Yahoo (YHOO)'s stock has done poorly recently. Analysts have declared their core business to be worthless, and since Alibaba's IPO in 2014, Yahoo's stock has been worth less than the combined sum of their Alibaba stake, their Yahoo Japan stake, and their net cash. However, Yahoo's core business is not worthless, and providing that a reverse spinoff does occur, we can expect their stock to significantly appreciate, possibly doubling it's value.

Yahoo's Non-Core Underlying Value

Yahoo, as of today, February 3rd 2016, is valued at $27.68 a share. They own 384 million shares of Alibaba (BABA), which is the largest e-commerce firm in China, although as of late, it has been undergoing some difficulty. It's current share price is $63.40. As such, Yahoo's 384 million shares of Alibaba, divided by Yahoo's 943.53 million shares, provides a $25.80 value per share alone. Normally, any divestiture of this would be subject to taxes, but Yahoo has been working on a tax-free spinoff of Alibaba, so the value is not affected by taxes. Add this to the $8.18 a share for their stake in Yahoo Japan (OTCPK:YAHOY) and their $4.96 in net cash, and their total underlying value is $38.94, which is a whopping 41% increase from their current price, assuming that their core business is worthless. However, the value of their core business is significantly understated, and may even be $10 billion, or $10.60 a share, which puts Yahoo's value at $49.94, which is almost double it's current levels.

Yahoo's Search Business

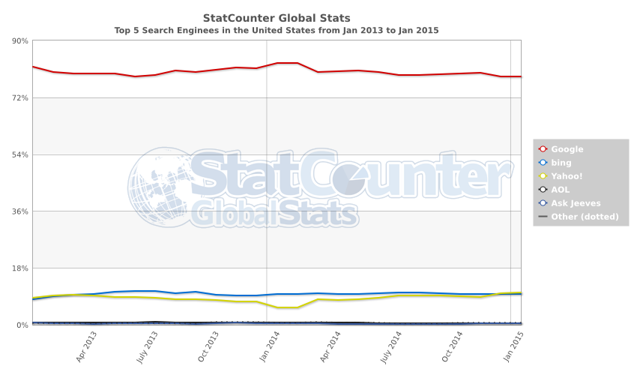

In the search business, Yahoo is often regarded as a loser. They were the top search engine in the 1990s, but they did not innovate, so they lost their search crown to Google (GOOG). A later deal in 2009 with Microsoft (MSFT)'s Bing, only seemed to help Bing and further destroyed Yahoo's business, so now they are not viewed as a serious contender. However, Yahoo is a serious player in search, although they have lost considerable ground. In late 2013 to early 2014, Yahoo bottomed out at 7% according to StatCounter, notwithstanding some statistical blips in the graph, and has since recovered to 10%.

While Yahoo's market share clearly pales in comparison to Google's, it is one of only three major players in the search market. As such, if Yahoo were to be acquired, their search marketshare may easily be a point of contention. The other two major players in the search market, Google and Microsoft, are both giant corporations with tens of billions of dollars in their war chest, and both would want to make sure Yahoo does not fall into the hands of the other, for Microsoft, so Google's lead does not become completely inpenetrable, and for Google, so Microsoft cannot establish Bing into a strong number 2 search engine that is a serious threat. Clearly, Yahoo's search marketshare is very valuable, adding to Yahoo's appeal as a stock.

Potential Suitors for Yahoo

In addition to Google and Microsoft, there are numerous other potential suitors for Yahoo, once the reverse merger is concluded. Verizon (VZ), which owns AOL, a business that nicely complements Yahoo's media business, Barry Diller's IAC (IACI), which is very skilled at managing legacy Internet businesses like Yahoo, and several private equity firms have expressed interests. However, in this author's opinion, Yahoo's ownership will probably come down to a bidding war between Google and Microsoft, and it's core business may fetch a price of over $10 billion, as Yahoo's search marketshare is essential to both companies.

Conclusion

Yahoo is grossly undervalued at current market prices. Alone, it's assets should be valued at about $39 a share. Accounting for its sizeable search marketshare, Yahoo should be valued at $50 a share or greater, which would represent almost a 100% gain. As such, at current prices, Yahoo is a screaming buy.