Special Report. You've seen these words on our website and in TAG Oil social media, but why should you care?

First, although sponsored by TAG Oil, the report titled The 7 Key Factors Driving Small-Cap Oil and Gas Valuations, was independently written by a well-respected energy analyst. Second, it gives you, as an investor, stronger insight into the characteristics to look for when deciding what small-cap oil and gas to add to your portfolio. Our only request of author Jamal Orazbayeva was to give investors her analyst's perspective on the tools she uses to invest, using facts, not emotions.

Although oil prices have stabilized to some extent, there is still time to capitalize on the "buy low" opportunity that has the potential to maximize future ROI increases.

Here is a sample of Key Factor #2, Assets and Reserves: Production, Development, Exploration. As Jamal says, this is the nuts and bolts - or the blood and bones - of the oil and gas business.

Enjoy and don't forget to download the full whitepaper here.

KEY FACTOR #2 to Driving Small-Cap Oil and Gas Valuations

Assets and Reserves: Production, Development, Exploration

Gauging assets and reserves are what we consider to be the nuts and bolts - or the blood and bones - of the oil and gas business. This section outlines how these assets and reserves are valued, which will help investors to read between the lines (and spin) of corporate releases and reports. Understanding the cycles of production, development, and exploration is key for assessing the risks.

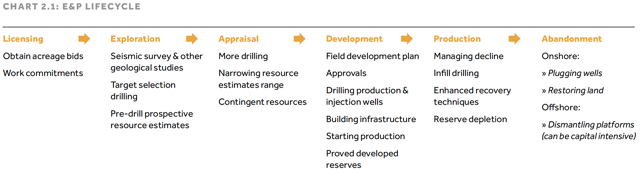

E&P lifecycle

Small-cap oil and gas companies can either be full cycle (all aspects) E&P companies or they can focus on one particular stage of the E&P cycle (exploration, development, and/or production, see Chart 2.1). As an investor, you want to know which stages the company is involved in. The asset portfolio can indicate that, but sometimes even companies with diversified portfolios of production, development, and exploration can be either producers or explorers. To know for sure, one must identify what will drive the value appreciation: Is it dependent on a major development project coming onstream and increasing production? A number of exploration wells to be drilled in the hopes of material discovery? Or is it a combination of both?

Even more importantly, investors need to be sure that the company can deliver value appreciation in a time period that does not exceed one's investment horizon. Note that the risk profile of each stage is different: Typically, geological risk begins to diminish after a discovery is made, while political and financial risks intensify after that.

So how do analysts value an oil and gas asset? Quite simply, these values are based on the future cash flows that the asset can generate, i.e., how much oil this asset can produce from its recoverable reserves and/or resources.

Reserves and resources: classification and usage

Under US reporting, the Securities and Exchange Commission's (SEC) definitions must be used when it comes to oil and gas reserve accounting. Proved oil and gas reserves are estimated quantities of oil and gas which geological and engineering data demonstrate with reasonable certainty to be recoverable from known reservoirs under existing economic conditions (i.e. prices and costs).

- Proved developed are reserves that can be expected to be recovered through existing wells with existing equipment and operating methods;

- Proved undeveloped are reserves expected to be recovered from new wells on undrilled acreage or from existing wells where major expenditure is required for recompletion.

SPE definitions from Chart 2.2:

Proved (1P) reserves are those reserves that, to a high degree of certainty (90% confidence or P90), are recoverable from known reservoirs under existing economic and operating conditions.

Proved plus Probable (2P) reserves are those reserves that analysis of geological and engineering data suggests are more likely than not to be recoverable. There is at least a 50% probability (or P50) that reserves recovered will exceed the stimate of Proven plus Probable reserves.

Proved, Probable plus Possible (3P) reserves are those reserves that, to a low degree of certainty (10% confidence or P10), are recoverable. There is relatively high risk associated with these reserves.

Contingent Resources are those quantities of hydrocarbons which are estimated, on a given date, to be potentially recoverable from known accumulations, but which are not currently considered to be commercially recoverable because of constraints on their development.

Prospective Resources are those quantities of hydrocarbons that are not yet discovered.