobil can be found in the below table and is over 18% per year for the last 4 years.

More Support for My Dow 30 Forecasting Accuracy

The following article supports my Methodology of "Investing Wisely" and with superior and consistent annual profits. Just Click.

I have completed my weekly study of all my High Profile Energy / Exxon Mobil Companies. I suggest that there is little support for notably higher prices in the making. This is a study that is a pleasure for me to do because I have spent time and experience in the study of Income and Growth Companies like XOM. Each time it offers support for my on going analytics, and I smile.

My management objective is to identify changing trends for my forecasting analytics. Simple stated, I want to have current notes to quickly refer to on the anticipated direction of this sector and industry group.

A Special Note for Seniors & Retired Investors - Dividend Yield: 2.62%

Forecast w/ 5 Year Performance

Note: The below Table is for your review, questions and perhaps thoughts. If you would like to "Invest Wisely" in my "Income &Growth Asset Allocation Model," please email me to open a dialog on how I go about providing superior performance with a very low threshold of risk.

My Current Forecast is not as bright as you are perhaps being advised! (I will be more specific upon your email request).

If you own or are considering owning Exxon Mobil or oil & gas companies, the securities are becoming a mixed, not a very positive bag. Exxon Mobil Corp. is currently just Ok technically, but I have reservations about my fundamental valuation. It is on my Initial Bearish Forecast - "Warning List."

My Current Opinion is to Hold in anticipation of taking profits. This may be at even higher prices, but there will be an end and time to sell, but that is not currently in my forecast. That is a balancing of my below three (weighted) pillars of research.

Fundamentally - ( weighting - - 40% ): My Analytics for my fundamental valuation play a vital role in profitable managing money. Earnings continue to be relatively strong.

Technically - ( weighting - - 35%): Within this outstanding company, my indicators remain questionable. It is making new highs but that won't last. Highs are $102, is selling for $97.

Consensus Opinion - ( weighting - - 25% ): My third pillar of research is one that is always distorted to the positive by most all financial analysts. That's because they are afraid of being bearish. I am not! My articles on "reality" are supportive of the below 20 year Chart.

I will personally and promptly reply to any serious investor's inquiry as to my very cautious position for XOM !

A Twenty Year Perspective of Exxon Mobil Corp.

Exxon Mobil Corp. has taken some big hits over the years!

URL for (20-years of -(XOM): http://stockcharts.com/h-sc/ui?s=XOM&p=W&yr=20&mn=0&dy=0&id=p83892495507&a=305205577

"Selectivity" is what I preach (along with discipline and patience) and is what separates the average investor and mutual funds from the profits that come with long-hours / hard work and "selectivity."

Here are a number of the Component Companies / Peers in the Exxon Mobil Industry Group that I focus on rather frequently if you wish to follow me: (XOM), (OLO), (OIL), (XOM), (CVX), (BP), (RDS.A), (STO), (TOT), (YPF), (E), (BAK), (SSL), (PTR), (PZE). And, more . . .

| Note: Should you have interest in my professional guidance and direction for your Portfolios, please Email Me with your questions or thoughts: senorstevedrmx@yahoo.com. For Daily Updates and a Deeper View into my work / Analytics, you might want to Click and Scroll Down to my "Thumb-Nail" Articles within my personal blog. Please spend some time reading my articles for a perspective of their and also viewing my Bio before making inquiries. Sharing a bit about yourself and your financial and needs, goals and objectives would be appreciated. A relationship between You and Your Asset Manager must be a "Win / Win" affair. You get the Performance and the Education and I get paid for my Analytics / Work and Experience. |

Smile, Have Fun, "Investing Wisely,"

Dr. Steve

XOM, UCO, OLO, OIL, CVX, BP, RDS.A, STO, TOT, YPF, E, BAK, SSL, PTR, PZE