There are lots of reasons to fear a top, reversal or correction in the market. Geopolitical risk is rampant, over seas economies are not doing as well as the US and the unwinding of Fed policy is yet to begin. Not to mention the unseen affects of Obamacare, an only slowly improving labor market and lackluster consumer spending. Just based on these two sentences I almost convinced myself to turn bearish but I just can't; and here's why. We are in a secular bull market and one that I see running on for another 15 to 20 years. It's not because the economy is booming, or because I think that things are going to be so rosy in the time to come. It is because of demographics and how they are changing in the US.

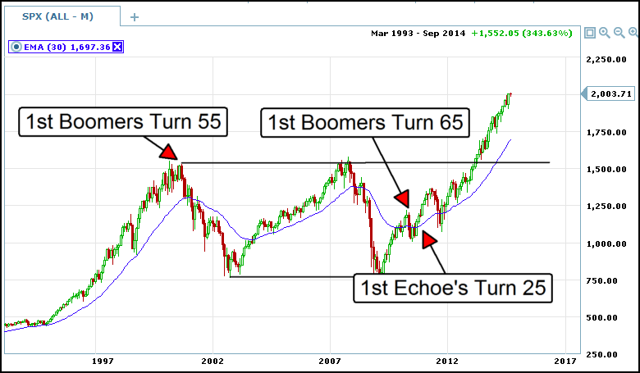

To fully illustrate my point I will have to back track just a little. The current situation begins with the Baby Boomers. This generation is generally accepted as those born between 1945 and 1965 following the post WWII boom in births. As a group they represent more than 26% of our economy, much larger than the generations before them and larger than the group that followed. The US as we know it today was built by the Boomers. Now, as they aged and began to reach retirement they, as a generation, began to sell risky assets in exchange for less risky ones. As a point of reference I will say that they earliest boomers were prepping for retirement at age 55, in the year 2000. The only problem was that the next group, the Generation X'er's, were not as large as the Baby Boomers.

As a generation the Gen X'er's are only about 16% of the population. In the year 2000, this generation was turning 35 and fully involved in society and the economy. The problem with this is that there simply weren't enough of them, on a secular basis, to handle the amount of selling brought on by the retiring Baby Boomers. Remember, the definition of a bear market is when net sellers outnumber net buyers and the Boomers represent 26% of 315 million while the Gen X'ers are only 16%. This is the underlying secular reason for the secular bear market the ran from the peak of the tech bubble in 2000 all the way until the break out in 2013.

This brings us up to the present. Over the past 14 years the Boomers have slowly worked their way into retirement. In that time the government has changed policy, enacted reform and the Federal Reserve has stimulated the economy in an effort to ward off the effects of a larger generation retiring on top of a much smaller generation. These changes, reforms and stimulations has helped us to weather the secular bear market times but what is really driving the current market is another shift in demographics. This is the emergence of the Echo Boomers.

The Echo Boomers are the generation that encompasses what we know as Generation Y and the Millenials. This generation spans from 1985 to 2005 and they represent another 26% of the population. What is really important is that they are coming of age as we speak, every day, more and more are turning 18 and 21, and are entering the work force, going to school, renting housing and generally becoming part of the economy. The oldest are turning 30 next year, the youngest just 15, meaning we have at least 4 years before we can even begin to expect for all of them to have found a job or other place in our society. After that, it will be decades before they reach retirement.

The change in demographics makes it much easier to understand the nature of the 2000-2013 secular bear market. As the Boomers grew up and older, then reached retirement, they left a void in society that the following generation could not fill. The new secular bull market is built on the back of Generation X but rallying on the back of a much larger generation. A generation large enough to fill the void left by the Gen X'ers and more, which is why I say we are in a long term secular bull market now. Now, not only is the 16% of the X'er's engaged in society, we also have a growing number of the Echo Boomers. We may see topping, we may see correction and we may see some reversal but I think each of those times will be a great buying opportunity for short and long term positions.