Gold Trust Shares - - SPDR - ETF (GLD) - The Glitter Went Away and I Called it to the Oz.

Yes, I have been deadly accurate with my Forecasts on Gold and Silver / Commodities for several decades. I am about to be accurate again.

I keep reading and reading unwanted and grossly exaggerated articles about Gold being ready to Buy again - for "Huge Gains." Rather than share my, likely "unwanted" thoughts and opinion of this kind of BS article(s) with you and about this kind of advice - - I will just say: loud and clear - - IT IS NOT YET A BUY !

It could be in the foreseeable future but I strongly recommend that you continue to HOLD-CASH.

The recent bounce off of LOWs of December will likely continue for a short time - a very short time. It is rescinding and will require even more work before my Analytics will give it a BUY.

I have not missed on tops or bottoms on Precious Metals in over 50 years and I won't miss on my next CALL !

You may want to review my articles on GLD (just click) you will be provided with the exact history of the accuracy of my Forecasting / Formal Recommendations and much more.

You may want to review my articles on GLD (just click) you will be provided with the exact history of the accuracy of my Forecasting / Formal Recommendations and much more.

My Performance (my 5-Year Table) for Gold Trust Shares - SPDR - ETF is available by clicking: (GLD) I treat GOLD and Gold Mining Companies just like any other Company, and my performance is an excellent credential that I will not hesitate to move my Clients to Cash when my Forecast dictates.

Look at the Profits for GOLD - Over the Years

It is simple, all Companies Cycle from "Favorable" to "Un-Favorable" and in between, they are "Also Rans." This horse-racing metaphor is the best guidance I have to explain how to know the Good / Bad and the Ugly for all securities on the planet.

Gold - has: a) gone nowhere in 20 years - - BUT - - (study the peak to peak and trough to trough); b) is UP over 100% in Favorable time-frames; is DOWN over 50% in Un-Favorable time-frames; and c) has spent years as an "Also-Ran." The Company - has: a) gone Up in 20 years (study the peak to peak and trough to trough); b) is UP over 100% in Favorable time-frames; is DOWN over 50% in Un-Favorable time-frames; and c) has spent years as an "Also-Ran." What a Waste of time and money during "Un-Favorable and Also-Ran time frames - don't you think?

The Company like so many others has taken some big hits over the years!

Have a long look at this Chart, it tells you a story about how to make and preserve your profits. Click on GLD. It is not hard to understand how Bear Markets can cause financial set-backs for years and in many cases those set-backs are never recovered. I have over 50 years of successfully doing what I call "preventative maintenance."

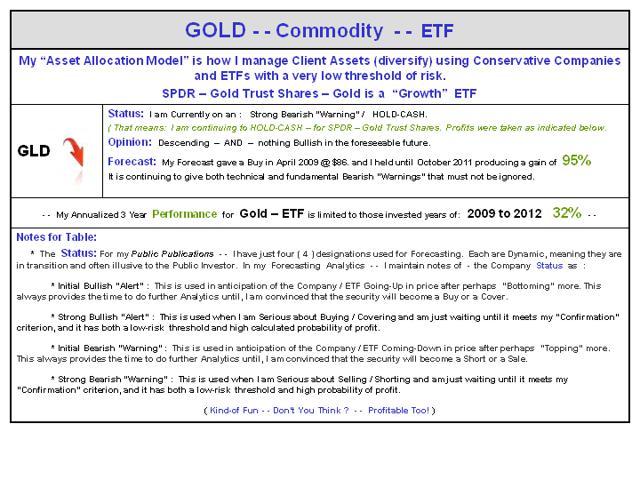

Forecast w/ 5 Year Performance

Note: The below Table is for your review, questions and perhaps thoughts. If you are seeking to "Invest Wisely" in my "Growth" - Asset Allocation Model" - - please Email me to open a dialog on how I go about providing super performance with a very low threshold of Risk.

My Current Forecast for Gold is not and has not been as bright as you may be lead to think by a large number of blogging sources! Hum . . .

If you own or are considering owning Mining Companies - or - Gold / ETFs, the securities are currently not a pretty picture. Prudent investing just does not support ownership at this time. Gold Trust Shares - - SPDR - ETF is currently very weak Technically and I have reservations about my very weak Fundamental Valuations. I placed it on a Strong Bearish Forecast - "Warning." That was way back in late 2011.

My Current Opinion is to HOLD-CASH in anticipation of a Bottom which at this stage cannot be Forecast - - other than to say - - there is a Possibility of a Bottom in the making. I said: "Possibility."

* Fundamentals - ( weighting - - 40% ): My Analytics for my Fundamental Valuations (of each Mining Company) plays a vital role in profitable managing money. At this time my Valuations of (GLD) (Mining Companies) are not as positive as perhaps you are being told by other sources. Plainly stated they are Descending.

* Technically -( weighting - - 35% ): My Technical work / analytics is both unique and profitable. The current rally is fading for the near-term, so don't get Greedy! (GLD) is currently selling for: $128. - - down a BUNCH from the Highs of $189 in 2011.

* Consensus Opinion - ( weighting - - 25% ): My third pillar of Research is one that is ALWAYS distorted to the Positive by most all financial analysts. That's because they are afraid of being Bearish. I Am NOT! My articles on "Reality" are supportive of the below 20 year Chart.

Special Note: For those who bought into this rally which began at $116 you are taking much too much risk in the process of investing your assets prudently. Hum!

It peaked at $184.and so far has fallen to a low of $114. That is a lose of over 38%. And very Unacceptable Asset Management on the part of this ETF, mining companies or gold bullion and Investors that have chosen to HOLD! I took my Clients out of Gold at the highs way back in late 2011. Have a loooong look at many Mining Companies - the picture is even worst.

I post frequently in my Personal Blog on Gold, Silver, and other Commodities. Please see my URL to visit my blog below.

Selectivity

Here are a number of the component ETF / Peers in the Gold realm that I focus on rather frequently: (GLD), (NUGT), (GDX), (GDXJ), (IAU), (GDX), (DGL), (DZZ), (UBG).

| Note: Should you have interest in my professional guidance and direction for your Portfolios, please Email Me with your questions or thoughts: senorstevedrmx@yahoo.com. For Daily Updates and a Deeper View into my work / Analytics, you might want to Click and Scroll Down to my "Thumb-Nail" Articles within my personal blog. Please spend some time reading my articles for a perspective of their and also viewing my Bio before making inquiries. Sharing a bit about yourself and your financial and needs, goals and objectives would be appreciated. A relationship between You and Your Asset Manager must be a "Win / Win" affair. You get the Performance and the Education and I get paid for my Analytics / Work and Experience. |

Smile, Have Fun, "Investing Wisely,"

Dr. Steve

GLD, NUGT, GDX, GDXJ, IAU, GDX, DGL, DZZ, UBG