Gold Silver Alerts Reports Signals

We send Buy and Sell signals, on average 30 to 50 times per month and you can easily make money in the gold and silver spot markets and commodities market with these Sell and Buy signals. It's that easy! Our gold trading signals and silver trading signals are valuable to the forex gold spot market traders and also for the long term gold investors in commodities market. We post the new gold signal every day in the users section of our web site. It will also be emailed to you, so you will not miss any signal.

Click Here to Review Our Latest Gold Analysis Blog Articles

October 30, 2012 - Gold & Gold Mining Stocks Santa Claus Rally? By The Gold and Oil Guy

If you own physical gold, gold mining stocks or plan on buying anything related to precious metals before year end, you are likely going to get excited because of what my analysis and outlook shows.

Since gold topped abruptly a year ago (Sept 2011) with a massive wave of selling which sent the price of gold from $1920 down to $1535, technical analysts knew that type of damage which had be done to the chart pattern could take a year or more to stabilize before gold would be able to continue higher.

Fast forwarding twelve months to today (Oct 2012). You can see that gold looks to have stabilized and is building a basing pattern (launch pad) for another major rally. The charts illustrated below show my big picture analysis, thoughts and investment idea.

Weekly Spot Gold Chart:

The weekly chart can be a very powerful tool for understanding the overall trend. This chart clearly shows the last major correction and basing pattern in gold back in 2008 - 2009. Right now gold looks to be forming a very similar pattern.

Keep in mind this is a weekly chart and if you compare the 2009 basing pattern to where we are today I still feel it could take 3 - 6 months before gold truly breaks out to the upside and kicks into high gear. The point of this chart is to provide a rough guide for what to expect in the coming weeks and months.

Weekly Chart of Junior Gold Miner Stocks:

If you follow gold closely then you likely already know junior gold mining stocks can lead the price of gold up to two weeks. Meaning gold mining stocks which you can track by looking at GDX and GDXJ exchange traded funds will form strong bullish chart patterns and generally start moving up in price before physical gold.

The chart below shows the junior gold miner ETF with a VERY BULLISH chart and volume pattern. Remember that gold stocks are a leveraged play on gold in most cases. For example, if gold moves up 1% we typically see GDX and GDXJ move 2-4%. Because they act as a leveraged play on physical gold smart money and big institutions start accumulating these investments in anticipation of gold rising.

GDXJ has formed a tight bull flag and the volume levels confirm there is big money moving into these investments. The first price target on GDXJ using technical analysis for a measured move points to the $32 area. Looking forward twelve months with gold trading above $2000 we could see this fund more than double in value.

Bonus: while most traders focus on GDX gold miner fund, I prefer the GDXJ fund because its almost identical in price performance BUT it pays you a 5% dividend…

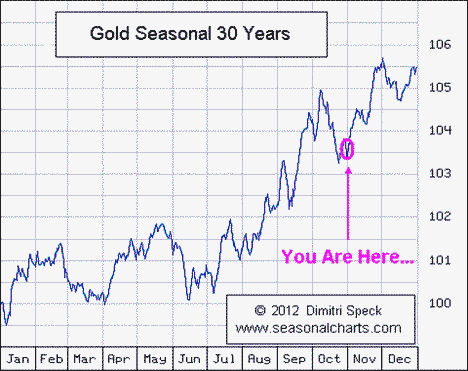

Gold's Seasonality:

It's that time of year again where gold tends to move higher. Below you can see where we are and what the price of gold typically does in November.

Gold Investing & Trading Conclusion:

Looking forward one month (November) and factoring in the recent pullback in gold to known support levels along with strong buying of junior gold mining stocks, I feel gold will take another run at the $1800 level and for GDXJ to test its previous higher of $25.50 at minimum. If both those levels get taken out then a massive bull market for precious metals could be triggered. Only time will tell…

Click here to review more daily gold trading analysis and trade setups.

Intraday Forecasts on Gold Silver Copper and Aluminum

You get short, clear forecasts for the direction throughout the trading session, most with short-term Elliott wave-labeled charts. And you get precise support and resistance points, so you always stay in control of your position risk.

Instaforex Metatrader

Forex - Gold Silver Copper Oil - Commodities - Futures - NYSE CFD's

Industry standard Metatrader platform. ECN & Standard Spread Accounts. ECN Spreads As Low as 0.10 Pips. 3 Pip Standard Account Trading Spreads. Trade Gold Silver Copper Oil and Agriculture Commodities Also. Forex Analytics Buy Sell Trade Signals. Metatrader Expert Advisors Auto-Trading & Free VPS Service. Mobile SmartPhone Metatrader Software Trading. ForexCopy Trade Copier. Forex Training Course & Videos. Instaforex TV. Trading Contests. No Minimum Opening Account Balance. Easy Deposit Withdrawl. Earn Annual Interest Paid Monthly On Your Cash Account Balance. Swap-Free Accounts Available. Easy Online Adjustable 1:1 to 1:500 Leverage. Hedging Allowed. New Account Bonus Deposits. 24 / 6 Support

Buy Gold Bullion Online at Live Gold Prices

BullionVault lets you buy pure physical gold and silver at the lowest possible price. BullionVault gives private investors around the world access to the professional bullion markets. You can benefit from the lowest costs for buying, selling and storing gold and silver. BullionVault is endorsed by the major gold mines and is the world's largest online investment gold service. We take care of $2 billion for more than 40,000 users.

Gold Newsletter

USA & Canadian Gold ETF Trading Strategies and Signals

High probability stock, index, sector, commodity, bond, & currency ETF trade alerts. US trading signals, Gold & Silver - GLD, SLV, Gold Stocks - GDX, Crude Oil - USO, Natural Gas - UNG, Index Trading - DIA, SPY, Bonds, Foriegn Investments US & Canadian Stocks. Canadian trading signals, Gold & Silver - CEF.A, Gold Stocks - HGU, HGD, Crude Oil - HOU, HOD, Natural Gas - HNU, HND, Index Trading - XIU, HXU, HXD, Bonds, Foriegn Investments, US & Canadian Stocks.

By Wall Street Cheat Sheet

Join Chicago Mercantile Exchange commentator Eric McWhinnie as he covers Gold, Silver, Gold & Silver stocks, and miners. We look for companies that based on their price today are trading at a discount now or likely bigger discount 12 months from today. The takeover game is a huge part of the resource business. Quality undervalued companies will not remain so for long.

How To Forecast Gold & Silver Prices

Shop Best Selling Gold Silver Coins and Protect Yourself from Financial Crisis and Inflation

Gold and silver are the most popular precious metals investments, especially in times of financial crisis. Investors buy gold and silver as a hedge or safe haven against economic, political, social or currency-based crises, like what is happening right now. These crises include investment market declines, burgeoning national debt, currency failure, inflation, war and social unrest.

Free Video: Part-Time Gold Trader Turns $1,657 into $1.4 Million

"Commodity Code" Gold Silver Oil AutoTrade Metatrader Expert Advisor

The commodity code is a 3 level system. Level 1: The Commodity Code Trading Station Gathers Gold, Oil and Silver quotes directly from the banks. It identifies the common patterns when the big banks are moving the price significantly. Level 2: Commodity Code analyizes the pattern and the signals and decides if there is a profitable low-risk high-reward trading opportunity to apply it. Level 3: The approved signal reaches your Metatrader terminal instantly, opening the profitable trade for you on autopilot.