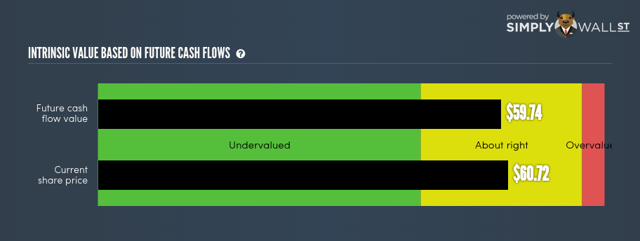

Soups and snacks maker Campbell Soup Company (CPB) reported fiscal fourth quarter earnings (FQ4) yesterday before market open. CPB's EPS of 46 cents fell short of market expectations by almost 8%; however, the revenues of $1.69 billion were in-line with consensus estimates. When a company like CPB, with a market capitalization of $18.7 billion, loses so much value in a single trading session, shareholders have only one question: will it drop more? Based on consensus analysts' cash flow forecasts and few other conservative assumptions, we find CPB's fair value to be $55.99, so its yesterday close at $56.91 doesn't indicate much downside potential.

The long-term perspective

Source: Simplywall.st

To CPB's long-term investors, these fluctuations might not matter much as the company pays a steady dividend and despite yesterday's steep drop, shares are up 7% year-to-date. However, what's concerning for them is CPB's stagnant growth. Over the past three years, CPB has missed or came in-line with its quarterly revenues, while beating earnings estimates on most occasions. So, while the company is struggling to grow sales, it's becoming cost efficient to still deliver earnings surprises. The same trend also reflects in analysts' forecasts, which indicate flat revenues over next three to five years, but a significant upside in earnings by FY'19.

Remains a solid dividend payer

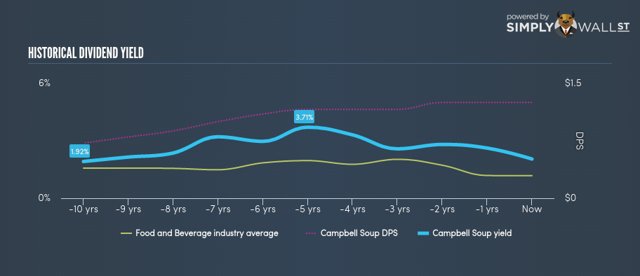

"While we have made progress, we recognize we need to deliver sales growth - and it remains a top priority. Reflecting its confidence in our long-term growth prospects and strong profit performance this year, the Board declared a 12 percent increase in our quarterly dividend today", said CEO Denise Morrison. CPB's dividend history has been impressive to say the least. Apart from increasing dividends consistently for over a decade, it's payout ratio stands at an acceptable 57%, indicating enough cushion for dividend investors.

Apart from cash flows, another aspect dividend-seekers are generally worried about is the balance sheet strength. Well, CPB has been consistently deleveraging its balance sheet, and its operating cash flows are strong enough to service the debt, pay out dividends, and fund capital expenditures - CPB's cash from operations increased to $1.46 billion in FY'16 compared to $1.18 billion during FY'15. CPB expects 0%-1% sales growth in FY'17 and an adjusted EBIT growth of 1%-4%.

Not just analysts, even the management is expecting muted growth. Additionally, its asset write-downs and restructuring costs, which have increased almost threefold over the last two years, may continue to pressure its earnings and consequently share prices if company tries to buy its way to growth through expensive acquisitions. If you are looking for organic growth, this is not the stock to be considered as an investment. Although, for a dividend investor, its 2% dividend yield appears quite safe due to strong cash generation and the fact that CPB is more or less resistant to economic cycles makes it even more attractive dividend-stock.

Source: S&P Capital IQ, Simplywall.st