This is my first submission, but I plan to use this as an opportunity to discuss my own idea for the younger generation to use your Roth IRA as a credit facility. Under tax rules, you can currently put $5,500 into your Roth IRA with after tax money. This means, at any time, you can take that $5,500 back out of your Roth IRA. However, the point of the Roth IRA is that you do not pay taxes on any money you make above $5,500. You can begin taking that investment income out when you turn 59 & 1/2 as long as you started the Roth IRA 5 years preceding that age. However, today, I am going to assume you are 25 years old and am not going to take that investment money out and pay a penalty.

My plan is to put the full $5,500 in the Roth IRA each year and invest in a mix of high dividend paying stocks and growth stocks, and using any earnings to begin drawing that money back out instead of using credit cards or bank loans. For the sake of this article, let us assume you just invest in the mortgage reinvestment trust (mREIT), MFA. The nice thing about mREITs is that they have to pay out 90% of their earnings, where you end up paying taxes for them. However, with the tax sheltering of Roth IRAs, you end up not paying the taxes and just take the money. So let's make a hypothetical 10 year plan, from 25 years old to 35 years old, using historical data for MFA.

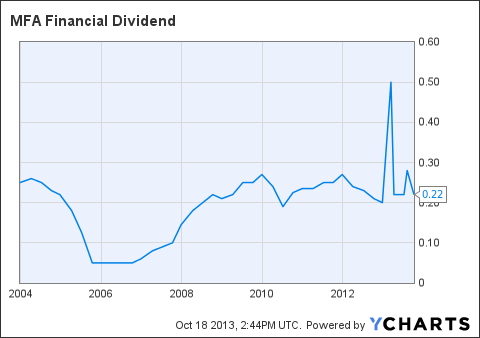

MFA Dividend data by YCharts

If you were to have passively purchased MFA every 1st trading day of February from 2003 until the beginning of 2013 using your $5,500 each year and just taken the dividends tax free, you would have accrued $32,883 in dividends. Because you had put $55,000 into your Roth IRA, you are now free to take that $32,883, without penalty, out of your Roth IRA and use it to pay down credit card debt that you accrued because of your naive spending practices. Or, you could use that money as a down payment on a house. Or use it to buy a new car, assuming interest rates have skyrocketed. Or use it to survive losing your job. Anyway, the fact is, you have $32,883 dollars to spend without penalty and without interest. Plus, if you were to sell MFA today, you have lost principal of less than $3000. So you still get to keep that money for retirement.

Disclosure: I am long MFA.

Additional disclosure: I currently own MFA in my Roth IRA.